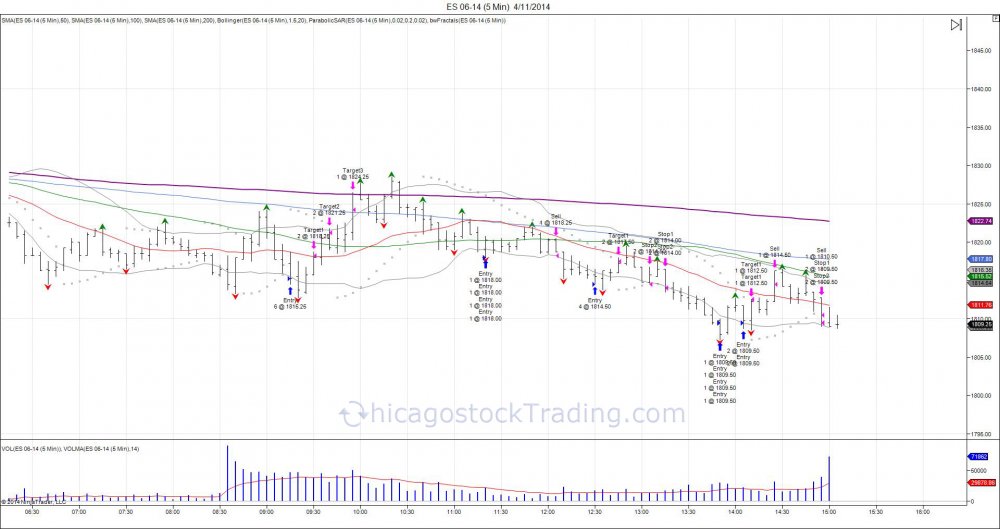

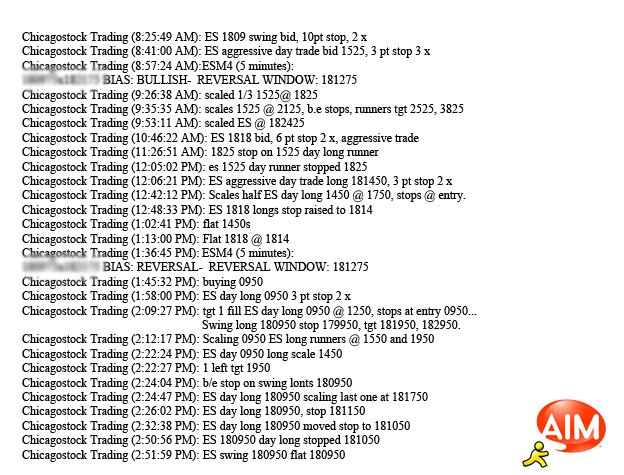

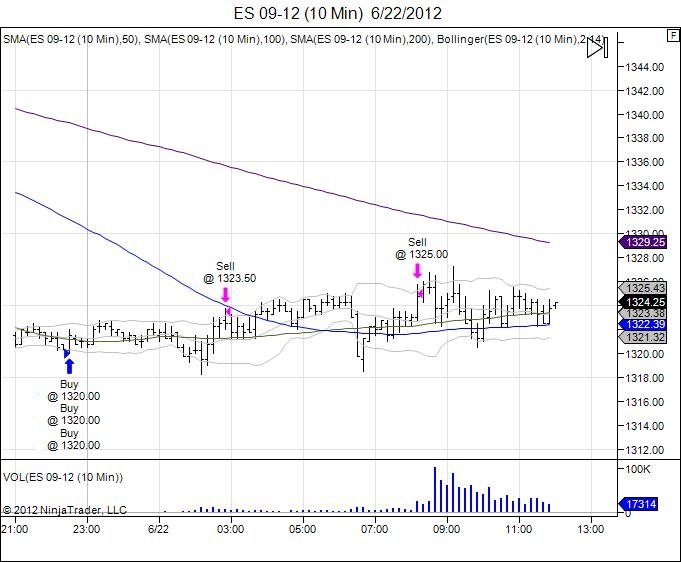

Excerpt from CST Pro subscription email sent on 04/27/15 for trade day 04/28/15. As highlighted in the report, 209050 was a long trade with specific stop and target levels. Bottom left of image is excerpt from our chat, highlighting Chicagostock's intraday analysis, followed by a chart of the intraday Emini SP500 on 04/28/15.

