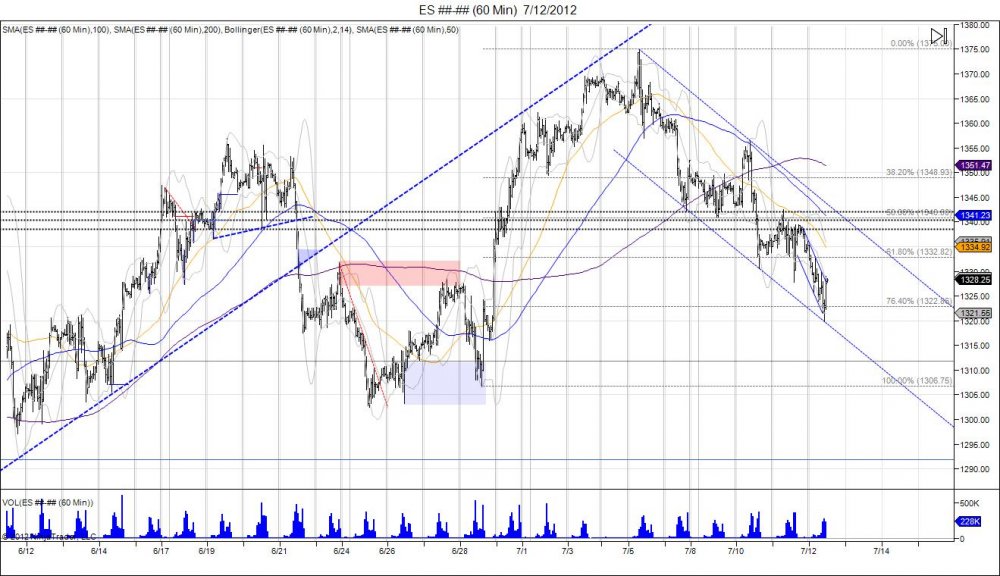

It was surely Friday the 13th for stock bears as the market moved through Thursday's highs which led to shorts being forced out as the market retraced back to where it failed earlier in the week at 1352.00-1356.50. The market closed the week a tick higher at 1352.00 from last week's close of 1351.75. The move was a win for bulls as the market was down pressing against the late June lows on Thursday. The market reversed on Thursday and was able to close above 1328, giving bulls their platform to continue higher. This was seen today with 1328.75 lows and a run into highs of 1353.25. The move in itself has given aggressive bulls who defended the pullback oppurtunity to take some money off the table and reduce exposure as the street now is back to bullish. With the short squeeze sparking this rally, going forward it will be up to buyers to come in at these levels to carry this momentum and retest the major resistance of 1357-1375 level from early July where the market failed. Bears are now looking at this squeeze as a simple retracement into those failed highs to build a -right shoulder, thus making the range of 135-1375 that much more important. Moving through this range sees next major resistance coming into play at 1390, followed by targeting the year highs of 1420. Downside support is now 1340 and a break below Thursday's lows of 1319.75, derails this move and puts pressure to retest the 1302.50 lows from late June, followed by the 1297 right shoulder created June 12th.

Click chart to enlarge