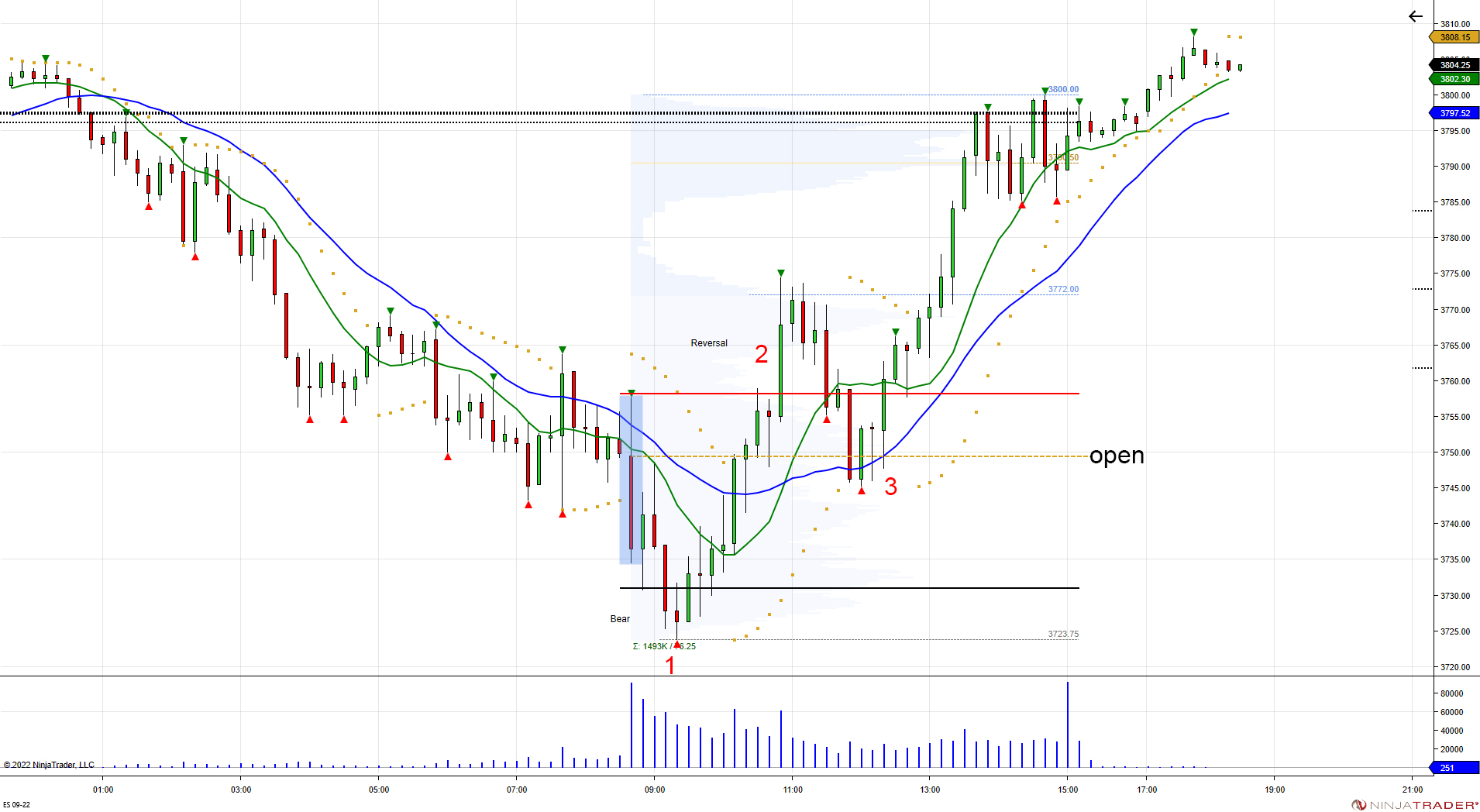

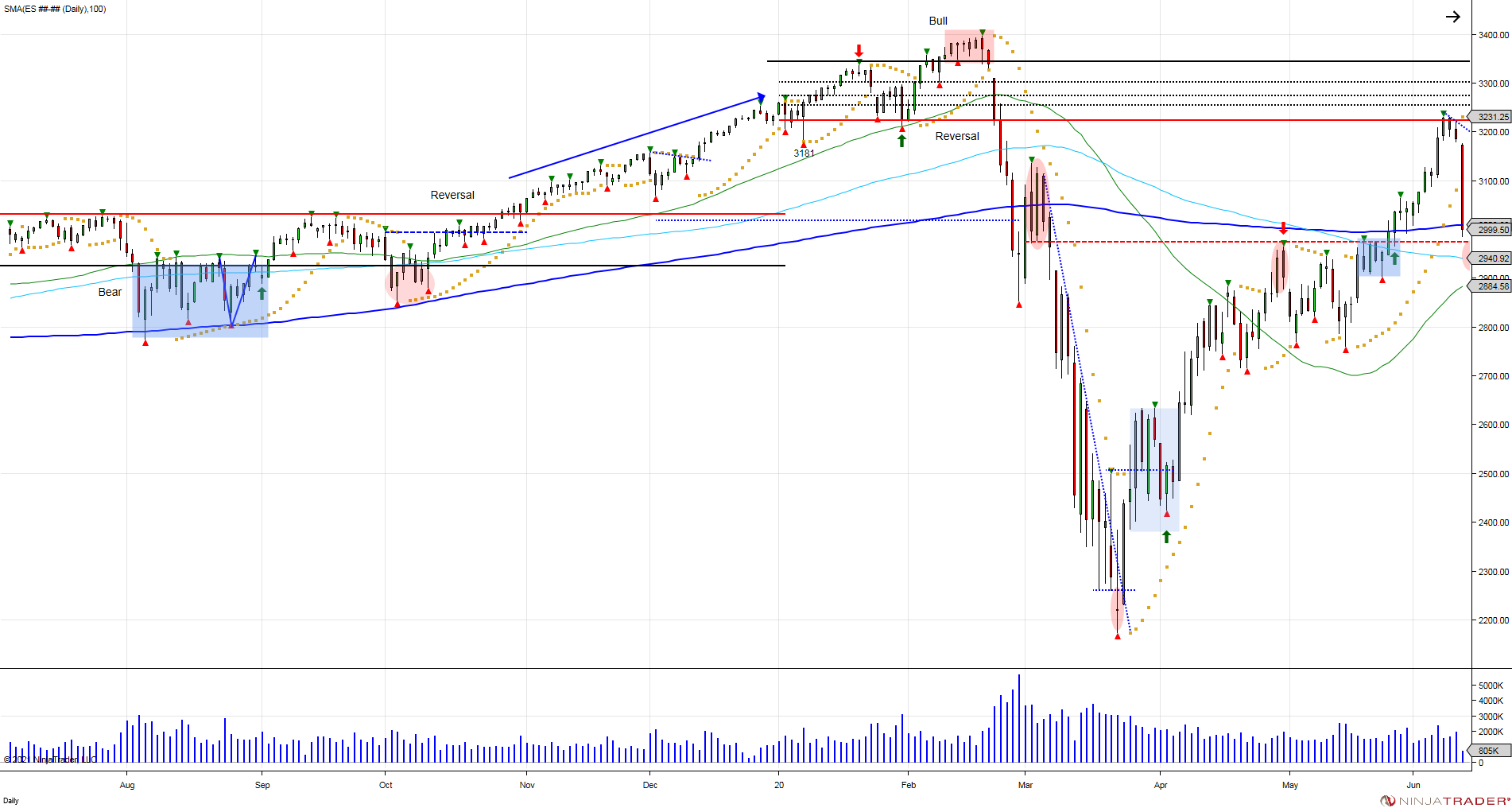

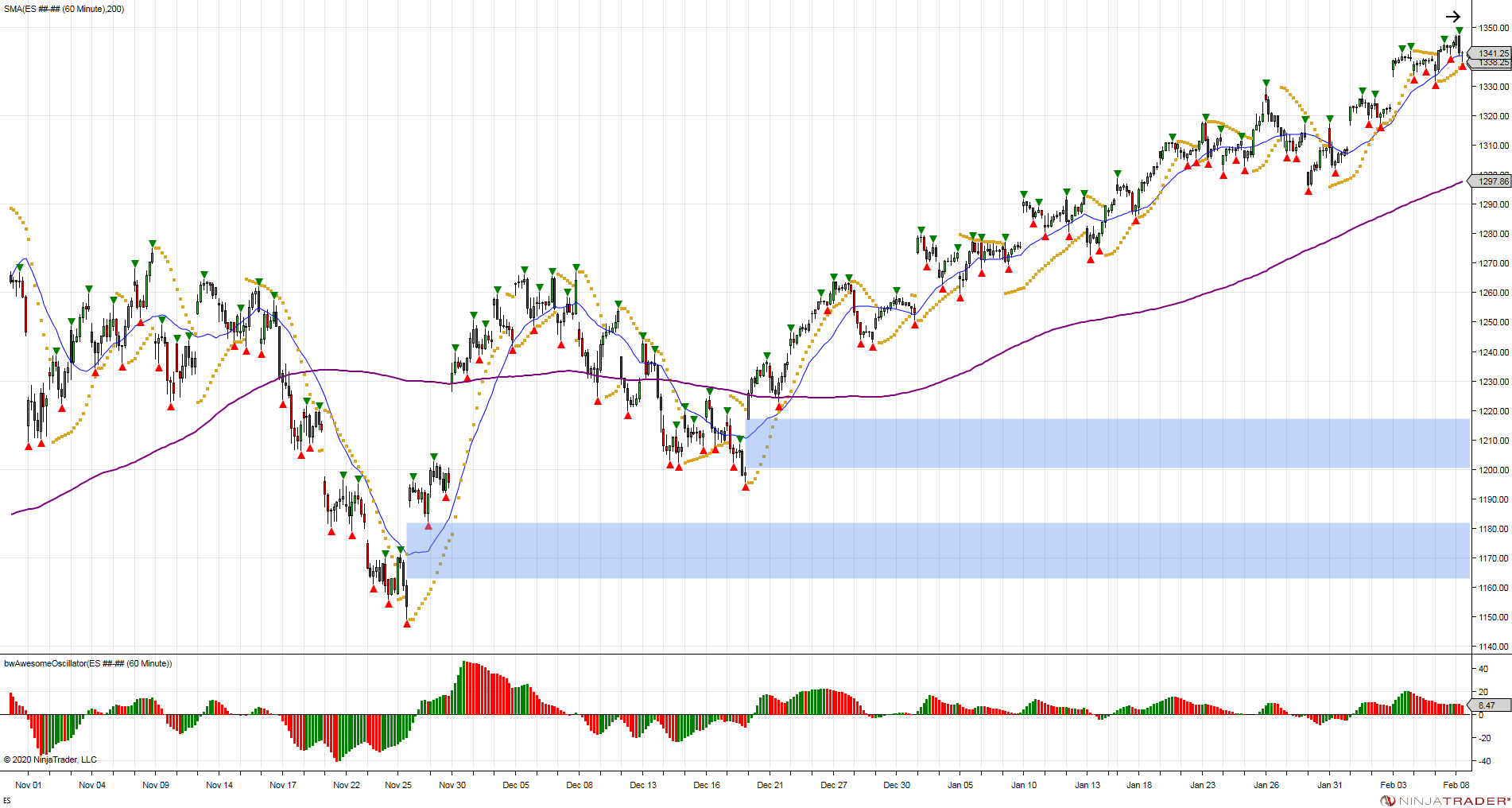

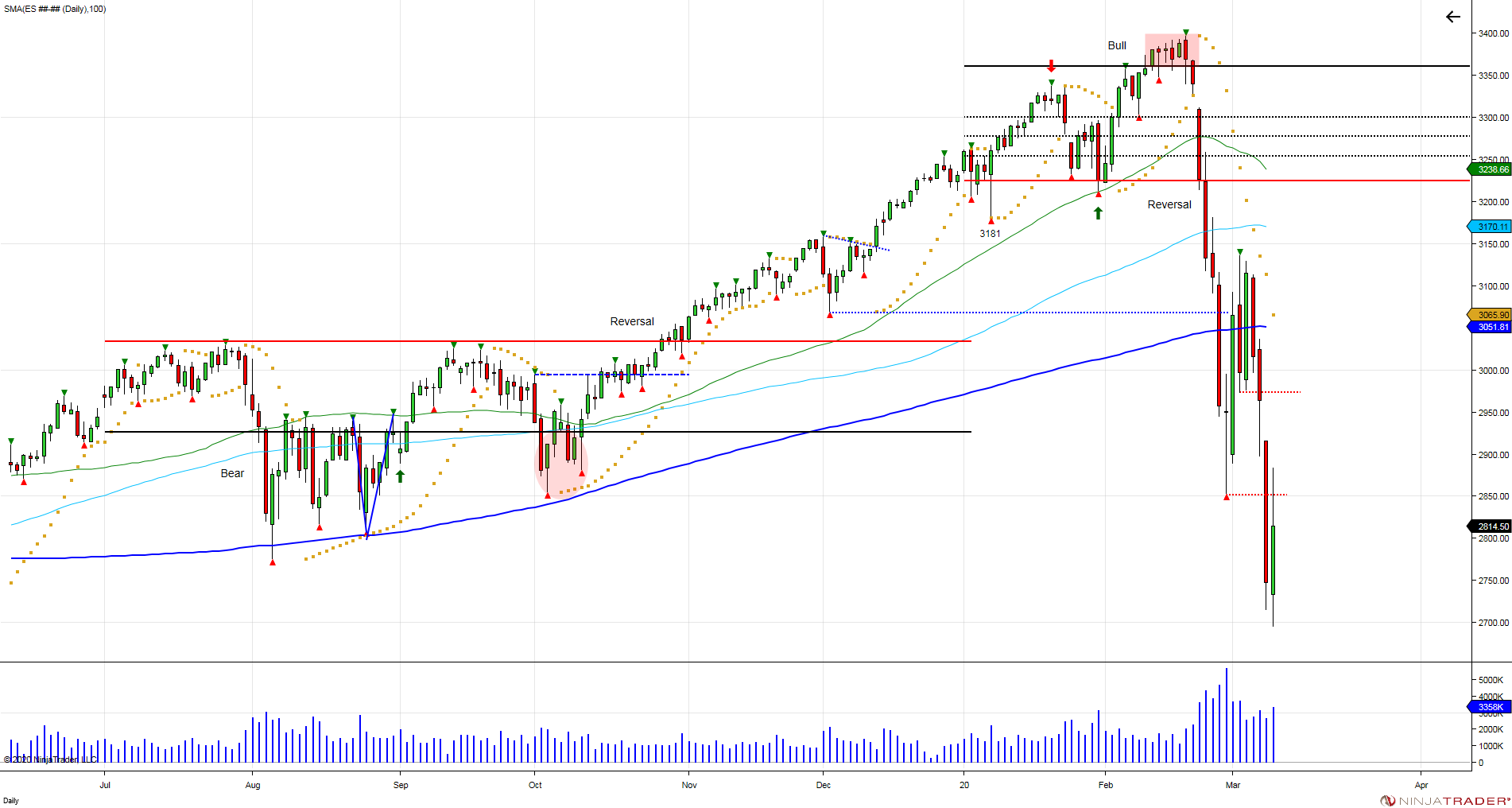

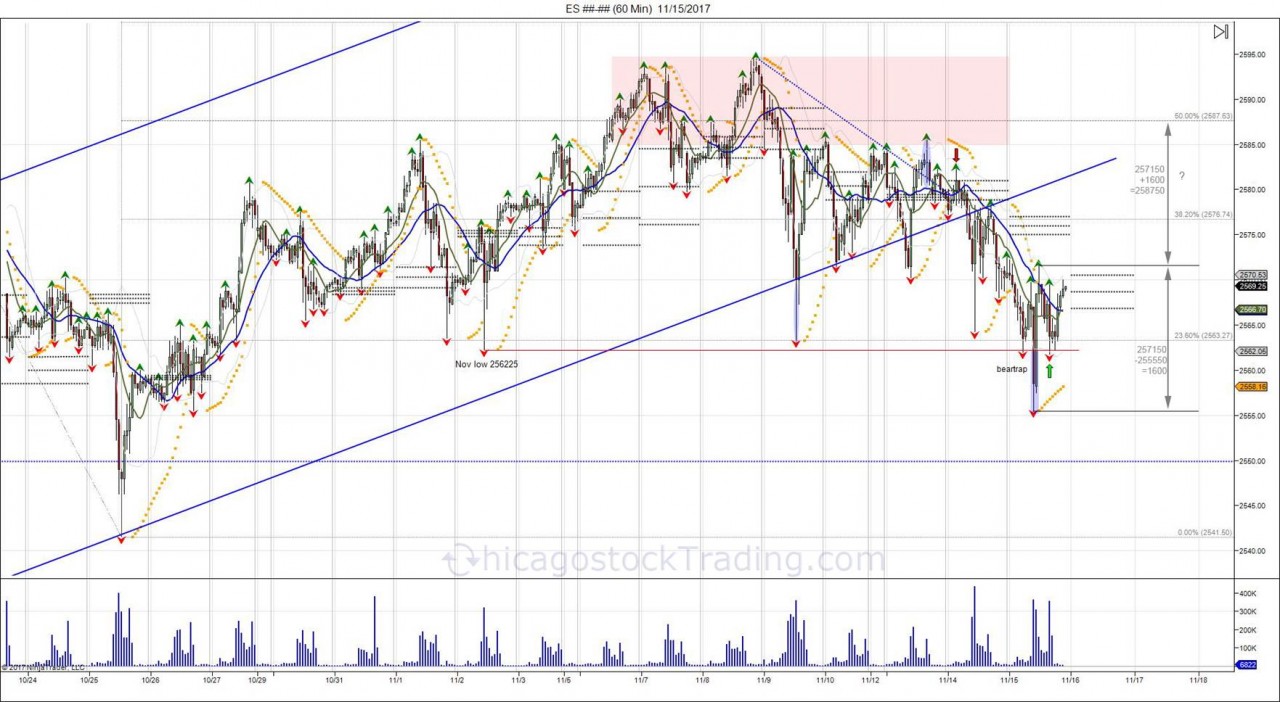

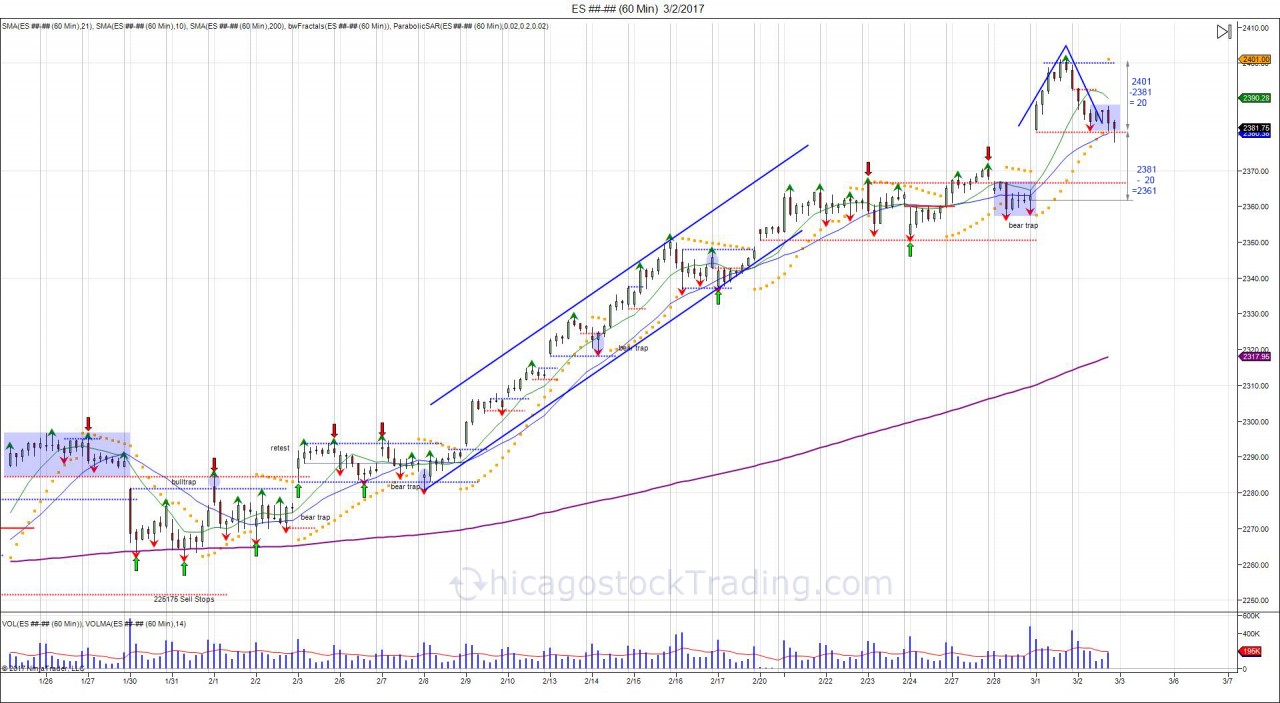

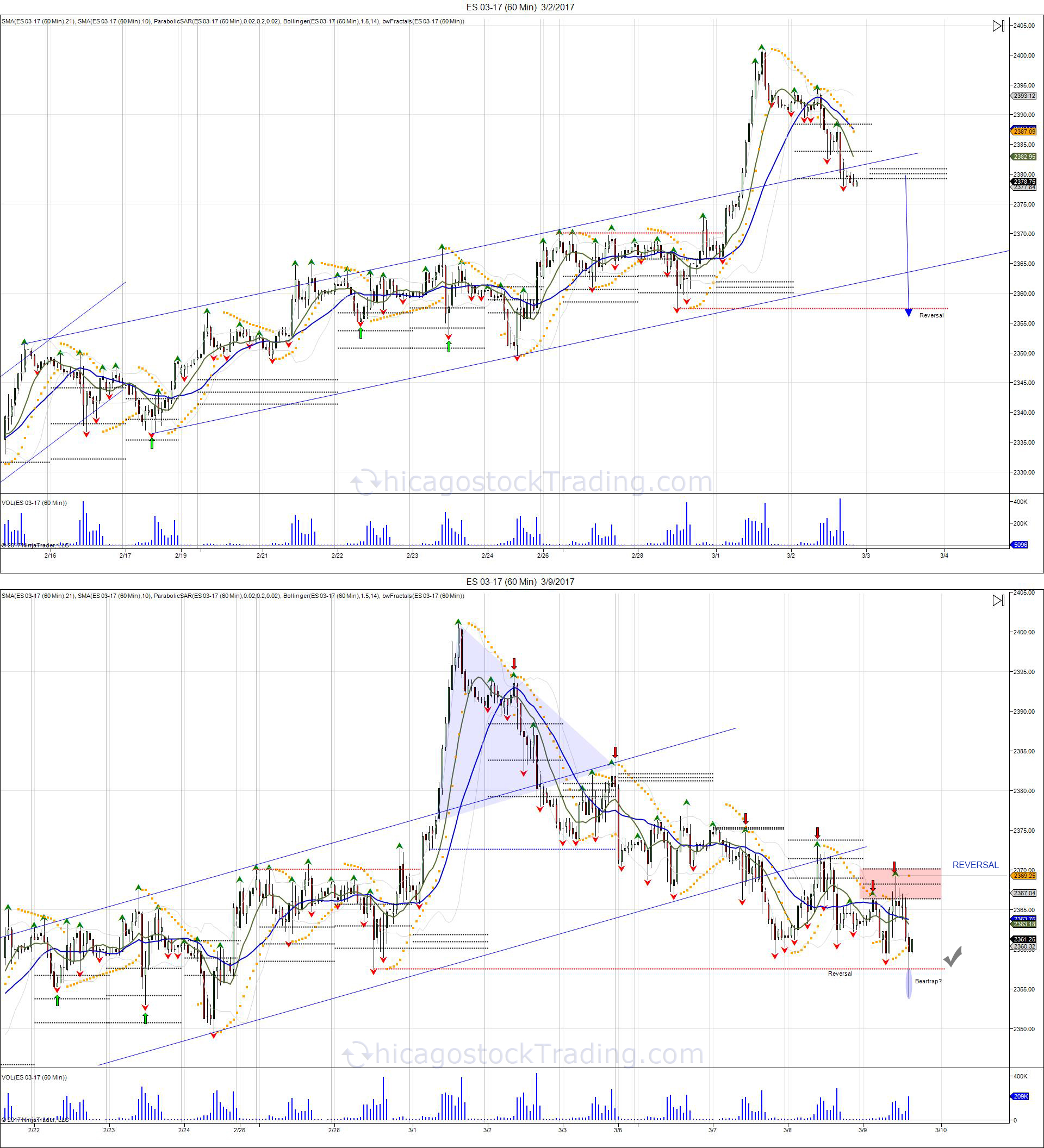

The market was sold in the overnight, setting up the cash market to open with a gap down. Cash market opened down, forcing sellers to chase weakness and breaking the lower Volatility window at 3731. By doing so, this set a bearish intraday bias, luring in "late sellers". When sellers were unable to expand below the lower vol window and the market recovered back above window, these late sellers were caught in a trap and used to fuel a run through the opening high and reversal window, reversing the bear bias. When a bias is reversed, in this case a bear one, it tells us the sellers were wrong and shorts on the day are then forced to cover their shorts and buy pullbacks. Pullbacks into the open, and the lower vol window become support as shorts are covering. In this case buyers defended the open, which kept sellers from buying back lower, giving way for another run and expansion back to the intraday pivot as sellers were forced to cover at higher prices.

Traps move markets, volatility windows are helpful to identify momentum on the day, but also when a trap is being set. When a majority of the selling is done in the overnight, the lower vol window becomes key to luring in late sellers. If they are unable to continue expanding lower, they get caught in a trap and used to move the market in the opposite direction.

