The SP500 took a breather last week. This came after seeing an explosive push on the first day of the month up to 2400, double topping at 2401 before turning lower...

The SP500 took a breather last week. This came after seeing an explosive push on the first day of the month up to 2400, double topping at 2401 before turning lower...

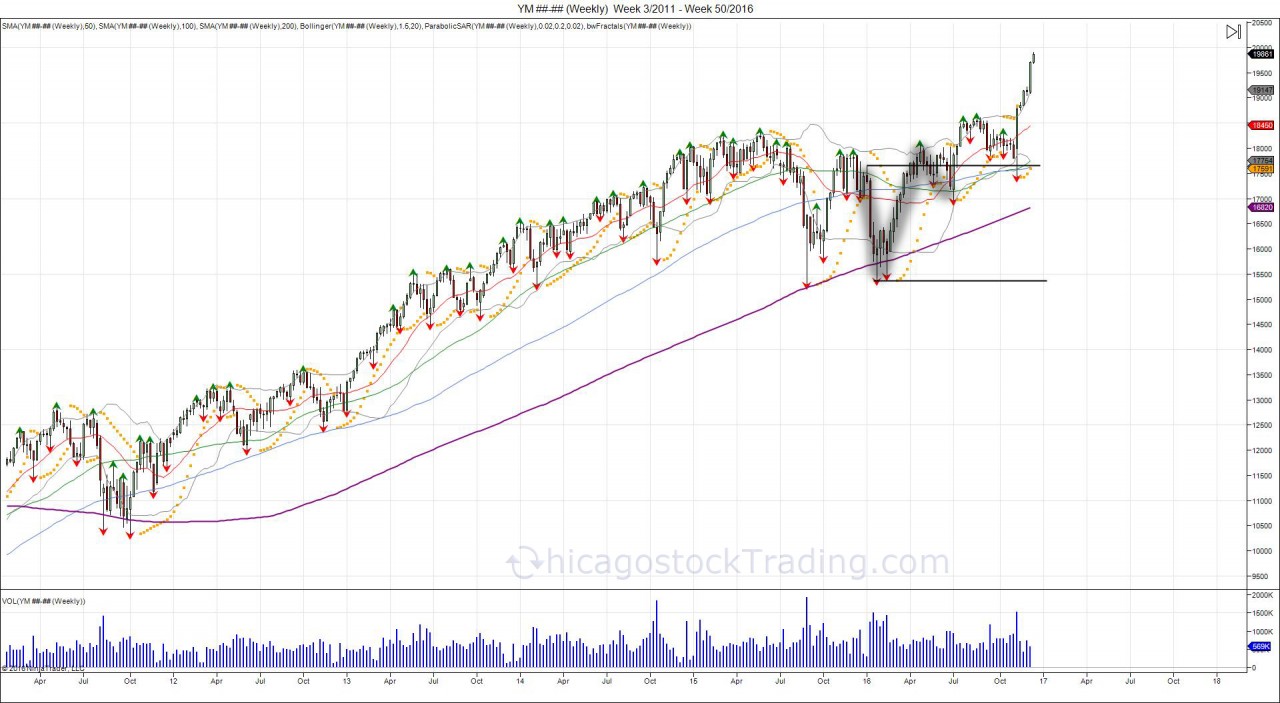

$YM_F Dow C/H Expansion = 20k... All aboard.. $DIA pic.twitter.com/RuhbCGiM6w

— Chicagostock (@Chicagostock) July 10, 2016

Update to Cup/Handle in DOW posted in July projecting 20k. #technicals #stockmarket #dowjones @NYSE @CMEGroup pic.twitter.com/6fJpdvVmxz

— Chicagostock (@Chicagostock) December 15, 2016

The stock market started 2016 weak, however recovered the highs of the year by summer, making a U turn. Those that were caught short, bearish, and wrong, were now forced to reverse position, thus creating the cup/handle formation, giving way to expand the U turn up to 20k.

The stock market started 2016 weak, however recovered the highs of the year by summer, making a U turn. Those that were caught short, bearish, and wrong, were now forced to reverse position, thus creating the cup/handle formation, giving way to expand the U turn up to 20k.

HOW DID THIS:

$ES_F Daily V bottom. Expansion > 1920 = test of year high. #psa pic.twitter.com/w558cz49I0

— Chicagostock (@Chicagostock) February 22, 2016

GET TO THIS?:

Commented on StockTwits: $ES_F Completes V bottom objective of 2042 from 1920. $SPY $SPX https://t.co/j102MzSsXB pic.twitter.com/yEP6aGyTfU

— Chicagostock (@Chicagostock) March 19, 2016

Let's take a look at how the oil short squeeze took place. In February, oil broke the January low of 2756, falling to 2605 on February 11th. Just as oil was testing and ready to break 26, the UAE Energy minister came out with remarks that they were willing to cooperate on production cuts. This instantly reversed the market off the lows to see it recover 30 in the coming days. Dubbing this the "OPEC put" as it clearly showed members of the organization were attempting to defend 26.

The move, setup a failed breakdown, leaving shorts below 30 trapped:

Crude oil chart sent to clients on Friday... pic.twitter.com/rDqZjno0VU

— Chicagostock (@Chicagostock) February 17, 2016

In December’s article “The Yellen that Stole Christmas”, the point was to show how buyers in the SP500 were caught above 2040, and needed a Yellen rescue. The market attempted to breakout to start December, however the rug was pulled from underneath as Yellen reiterated a rate hike later in the month. After bluffing the market for 2 years on this rate cut, the call fell on many deaf ears. So it was. Buyers were left caught at higher prices, betting on a “Santa Claus Rally” only to be hoping for Yellen to save Christmas. For the first time in 6 years and exactly 3 years from December 2012’s FOMC that placed a 6.5% target on NFP for a decision on Fed Funds rate, the FOMC reset the market and hiked the Fed Funds rate by a quarter point. Bulls did not get what they were looking for and saw the market fall back to retest 1982 support. The level barely held on December 18th, as the market rallied back for Christmas holiday and the “Santa Claus Rally” was actually a gift from Yellen for stuck longs above 2040 to “breakeven”, or as we like to call it “get out of jail free card”.

Risk Disclosure: Futures, foreign currency, and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one's financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Video content hosted by a third party.

Live Trade Room Example: This presentation is for educational purposes only and the opinions expressed are those of the presenter only. All trades presented should be considered hypothetical and should not be expected to be replicated in a live trading account.

Hypothetical Performance Disclosure Example: Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points that can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect trading results.

© 2025 Chicagostock Trading. All Rights Reserved.