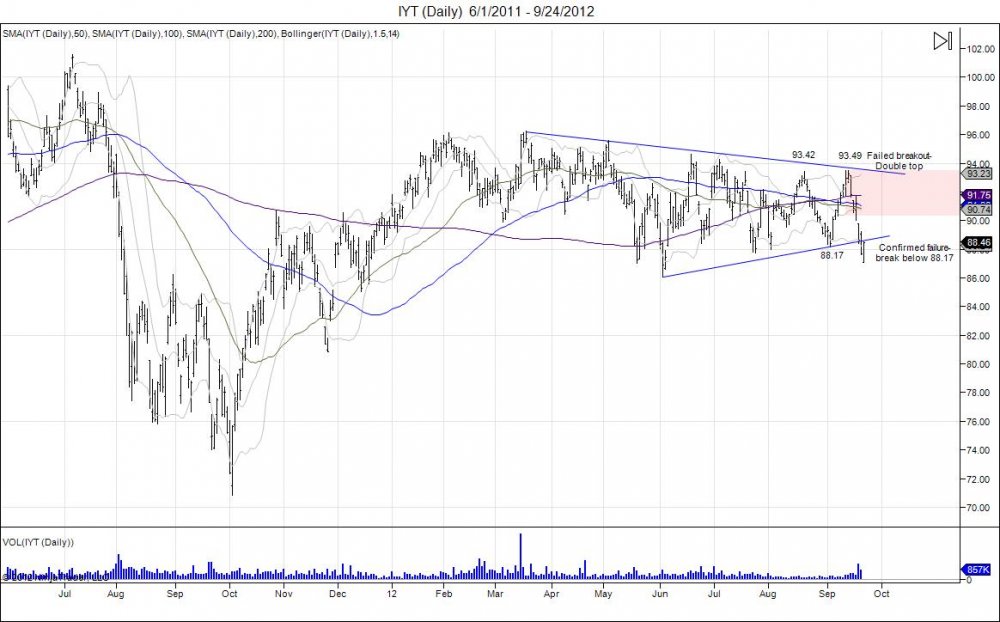

The Dow Jones Transportation Average Index Fund (IYT) has now cracked 2 month lows and on the verge of testing the year lows set early June at 86.09. As the equity markets grinded higher in August to complete the Emini SP target of 1420, many investors along with other "personalities" looked to the transports for confirmation of the equity strength. Unfortunately for these 'buyers', the confirmation in transports never came. The transportation index fund made a high of 93.42 in August just as the Emini SP500 made new highs for the year. As equities digested this new high and consolidated down to 1395 where a base was built, the transports corrected sharply off their August highs and fell into the summer lows. This index turned to chase equities as the SP500 base of 1395 was supported to see a squeeze into the 1441 level, the transportation index began to play catch up. As 1468 highs were made in the SP, the transport fund took out its August highs by 7 cents. This attempt to breakout failed to hold these prices and breakout of this pennant that has coiled all year. Once again with the small correction taking place in equities down to 1443.50, IYT fell sharply to take out the pivot low of 88.17 made in September just before it chased the SP higher. With the break below 88.17, this confirms weakness in this index and the double top made in August-September as the pennant has now been broken to the downside. Those that were looking for transports for confirmation, not only missed the move up in equities, but should be completely puzzled now of the weakness taking place here. Going forward, IYT is looking weak. The pennant created all year has seen a break to the downside following the double top at the 9340 level. Rallies up to 90 offer oppurtunity to defend this breakdown and sell with stops above 9350. This range will need to be taken out for buyers to regain control over this sector. Downside support levels = 83.00, 82.60, 80.84, 80.00.

For precise entry, stop, and target levels on day and swing trades along with updates, click here for more information.