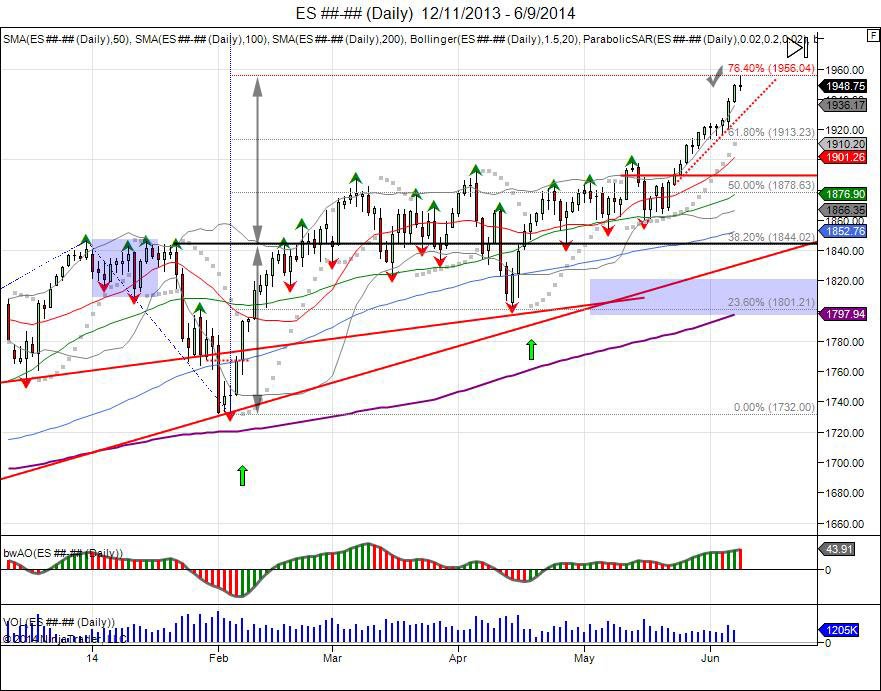

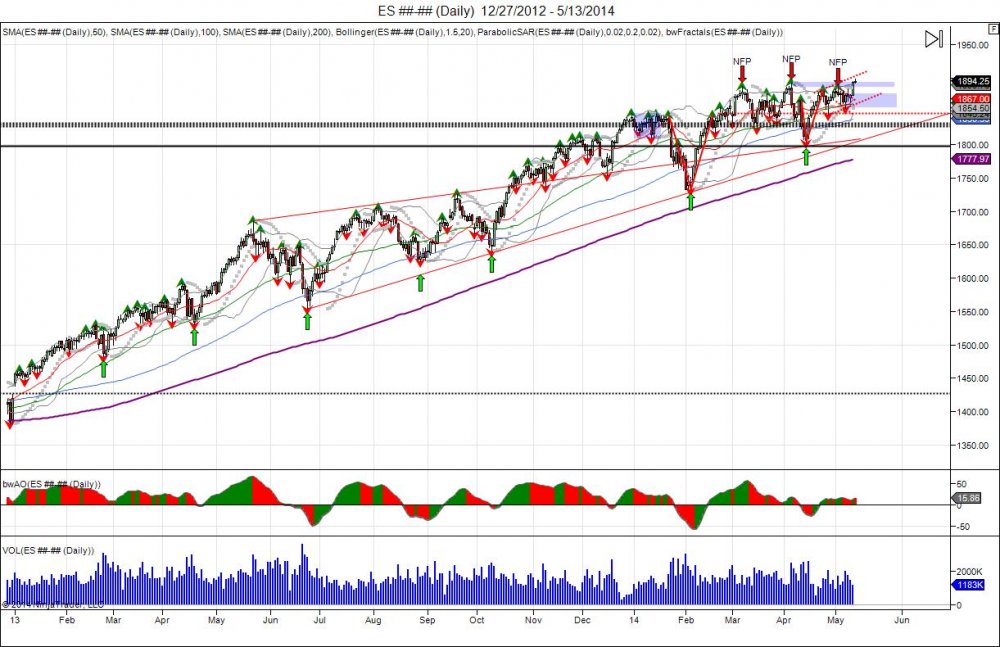

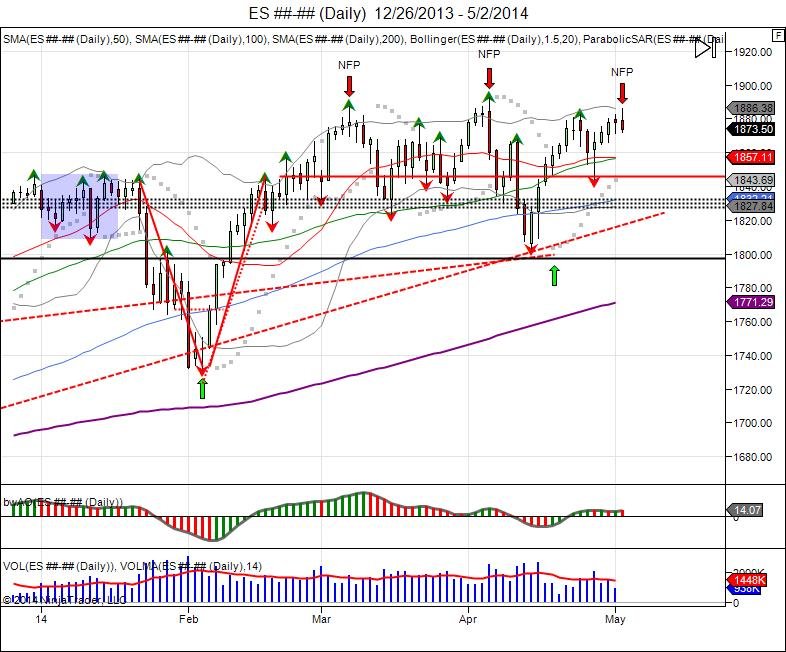

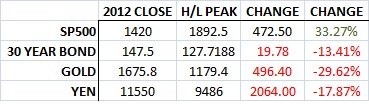

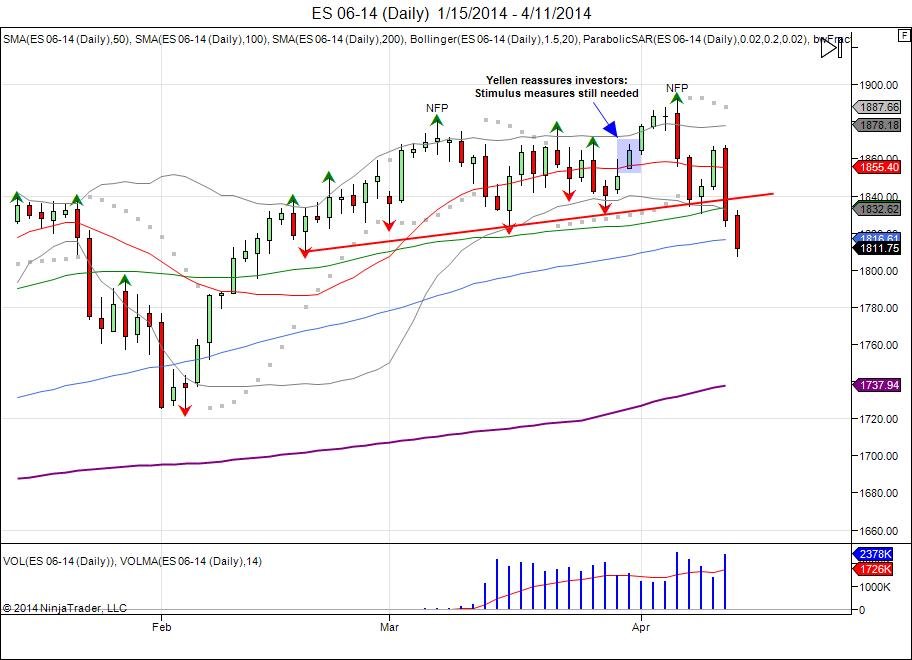

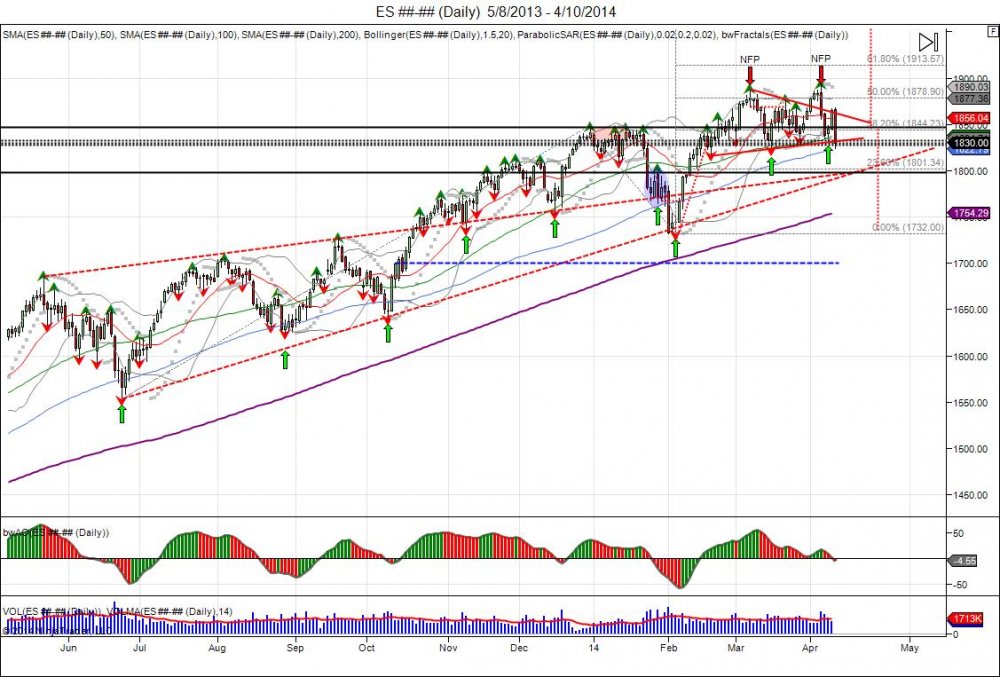

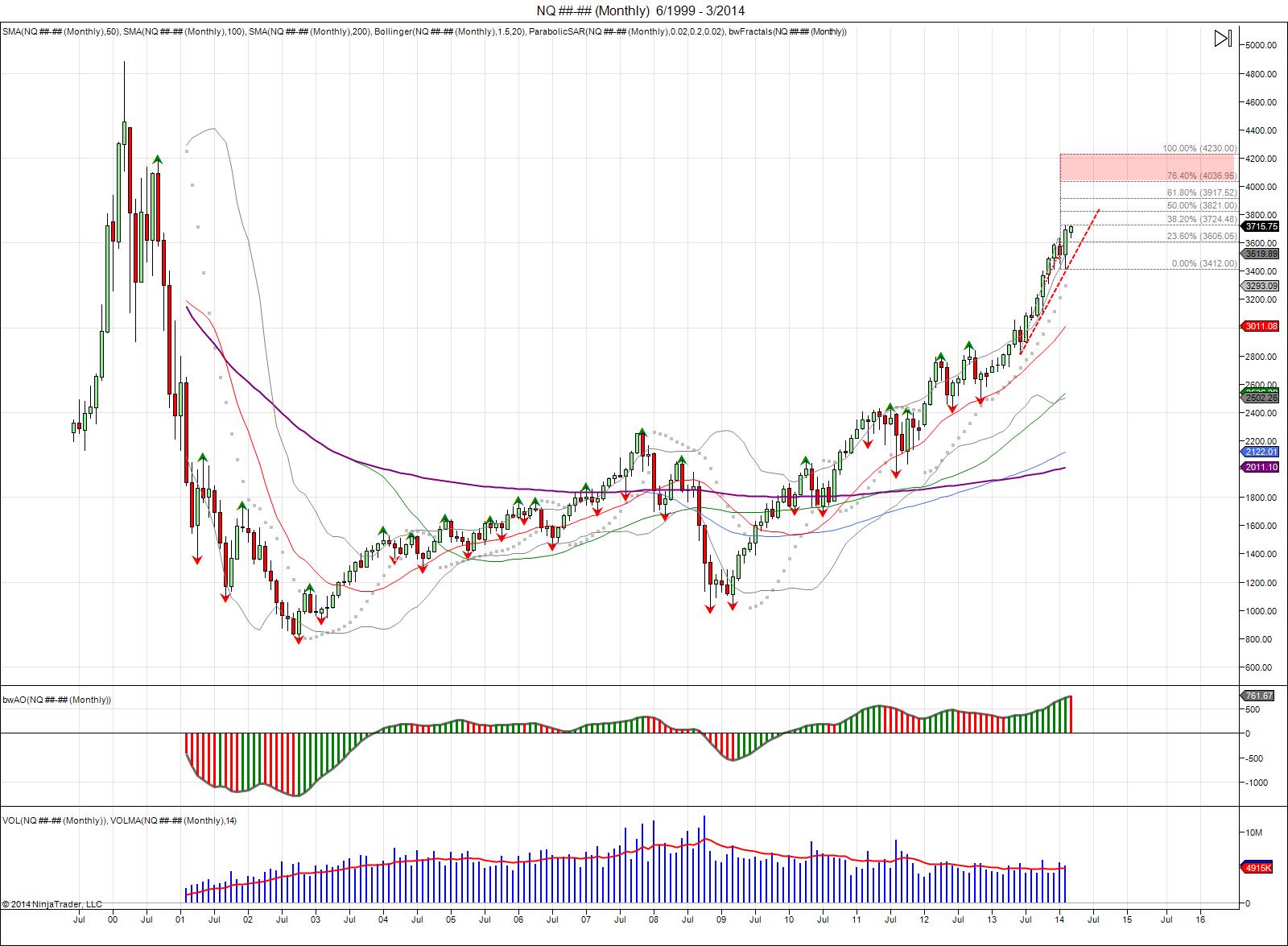

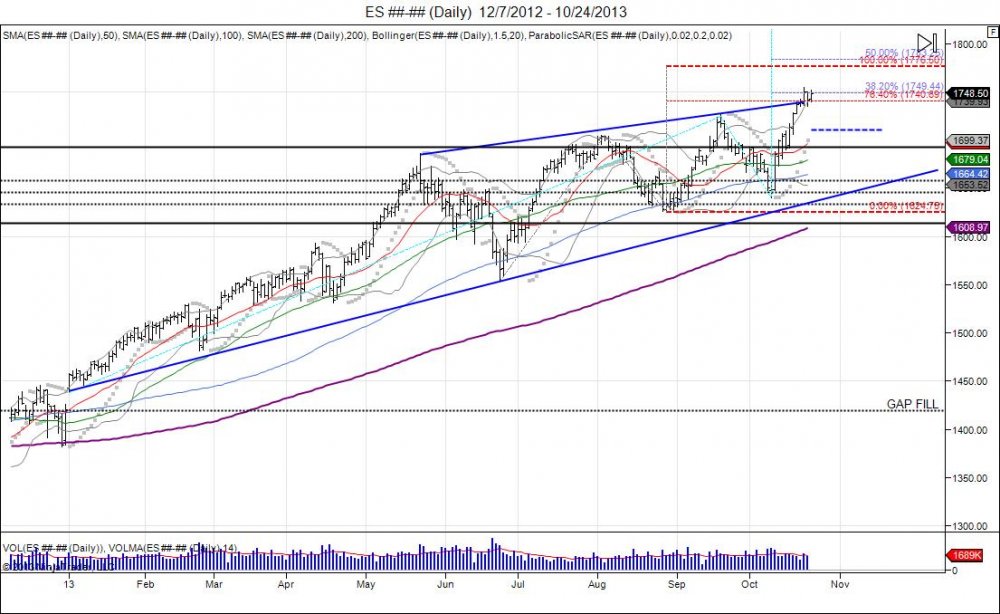

The second half of the year kicked off this month with the SP500 seeing a spillover effect from the 1st half’s close in June with the market printing a new high of 1978 during the July 4th holiday. The first half of the year began