The SP500 started this year, zooming through last year's high and charging up to 2800. This 2800 level is the 6 month volatility window in which 5 daily closes above established a bullish 6 month bias, forcing buyers to buy the breakout. The bias was established on January 24th, when the market completed its Cup/Handle target created on January 17th, after recovering its prior high of 280850 based off the January 16th low of 276925. The market expanded this Cup/Handle up to 2846, seeing 2 days of consolidation, before expanding higher on Friday January 26th. The breakout over the prior ATH of 2855 lured in new buyers, in which were caught when the market fell back under fell back under the January 24th low of 282550. Over the last 2 days, buyers have fought to defend this level, seeing the market fall back to its Cup/Handle breakout of 2810 in which buyers defended, however were unable to overcome 2840. Today the cash market opened lower, leaving longs trapped above and forcing sellers to chase lower, giving way to fall back under 2810 and target sell stops below the January 16th low of 276925 that began the move up. By falling under 2800, buyers who bought the breakout above are now on the hook as the market falls back to test its 6 month pivot of 2751. Buyers will be forced to defend this level, to prevent further damage, however as the Midcaps are showing, a move below the 6 month reversal window of 2717 and 5 daily closes below, will reverse the 6 month bullish bias into a reversal bias, giving way to expand the range of 211 (2667-2878), down toward 2456, which retraces the market back to test its breakout from September. Rallies back to 2800-2810 now offers new resistance as supply is caught above, for buyers to overcome and sellers to defend. Buyers will need to squeeze shorts through the February high of 2837 in order to get another shot at the high. Failure to overcome 2800-2810, leaves longs vulnerable to see a shakeout under the 6 month volatility window of 2717.

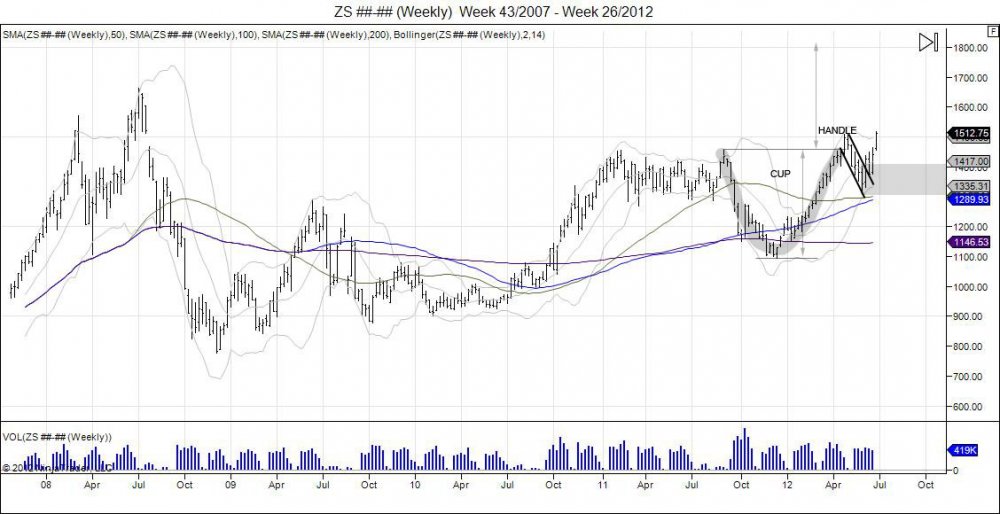

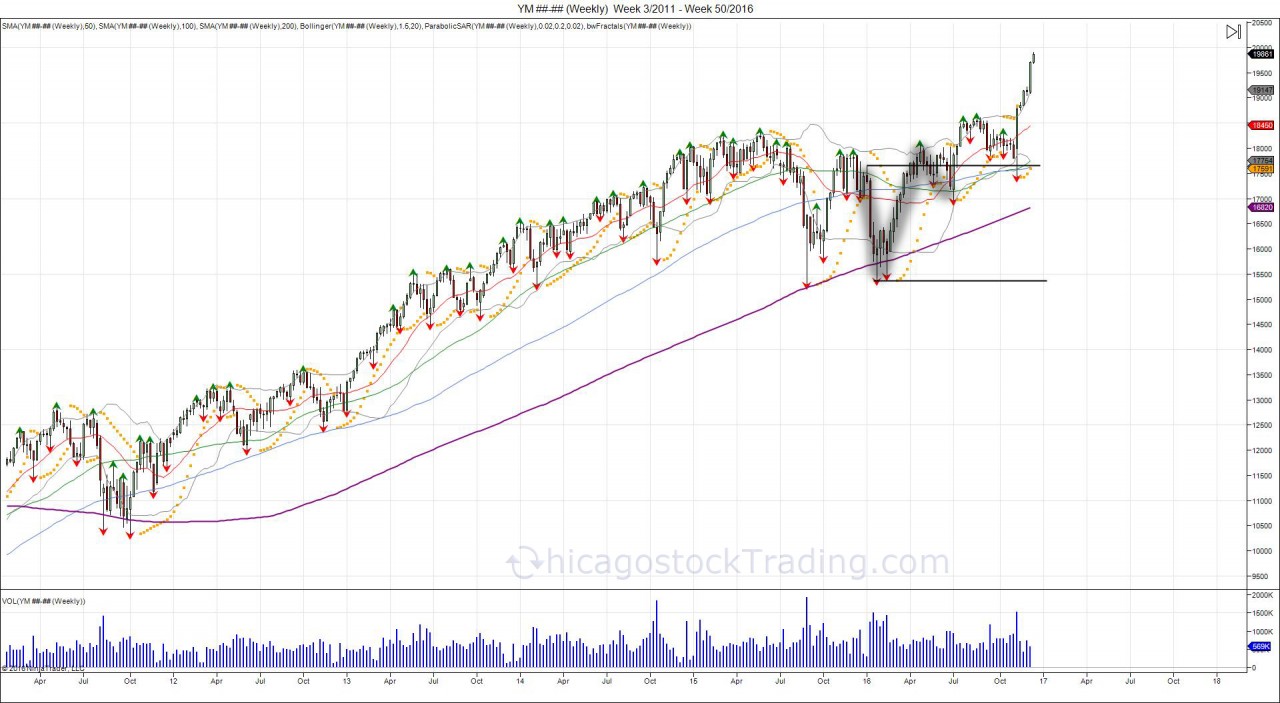

The stock market started 2016 weak, however recovered the highs of the year by summer, making a U turn. Those that were caught short, bearish, and wrong, were now forced to reverse position, thus creating the cup/handle formation, giving way to expand the U turn up to 20k.

The stock market started 2016 weak, however recovered the highs of the year by summer, making a U turn. Those that were caught short, bearish, and wrong, were now forced to reverse position, thus creating the cup/handle formation, giving way to expand the U turn up to 20k.