Sign up here for a 2 week free trial to receive daily ES reports, volatility windows and pivots: https://www.paypal.com/cgi-bin/webscr?cmd=_s-xclick&hosted_button_id=T9TWRWFGUB8NJ

Access to our chat room, screenshare, and live trading 1 week free trial here: https://www.paypal.com/cgi-bin/webscr?cmd=_s-xclick&hosted_button_id=59K8NHY2S5B6N

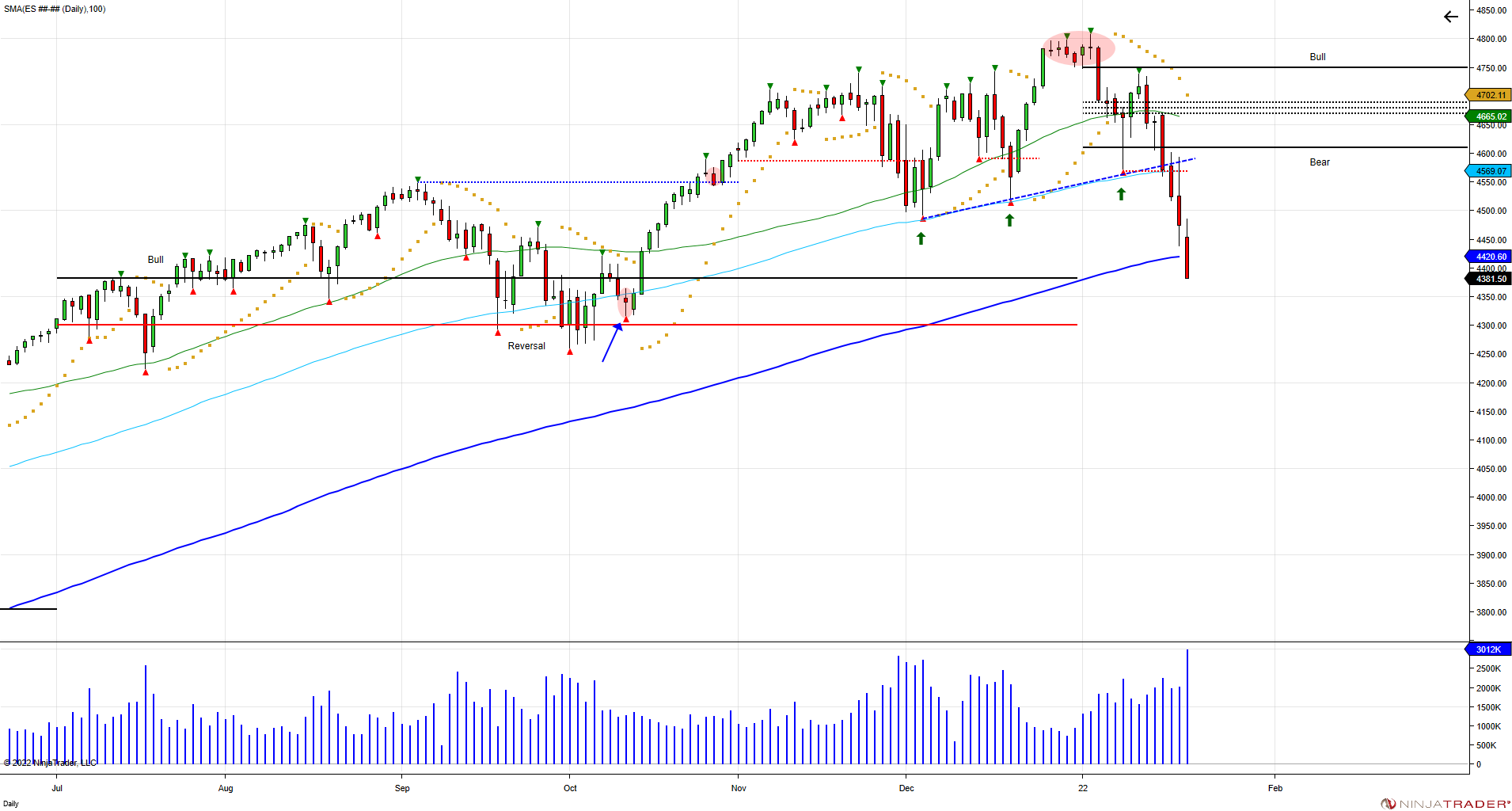

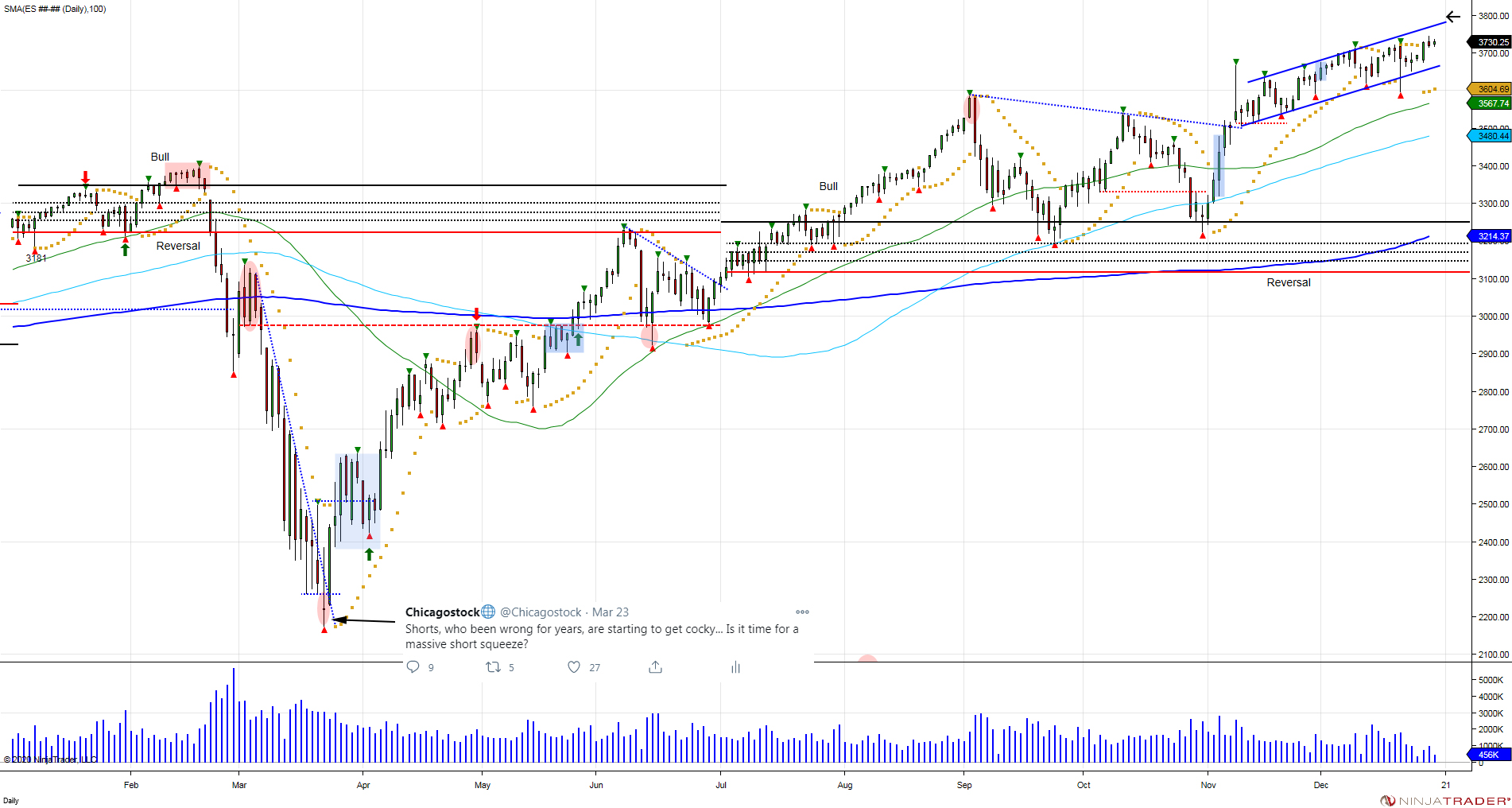

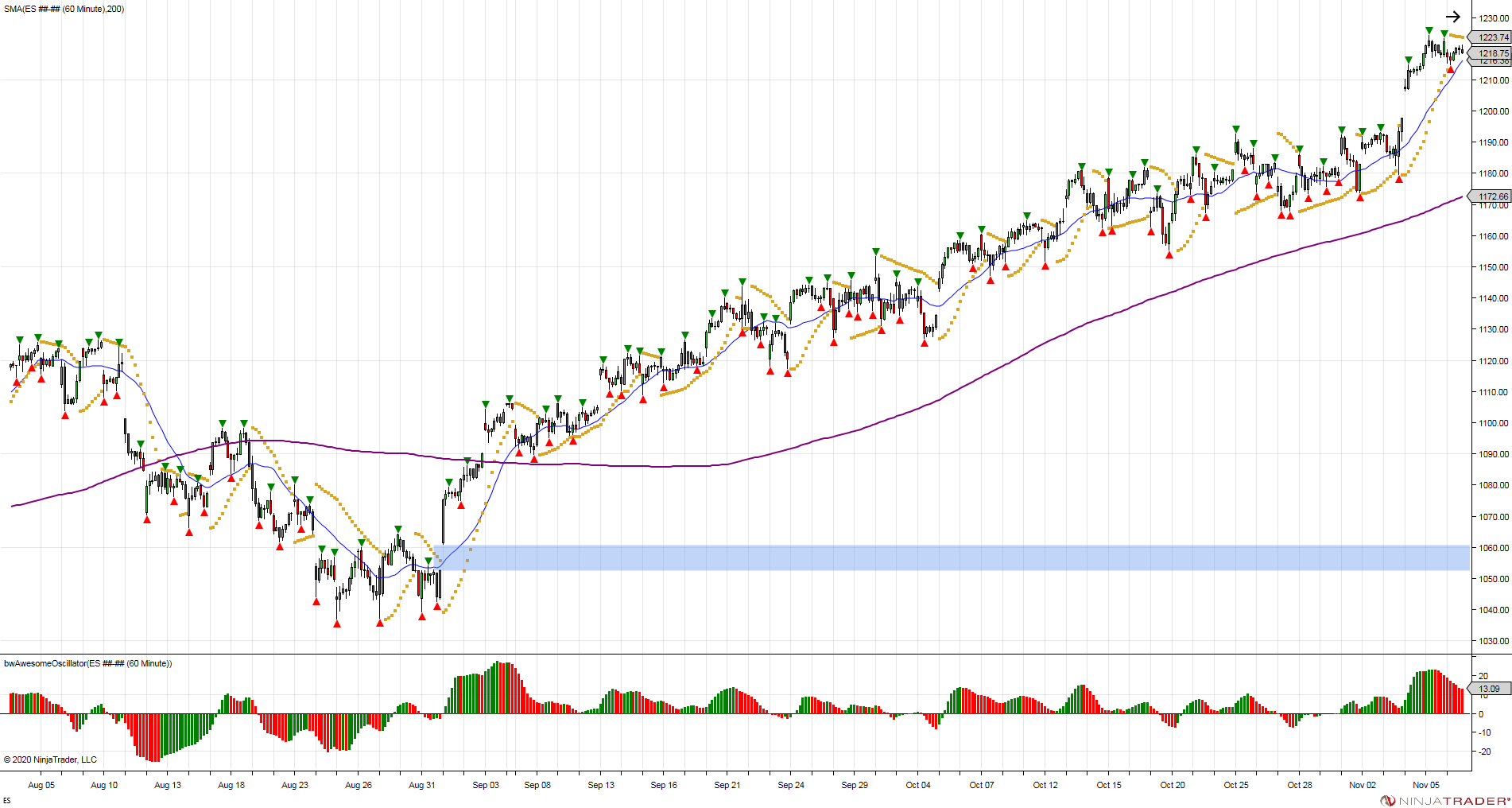

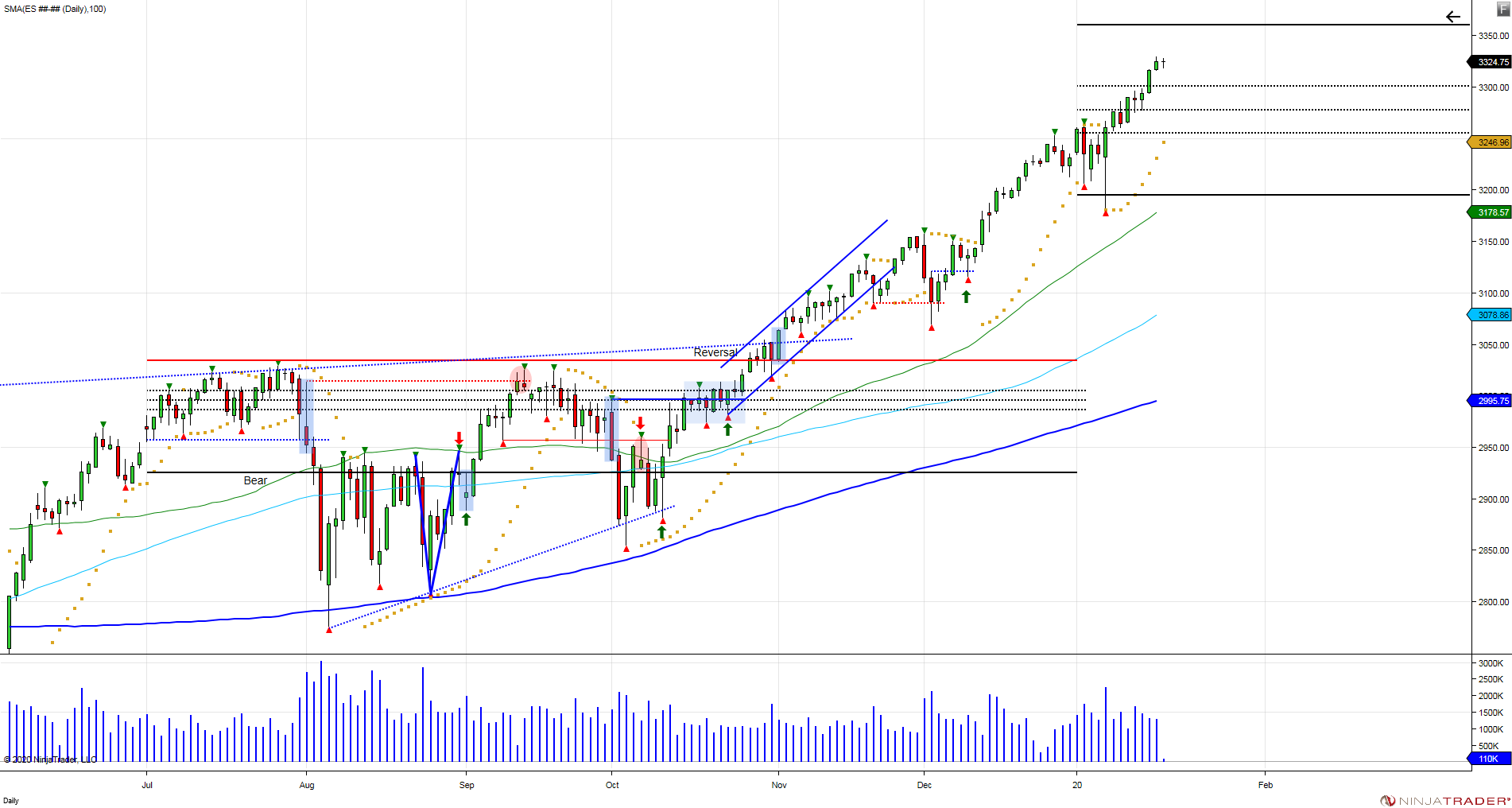

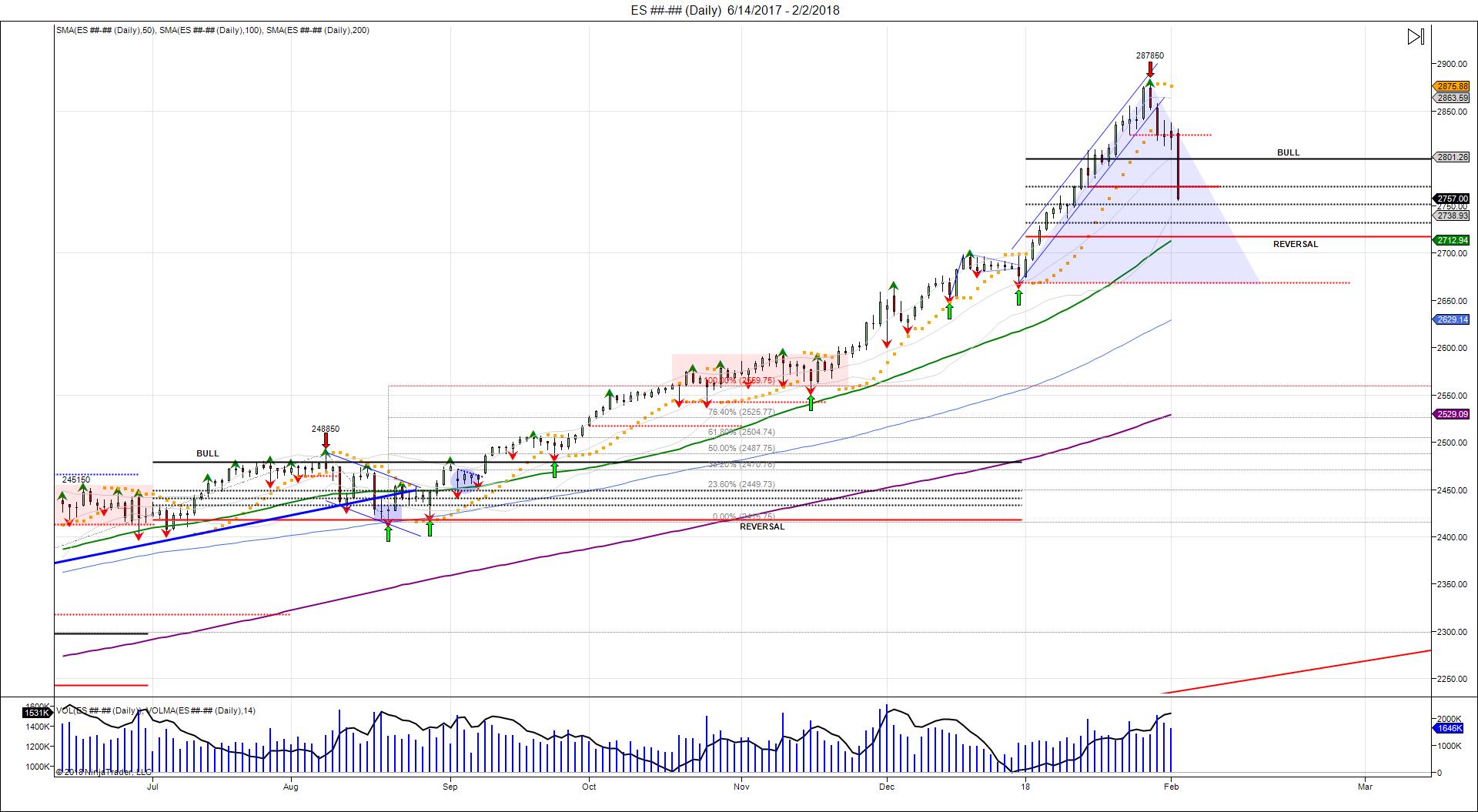

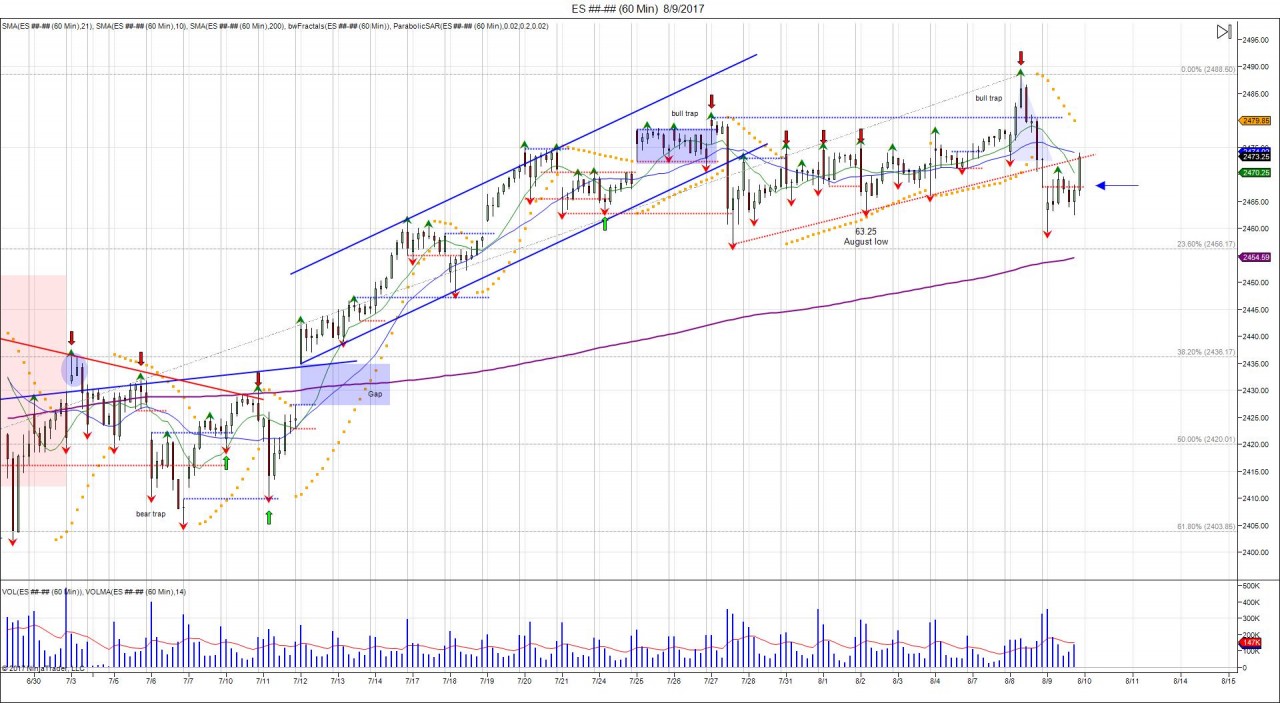

On Thursday, the day after the FOMC statement, we review the intraday action in regards to Chicagostock's Volatility windows and pivots. The highlighted blue box, is the cash market open, NYSE 930 AM. After the open, the cash market had trouble overcoming the intraday pivots, seeing the range act as resistance. This led the market to fall into the lower Vol window which was met with a defensive bounce. The defensive bounce gave way for a retest of the open, giving sellers an area to defend and buyers major resistance to