SP500

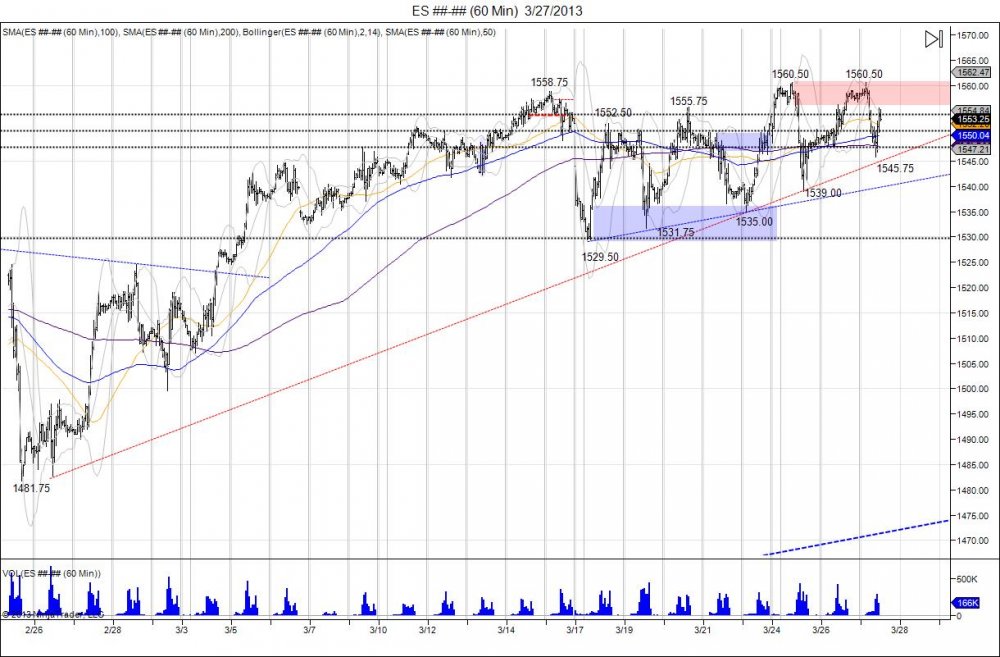

Since the gap down two Sunday's ago on the Cyprus news and bouncing off the old highs from February at 1530, the market has gone into a major tug of war whipping short sellers who have tried to come in following the news. The "plunge protection team" has managed to keep the momentum alive with higher lows. Just 1 week after that gap down, the squeeze managed to print new highs on the year at 1560.50. Following this new high, another pullback was seen to retest the prior low of 1535 only to see another higher low develop at 1539. On Tuesday this led to a recovery that retested and pressed against resistance based off the Sunday high. This has led to the market climbing back Tuesday night and retesting the 1560.50 level with the market tapping it again, however failing to breach. Thus far this has led into another pullback, retesting the previous lows of 1539 with lows of 1545.75. Higher low again as the range tightens and the market builds buy stops above the highs going into the holiday weekend. Sell stops also building below this trend of higher lows and they will be targeted eventually, question will be if momentum can stay alive into the holiday weekend as the range is now 154575-156050. Resistance met against 1558 with stops above 1560.50. Support 1548-1539. Bonds as shown below have continued to hold their bid following the Cyprus gap above 14200 and this has led to tap the March highs of 14429. The squeeze eventually completes on a move past the February high of 14611 to confirm the break below 14200 as a failure.

BONDS

EURO

YEN