The SP500 established a 6 month bullish bias in February which lured in buyers that were used as fuel to expand the market lower. We wrote an article late January on the 6 month volatility windows highlighting a failure to sustain a breakout over a volatility window had the opportunity to trap late buyers, similar to what took place in January of 2018.

You can read more about it here: SP500 6 Month Volatility Window Update

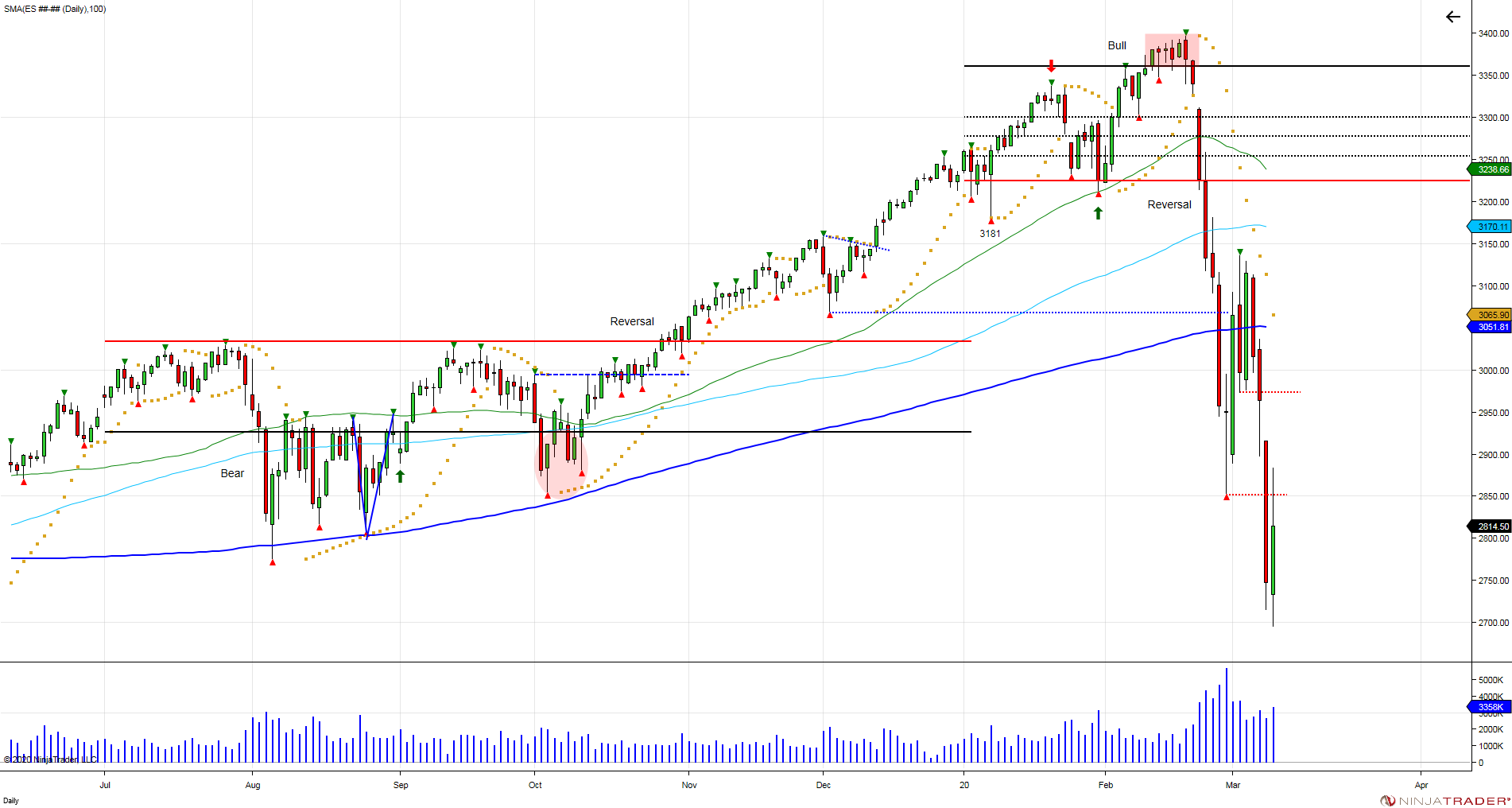

What's taken place has been almost identical to what happened in January of 2018. Both times the market was coming off a major rally and the upper vol windows were used to lure in late buyers that failed to hold the market, developing into a bull trap that was reversed. Current action has been sparked by Coronavirus, but the fuel that's expanded the market lower is trapped buyers that failed to hold the year low. Dip buyers failed on February 20th when the market broke below its 3D pivot range, breaking its upward momentum. The following day on Friday, February 21st, the market fell below its 6 month vol window of 3361, which left buyers above on the hook. Monday's trade on February 24th gapped lower, trapping buyers above as it fell into testing the 6 month reversal window of 3225. Dip buyers coming out as heroes in attempt to buy the dip (which worked so well until it failed on 2/20) failed to stop the market from reversing. Too many longs were caught at higher prices and not enough buying to sustain the drop. Since the door opening at 3225, the market dropped into the October low of 2855 before a defensive bounce up to a high of 3137 in March. By falling short of the January low of 3181, buyers on the year are still holding the bag above. By holding