overcome. For buyers that picked up the initial test of the lower Vol window, this provided a bounce to take some profits into. Second or third attempt at the lower Vol window, increases the odds of seeing the level failing. After failing to overcome the opening range, the market drifted back toward the lower Vol window which was taken out. In order to establish a bearish intraday bias, a 5 minute hold below the lower Vol window needs to be seen. Sometimes the market can establish a bias, and bounce back to the open to again force sellers to defend their intraday trend. In this case, the second test of the lower Vol window saw the level taken out, establishing a bearish intraday bias. Since there was already an early bounce off the lower Vol window, there was not another one and sellers expanded the market lower, forcing longs to liquidate into the close.

On Thursday, the day after the FOMC statement, we review the intraday action in regards to Chicagostock's Volatility windows and pivots. The highlighted blue box, is the cash market open, NYSE 930 AM. After the open, the cash market had trouble overcoming the intraday pivots, seeing the range act as resistance. This led the market to fall into the lower Vol window which was met with a defensive bounce. The defensive bounce gave way for a retest of the open, giving sellers an area to defend and buyers major resistance to overcome. For buyers that picked up the initial test of the lower Vol window, this provided a bounce to take some profits into. Second or third attempt at the lower Vol window, increases the odds of seeing the level failing. After failing to overcome the opening range, the market drifted back toward the lower Vol window which was taken out. In order to establish a bearish intraday bias, a 5 minute hold below the lower Vol window needs to be seen. Sometimes the market can establish a bias, and bounce back to the open to again force sellers to defend their intraday trend. In this case, the second test of the lower Vol window saw the level taken out, establishing a bearish intraday bias. Since there was already an early bounce off the lower Vol window, there was not another one and sellers expanded the market lower, forcing longs to liquidate into the close.

