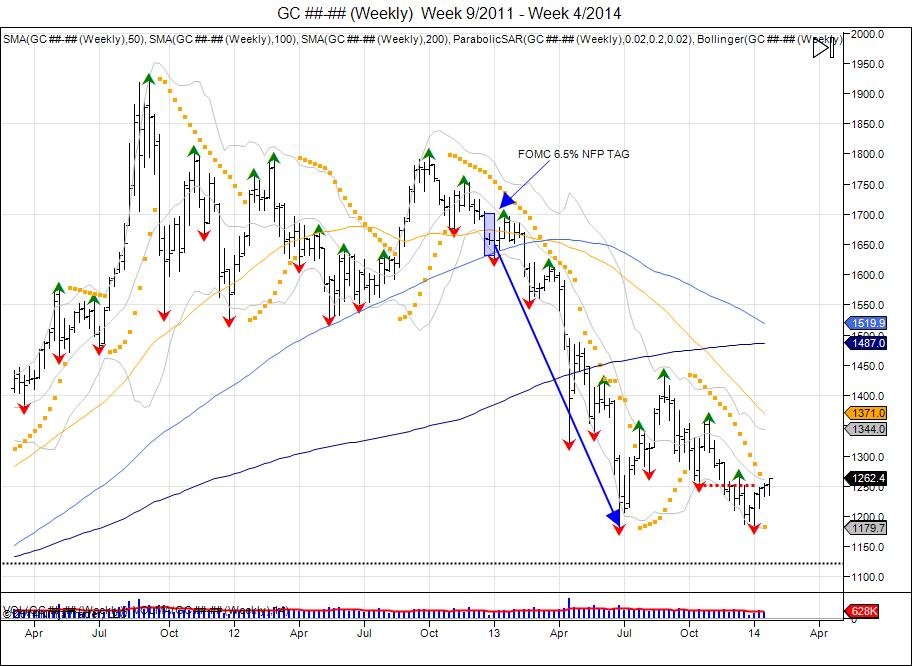

When President Trump was inaugurated in office, the US Dollar topped out with a high of 103815 in January of 2017. In March of 2017 we wrote, "Will President Trump Devalue the US Dollar", highlighting Trump's comments about the currency, as well as the Bernanke's comments of dollar devaluation as a tool to fight deflation. One year later, February of 2018, the dollar made a low of 88150, falling 15% from its January 2017 high. For the last 2 years since this low, the market has worked its way higher in attempt to retest the failure in January of 2017. The retest is technically major resistance for sellers to defend and buyers to overcome. Thus far, the dollar has put in a lower high and is slowly backing away. Going forward, the dollar will need to overcome 100 for another shot at the high. Failure to overcome 100 leaves the market vulnerable to continue falling in attempt to retest the 2018 low which is considered the neckline for a large monthly head/shoulder topping pattern that has developed. A head/shoulder topping pattern is created when the market takes out a prior high to make a new high (01/17), failing to expand on the new high and falling back to take out the prior low (05/16). By taking out the prior low, the breakout into the new high is considered a failed breakout. The low made after the breach of the May 2016 low is considered the neckline at 88150 as the market has bounced off this low in attempt to retest the failed breakout. Breach of the neckline will be key. As breaking the neckline can see sellers chase the market to force expansion of 15.665 range (103815-88150), down to 72485 (88150-15665). The precious metals markets (gold/silver), have already seen a recovery as they have broken away from their multi-year downtrend. Gold squeezed back to retest the Dec 2012 low of 1520, and has taken a pause since then, consolidating the gains. Any further weakness in the USD would provide opportunity for the precious metals to push past these resistance levels in attempt to retest their highs.

Reference: Will President Trump Devalue the US Dollar