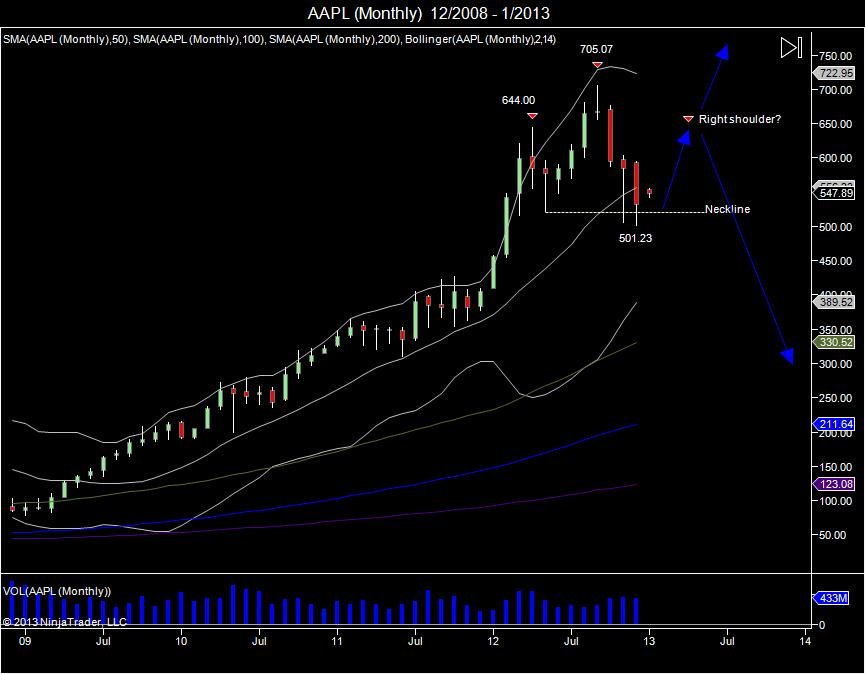

Since putting in highs of 705.07 as the iPhone 5 was announced in September of 2012, doubling from the August 2011 lows of 350, Apple saw a reversal in October that broke the September lows of 656. This turned into a major failure and sell the news catalyst as the market quickly reversed lower. This reversal led the market to fall into its 100day moving average on the daily chart, making lows of 623.55 to test where the market broke out in August. Just as the market was on these lows at 623, Apple bulls were relentless in thinking to just buy the dip. An Apple event was scheduled for October 23 that had these bulls giddy for a move higher. Warning about how this event was what the bulls were hanging their hopes on, a mini ipad.

Apple event just what the bulls have their last hopes on to save this market... a mini ipad.

— Chicagostock Trading (@Chicagostock) October 16, 2012