Before politicians or anyone began to talk about "The Great Reset", we titled our article from March 22, 2020 just that. It was based on the fact that the upside chase since the 2016 election had created a trap in February that was popped by the coronavirus pandemic and fueled lower with longs being forced to liquidate. The move, dropped the market right into a low of 2174 on March 23rd, resetting all of the gains from the 2016 election and retesting the breakout which provided longs a key level to defend to prevent further losses.

Things were looking grim. Coincidentally just when the market reset all of its gains from the 2016 election, the market found its bottom, as bearish sentiment reached a peak and the Fed initiated more programs to support the market. Technically the 2170 level provided a bounce, however the support from the Fed provided the opportunity to bounce back, and using shorts as fuel to squeeze the market back higher. On March 23rd they lifted the cap on their asset purchases from $700 billion to unlimited. They also announced a $300 billion credit program.

Shorts, who been wrong for years, are starting to get cocky... Is it time for a massive short squeeze?

— Chicagostock🌐 (@Chicagostock) March 23, 2020

The probe below the prior week lows of 2260 failed to expand, luring in shorts below into a low of 2174 before recovering 2260 to trap shorts and setup a shrot term failed breakdown. This failed expansion lower forced shorts to cover as sellers lifted and the market bounced back to 2600.

This was a defensive bounce and short squeeze which led up to the Fed announcing a $2.3 trillion dollar lending program in the beginning of April that held the market maintain its bounce and work its way higher.

By the end of the 1st half the market had retraced all of its losses back to retesting where the bottom fell out at 3225 which was the 6 month reversal window after the bull trap was set earlier in February.

The 2nd half of the year provided new 6 month volatility windows with the first 2 weeks of July being the opening range that set the tone for July-December. July saw the market press against 3235 only to see buyers step up in July to break above the 6 month volatility window at 3250 which was set by July's opening range. By holding above this window, a bullish 6 month bias was established, which saw the market squeeze into new ATHs, recovering the February high, to 3587 on September 2nd, before retracing to retest the vol window at 3250. Retest of the vol window was defended to keep buyers in control, which was followed by another test in October that also held up. So long as the market is above this window, buyers that bought the market above are in control and have opportunity to expand the market higher. With the election of 2020 being out of the way, the market continued higher. Positive news on COVID vaccine on November 9th started a new wave higher, forcing longs to chase into new highs as the market created a bullish channel that is being expanded into the end of the year, following through on the bullish 6 month bias that was set in the 2nd half of the year.

Chase creates risk, as we saw in early 2018 and 2020. Going forward, as we close out the year of 2020, the new year brings us new opportunities and windows. The first 2 weeks of January is considered the opening range which can set the tone for the 1st half of the year. The opening range will also establish 6 month volatility windows above and below the market. The windows provide the market an area to trade within, or overcome to establish a bias (bullish or bearish) to trend, or become traps if buyers/sellers fail to expand. In order to establish a bias, 5 daily closes above a window are needed. Once a bias is established the other side turns into a reversal window. We like to use these windows to look for trends. We also like looking at the windows to create potential traps, as we saw in early 2020. Most of the gains came in the months prior November and December, so the break above the upper vol window in February lured in late buyers that failed to expand, thus creating the trap which saw the reversal window at 3235 fail to hold, which forced longs to liquidate, accelerating the downside.

With the 2nd half of 2020 closing on the highs of the year, the start of the new year will show us if the market can expand on these gains or attempt to correct in search for support lower. Shorts have been grinded out since the March lows, but also recently since the vaccine news which has also lured longs forced to chase above the September high. Going forward, the low from the vaccine news in November at 3500 is key as losing this would put pressure on retesting the November election and low of 3243.

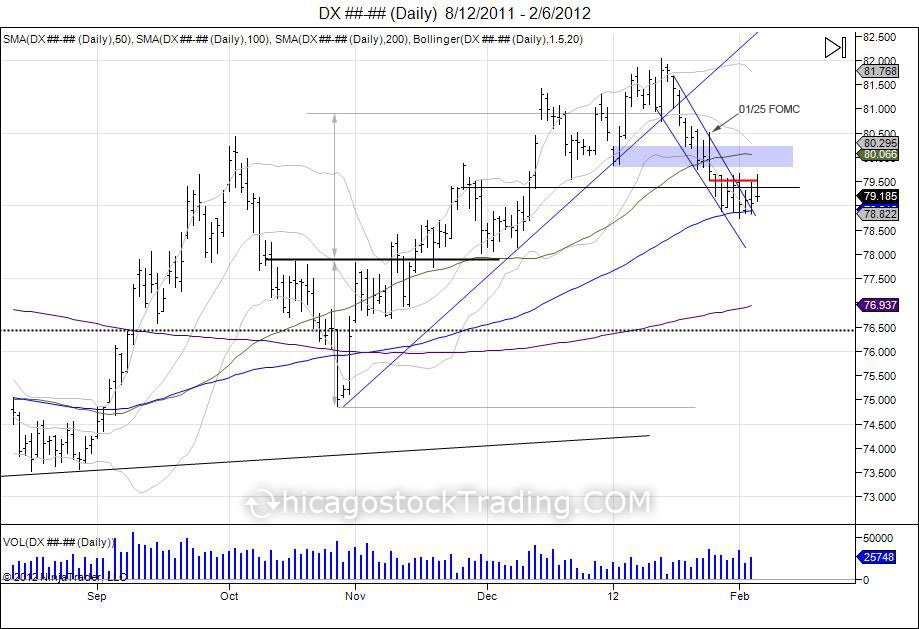

Keep an eye on the dollar index. As stocks bottomed on March 23rd, the US Dollar also topped that day, with a high of 10396.

We wish everyone a healthy, safe, and prosperous new year.

LIMITED TIME: Get 50% off your first month of Futures Pro Monthly. Includes access to live trading room/screen share, nightly reports, and the 6 month volatility windows for January - June of 2021. Use coupon code "newyeardiscount"