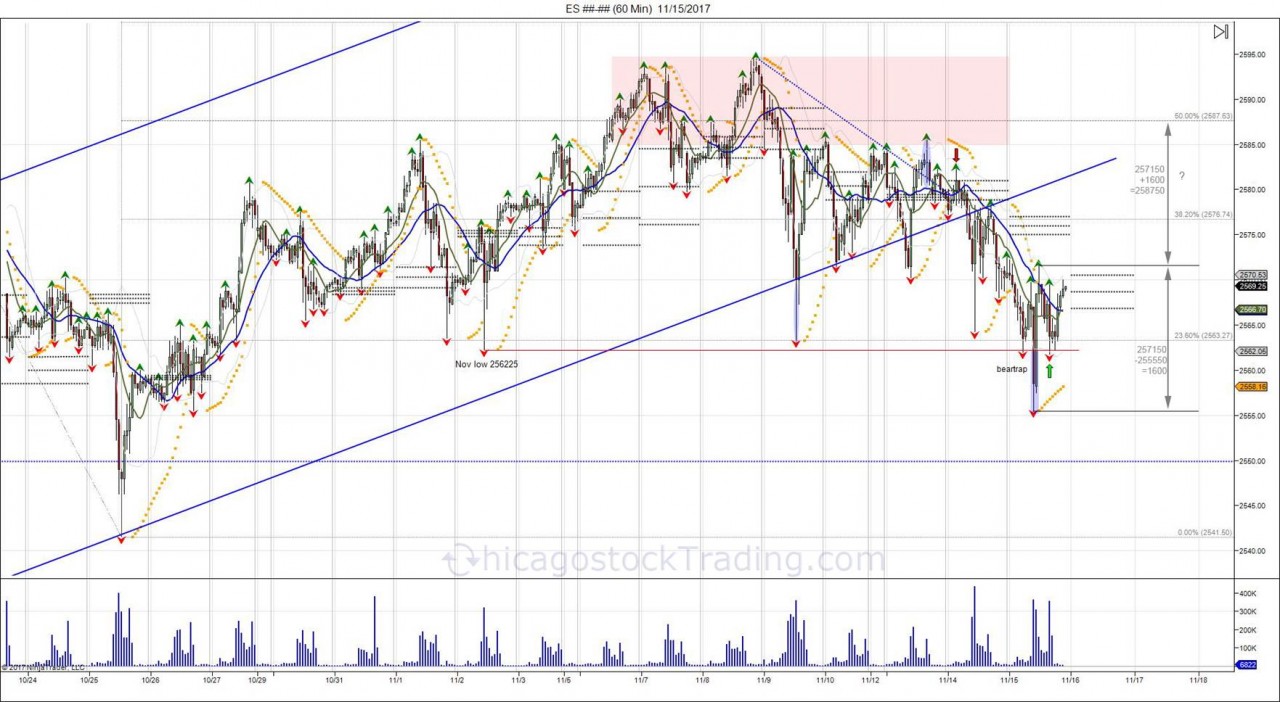

Last week, the market took out the early November low of 256225, falling into 255550, before quickly bouncing back to 257150. This break of the monthly low turned into a failed breakdown and a head fake as the market retested 2562 into the end of day, creating a right shoulder for an inverted head/shoulder pattern. Shorts below 2562 were left trapped, giving opportunity to expand the range up to 257150.

12_10_2010 - 1_27_2012.jpg)