CST Pro Subscription- 2 Week Trial

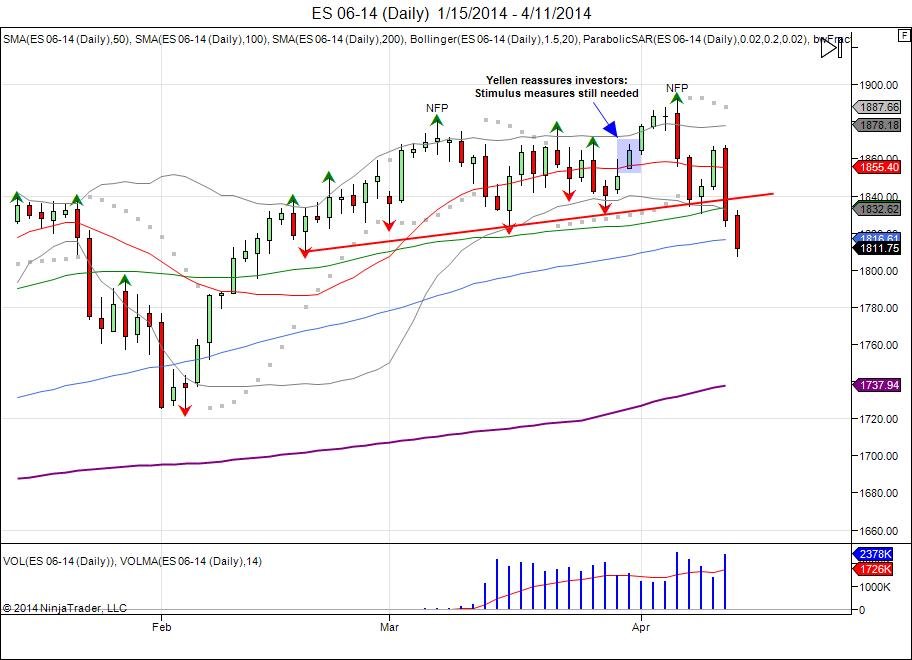

- Daily Emini SP500 Futures Analysis

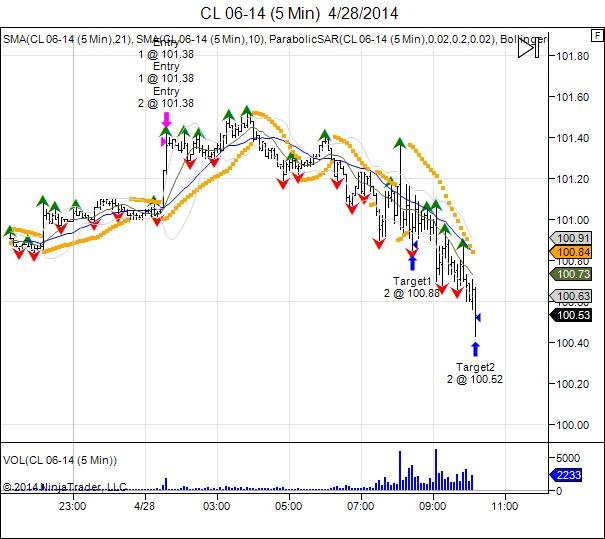

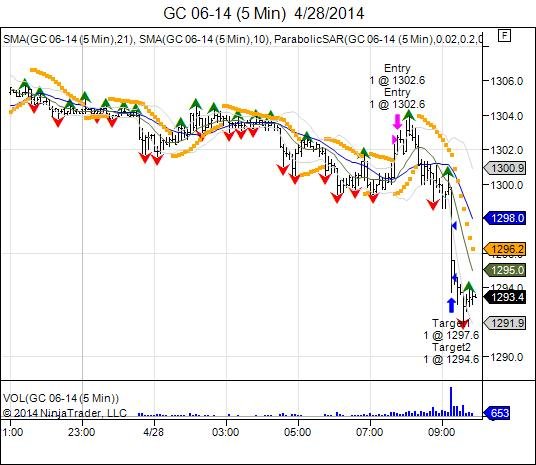

- Daily pivots & vol windows (ES/CL/GC)

- Volatility Windows PDF Guide

- Swing trade recommendations

- Live trading chatroom

- Live charts

- Live day trading signals

For the month of May of 2015, we are offering a special 2 week trial period to CST Pro for only $99! This will gain you access to the daily letter, pivots, live day/swing trade signals, trading room, and screen share.

This is an open offer to allow you the opportunity to try our group and see what we are about. Only serious traders apply. We have room for a maximum of 10 new traders. If you beleive you can find value in joining our group and services, please feel free to apply. See you soon and best of luck trading!

Please email This email address is being protected from spambots. You need JavaScript enabled to view it. for future trials and or any questions.

By accepting trial membership you agree to terms and conditions. Chicagostock Trading uses proprietary and copyright protected material.

RISK DISCLOSURE: PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN TRADING FUTURES AND OPTIONS IS SUBSTANTIAL AND SUCH INVESTING IS NOT SUITABLE FOR ALL INVESTORS. AN INVESTOR COULD LOSE MORE THAN THE INITIAL INVESTMENT.

6_6_2012_1.jpg)