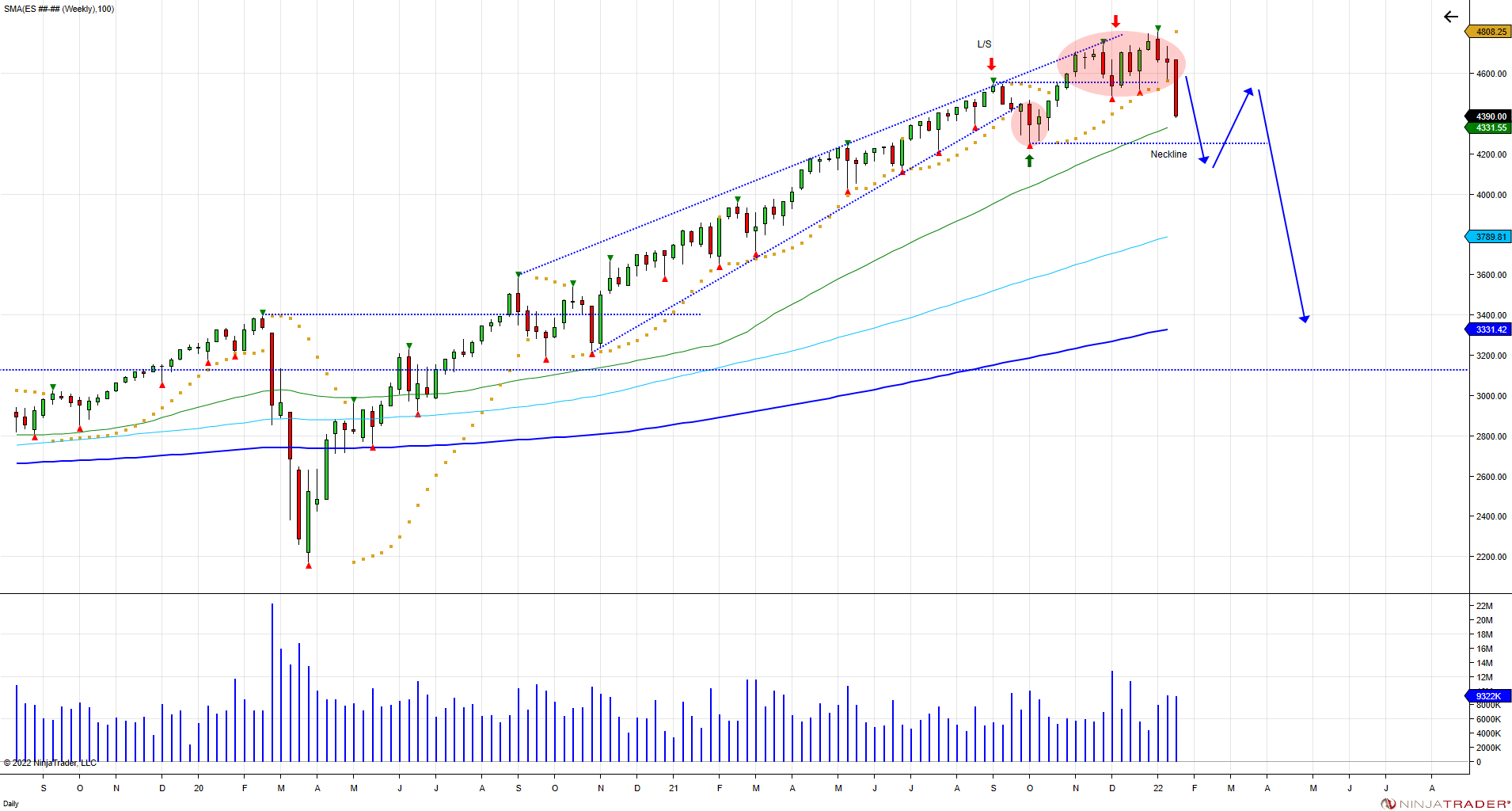

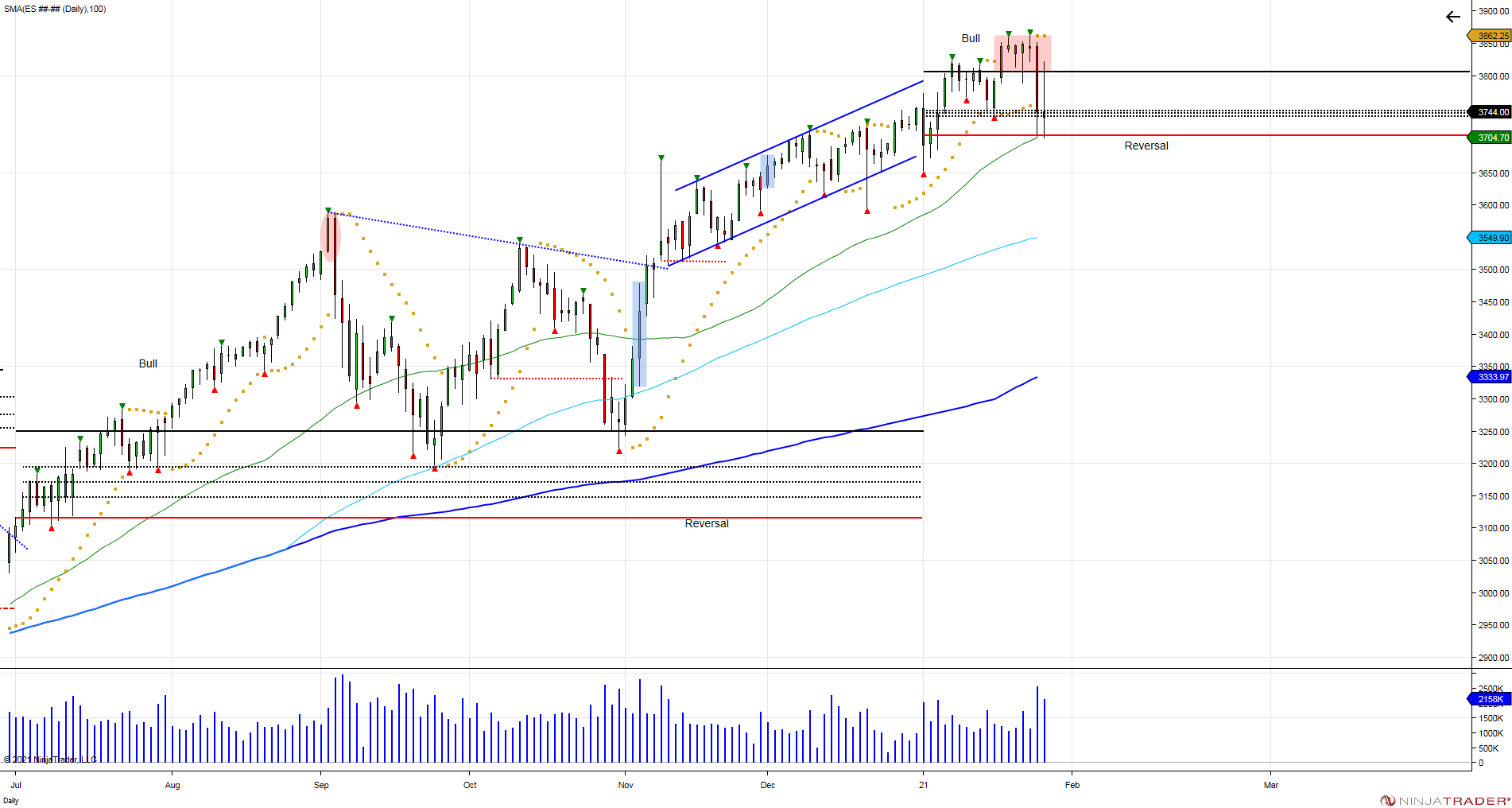

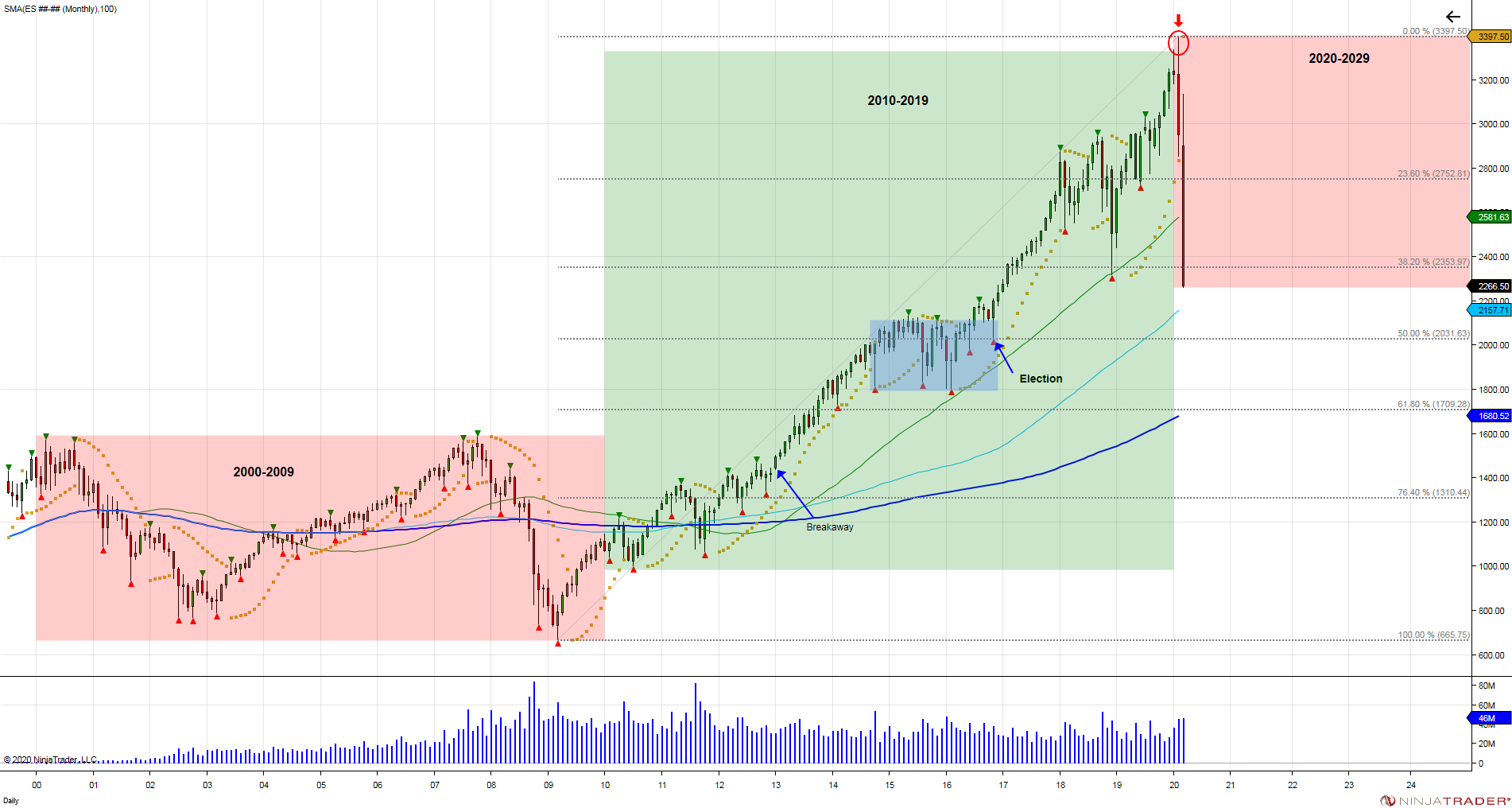

