more...

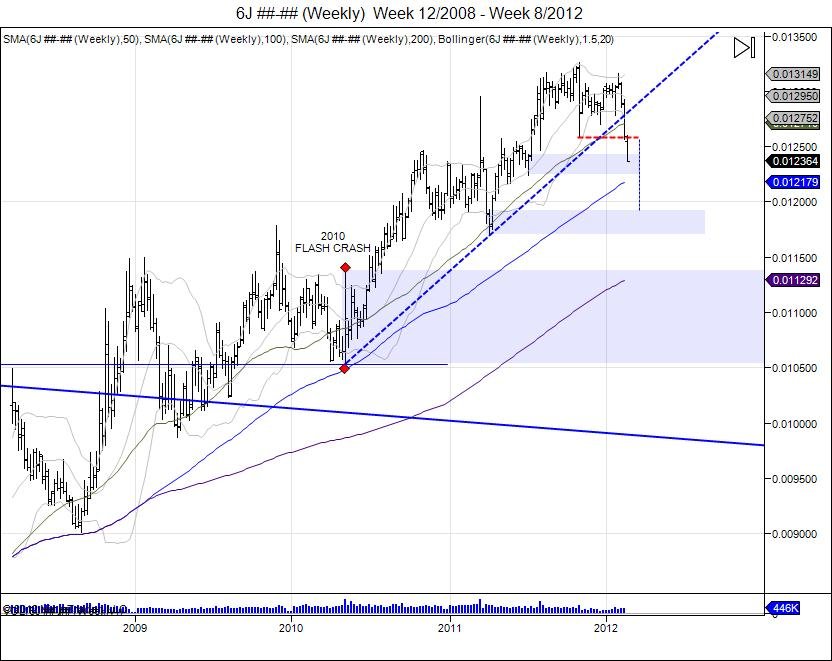

As the Yen moved up to test its .013264 high from November of 2011, the market put in a high of .013160, falling short and failing the test leading the market into a downside reversal. This reversal broke below .012582 lows from that high in November, taking out it's neckline and has the market in free fall now as this has triggered sells signals and is squeezing out longs. Market is now falling into its support from July of 2011 at .012429-.012243. It will take a bit of work to get through this however this will lead the market into its 100day moving average on the weekly. Taking the range of .012582-.013264, this gives a downside target to complete this move at .011900 which puts the market at its next major level of support from April of 2011 at .011931-.011697. This would complete the move and some consolidation and attempt to hold would be expected to digest the move as this would lead into testing the 200day moving average on the weekly. Thereafter, the next major level of support whcih was never retested is the range from the 2010 flash crash in the SP500 giving the Yen a range of .010532-.011375. This market may be looking to revisit these lows and this range which would be a major free fall from where it is at now. Since the failure at .013** the market has been caught off guard seeing this downside chase taking place. Upside resistance is now the .012582 level that was broken followed by .013000.