with the market liquidating to breach its lower 6 month vol window at 1797 to establish a bearish bias, enough to lure in shorts, making new lows on the year down to 1732. The breach of the vol window was used as a bear trap as the market put in a V bottom with lows of 1732 and squeezed through its 6 month reversal window of 1847 after establishing the bearish bias below 1797. By holding above 1847, the market reversed its 6 month bearish bias for the 1st half of the year, and forced shorts to have to cover as the 6 month pivots turned into support and the market stabilized above 1800. Going into the close of the 1st half any shorts that were left were forced to through in the towel which led the market to squeeze out of its 3 month range and breakout through 1900 and into 1978. With the 2nd half of the year beginning, the SP has traded in a very narrow range, within 1978- 1945. This has established a new set of volatility windows and 6 month pivots for the 2nd half of the year. The upper vol window coincides just below the psychological 2000 level which if breached, can establish a bullish bias to lure in longs and attempt to complete a 100% fib extension from 2013 low of 1553 and this year’s low of 1732, up to 2025. The lower vol window coincides with the late June lows of 1936, just before breaking above 1956 and setting new highs. Failure to hold the lower vol window shows the breakout above 1955 as a failure and gives room to retest next low down to 1917, followed by old resistance at 1900 in search of new support. The 6 month pivot for July-December is extremely tight due to the opening range’s indecision, giving way to break out of this range and for volatility to expand.