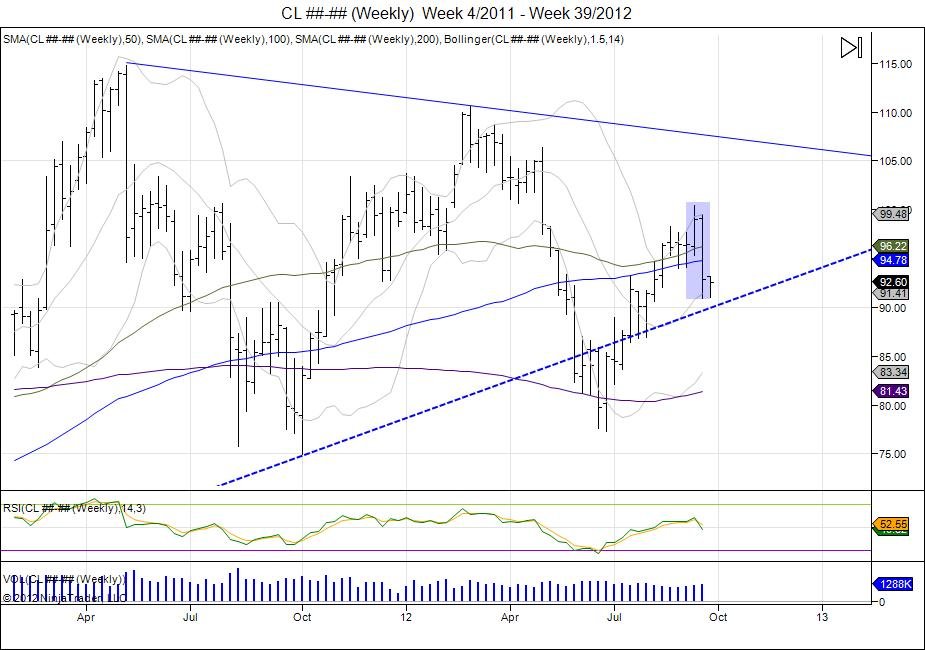

Here is a question... Shouldn't falling oil prices be a positive for the transportation sector? Looking at the weekly crude oil chart above along with the weekly transportation index fund chart, what do we notice? Both oil and the transports traded exactly the same the past 2 weeks as highlighted in blue. Crude oil made a high of 100.42, failing to break out and seeing a quick reversal the following week to take out the lows made the prior week. The transportation index made a high of 9349 and also saw a quick reversal the next week to take out the lows made the prior week. In theory, a weaker oil market should be supportive to the transportation index and the weakness in this sector should not have been as strong. Only we are now living in a QE world and these assets are trading as risk on and risk off. The weakness and similarities should be noted, as this may be giving a bigger picture of what is going on in the economy, and why the Fed continued with quantitative easing. Going forward, the range from the week these markets made these highs is new resistance needed to breach to move higher.

For precise entry, stop, and target levels on day and swing trades along with updates, click here for more information.