below the reversal window of 3225 for 6 days, the 6 month bullish bias has been reversed, creating overhead supply that is acting as resistance as rallies are being sold. The velocity to the downside and failure to hold support levels shows a lack of demand from new buyers. This is what happens when buyers are forced to chase the market, when it does come down, there are not many left, which lead to failures.

Futures went limit down in Sunday's trade, falling 5% to a low of 2819. Once again dip buying heroes tried to step up, only to see the cash market on Monday trigger another halt with the market falling 7% before opening to see a flush into 2715. This is what trying to catch a falling knife looks like. Tuesday's trade clipped the recent low of 2715 down to 2695 before bouncing back to retest last month's 2853 low that was lost this week. This will be a key level for buyers to overcome for a shot at last week's failure at 2970. Failure to overcome 2850, leaves the market vulnerable to continue trading lower, in attempt to expand lower to retest the breakout from 2500, which provides key support for buyers to defend the December 2018 low of 2316. Buyers who did not chase the market earlier this year and double down, can take advantage of the opportunity of that retest. Whether it holds is another scenario, but the first test of the level provides buyers opportunity to defend major support from the December 2018 low. Going forward, any rally back to the reversal window of 3225 will be key resistance for sellers to defend and buyers to overcome. With supply being caught above, this will make it tough for buyers to recover as new buyers will need to step up to attempt to recover trapped buyers from earlier in the year.

