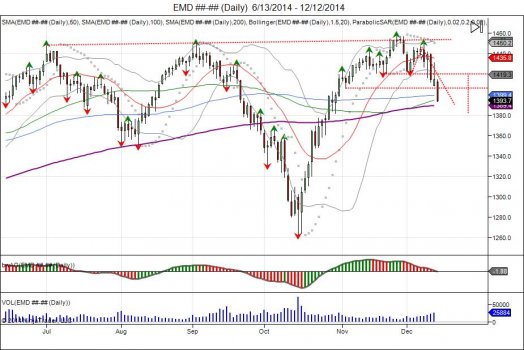

Last week, we highlighted the inverted head/shoulder technical pattern that was created after the market made new lows for the month in November and caught new shorts on the hook. This inverted head/shoulder pattern, gave room to expand the market above the neckline of 258950 up to 262350. The target was met on November 28th, with the market hitting a high of 2627.