The spread between copper and the SP500 is now down to 5410 after hitting highs of 5679 in November. This high marked a 25+% move higher in the SP500 and a 13-% move down in copper for the year of 2013. Copper, known to be bell weather of economy as it shows industrial demand, tends to be a leader for the equity markets. The fact that it was down this year as the SP500 diverged higher shows the move in equities was fueled only by QE as opposed to underlying macro. Going forward, a breach of the August low in this spread confirms a failed break out with reversal attempt to cover/buy copper and sell the SP500.

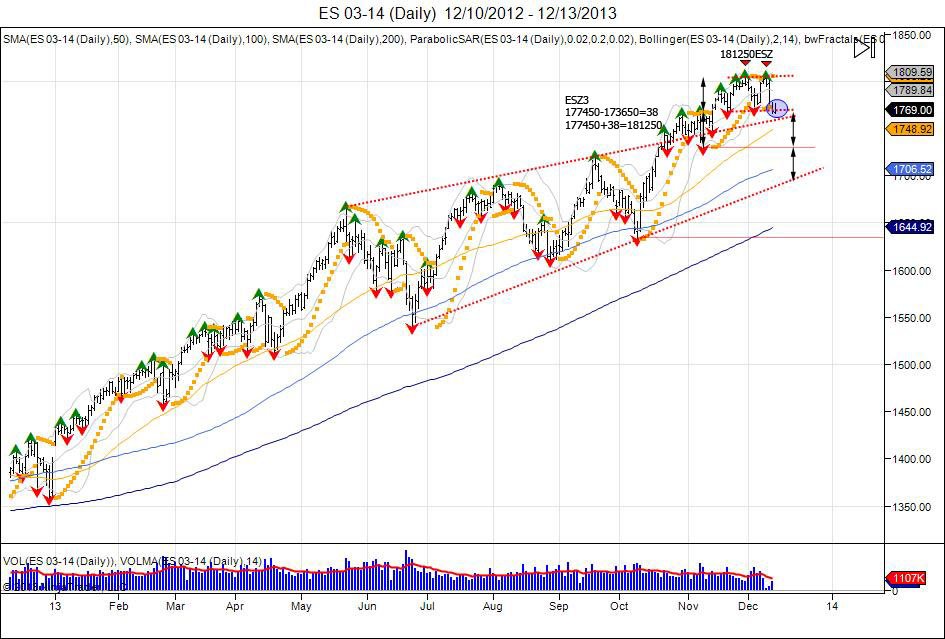

After breaking through the daily pennant created after the May correction that was followed by higher lows and higher highs, the SP500 traded in a tight range of 173650-177450. This range of (38) was expanded higher as market broke above and turned 177450 into support, completing its target of 181250 to the tee with highs of 181250. This was followed by a pullback to retest the 177450 level that held at 177775, followed by another retest of highs. The retest was seen on the December release of the November NFP # that fueled the market to retest highs. This retest fell short at 181150, seeing a rejection to take out the 177775 low, confirming a short term double top. Market is now ont he edge fighting to hold above 1760 as this 1774 level becomes new resistance with the double top trapping longs and putting pressure lower. Continued weakness below 1774 gives way to target the bottom of old range at 173650 for stops. Failure to hold 17360 can see the 1774--1736 range expanded down to 1698, into the bottom of the daily pennant and a test of the 100 day moving average which has not ben touched since October.