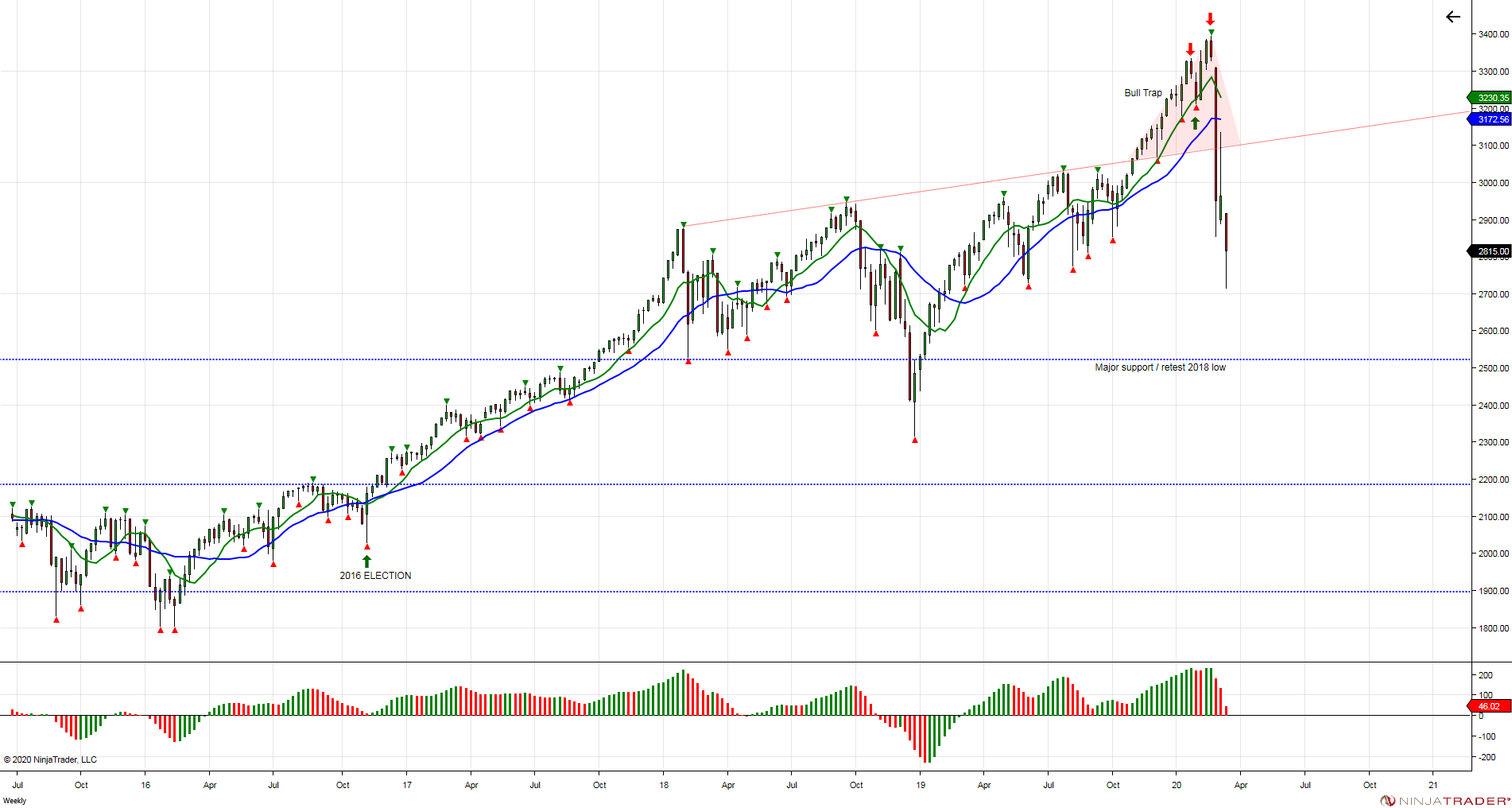

Looking at the weekly chart above, you can see the market broke above its resistance trend line from higher highs in November of 2019. This was fueled by shorts that were caught in August that failed to expand lower. The market reversed its bearish bias on November 1st, trapping shorts and using them as fuel to expand higher. As seen in the weekly chart, you can see the expansion, led the market to break above its resistance trend line, forcing shorts to capitulate, and setting up this year with a higher market that lured in the late buyers that are now caught with the market falling back below. Shorts squeezed end of last year, buyers lured in this year, the downside velocity has increased because longs have been caught on the wrong side and shorts have been sidelined, which is forcing short sellers to chase the market lower. First major support met at 2500 to retest the December 2018 low, this will give buyers who did not chase this market opportunity to defend that retest. Failure to hold the December low, sees next major support into 2200 to retest the election low of 2028 from November 2016. This is how the market moves, when more buyers or sellers are caught on wrong side and are used as fuel to expand the market in the opposite direction.

The Fed cut rates last week, but it was not enough. Soon they will be down to 0%, but that will not be enough either. According to Ben Bernanke, the Fed has one more tool in their tool box, which is devaluation of the US Dollar. If you STILL don't believe this can happen, take a look at what the US Dollar has done this year. We warned of a bearish pattern that was developing in the US Dollar Index monthly chart in December. If you look at the pattern, the market topped out when President Trump took office. It has spent the last 2 years coming back in attempt to retest that failed breakout above 100. This is a major resistance level the dollar will have to overcome for another shot at the 2017 high. Failure to overcome puts in the lower high and sets up a failed retest that can lead to lower prices. Obviously no one wants to see the dollar devaluated, but if things get ugly and cutting rates no longer work, it is an option the Fed has and it's better to be prepared for it then not. Gold is benefiting and already recovered where it failed in December of 2012 when the Fed hinted at higher rates. Here we are, 7 years later and instead of higher rates, they're back to cutting.

Will President Trump Devalue the US Dollar?

2018: The Year of the Bull Traps

January 2019 Bullish Cup/Handle

November 2019 Bearish Bias Reversal

January 2020 Bullish Bias Trap