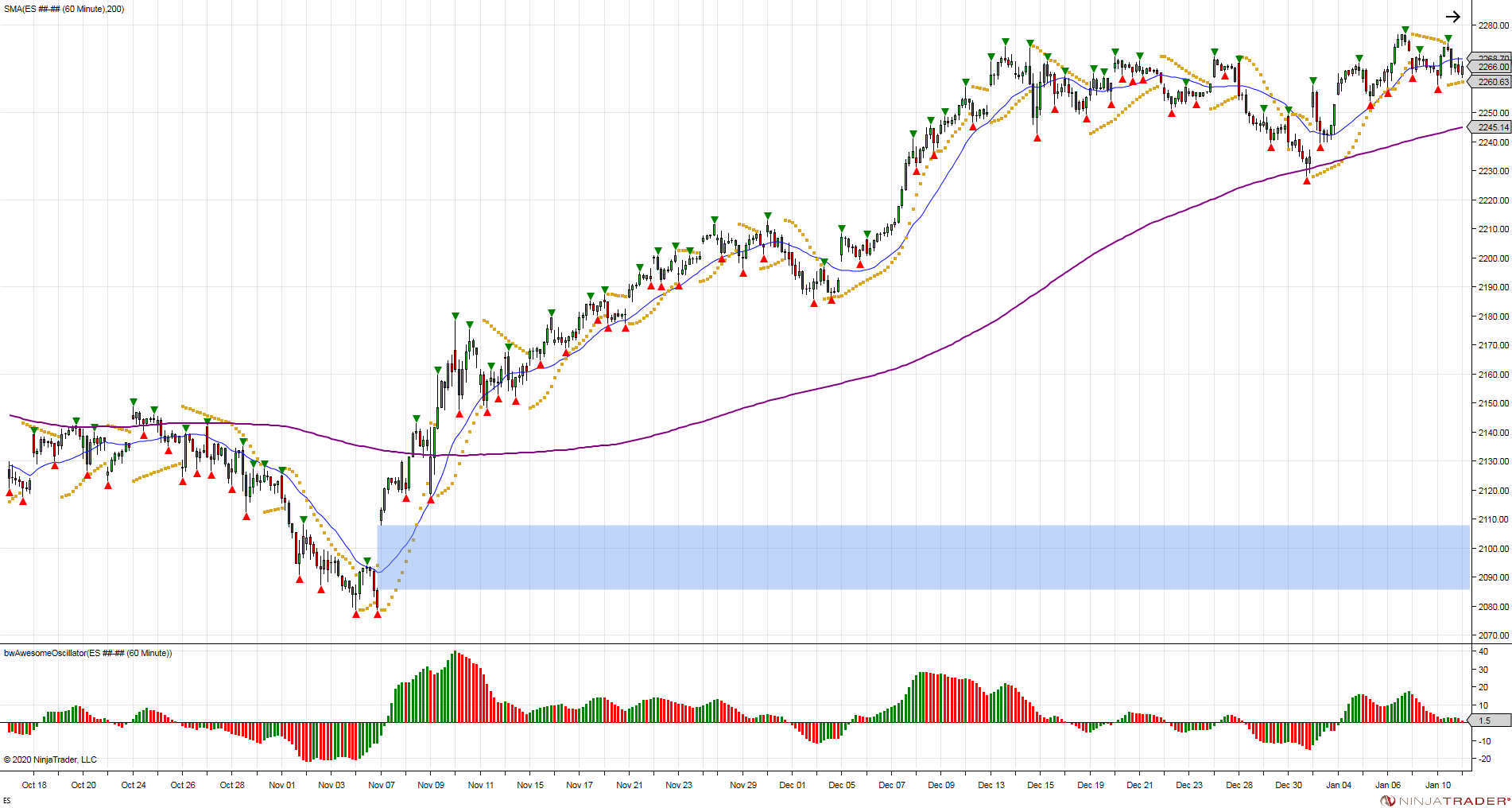

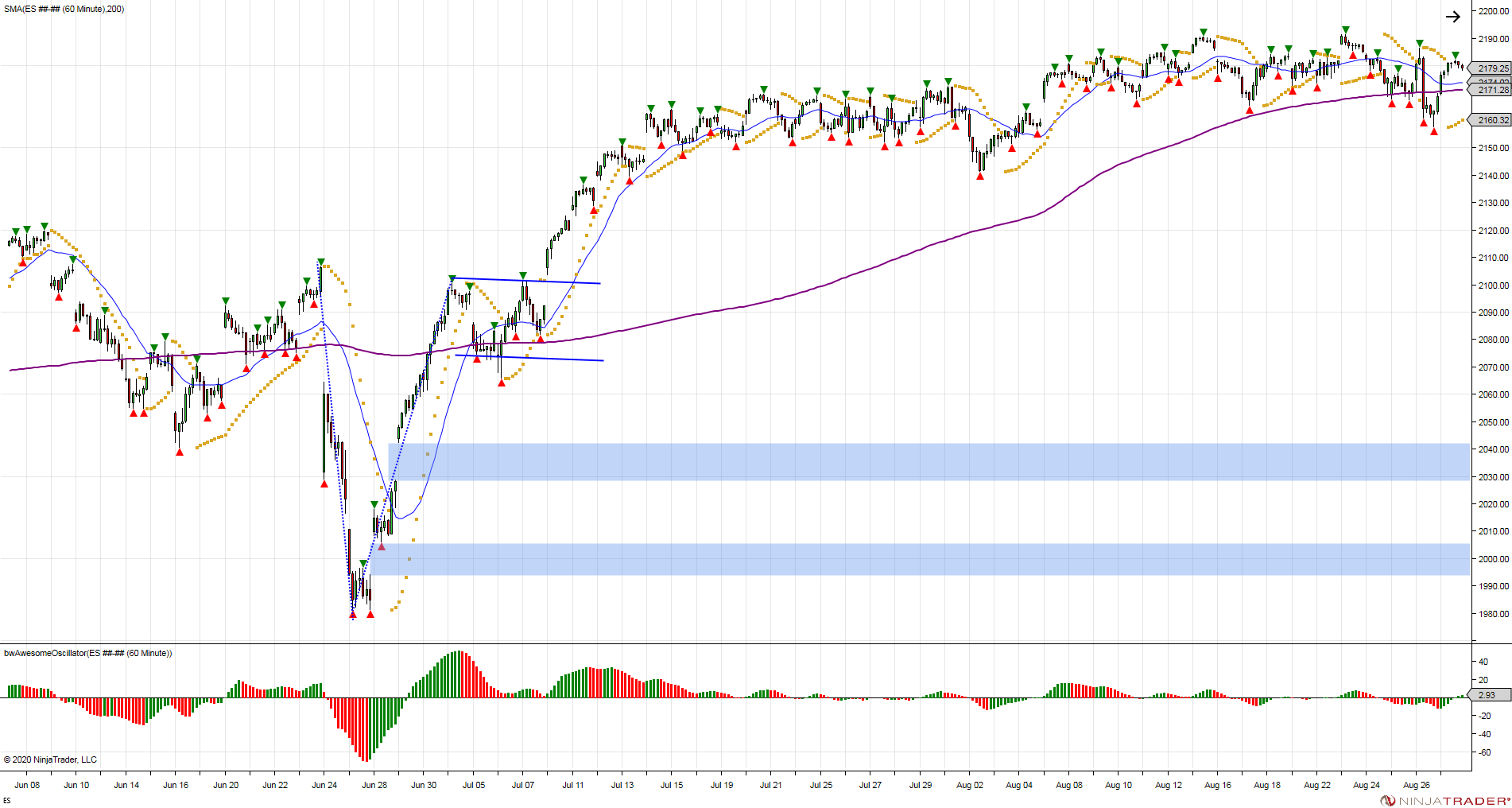

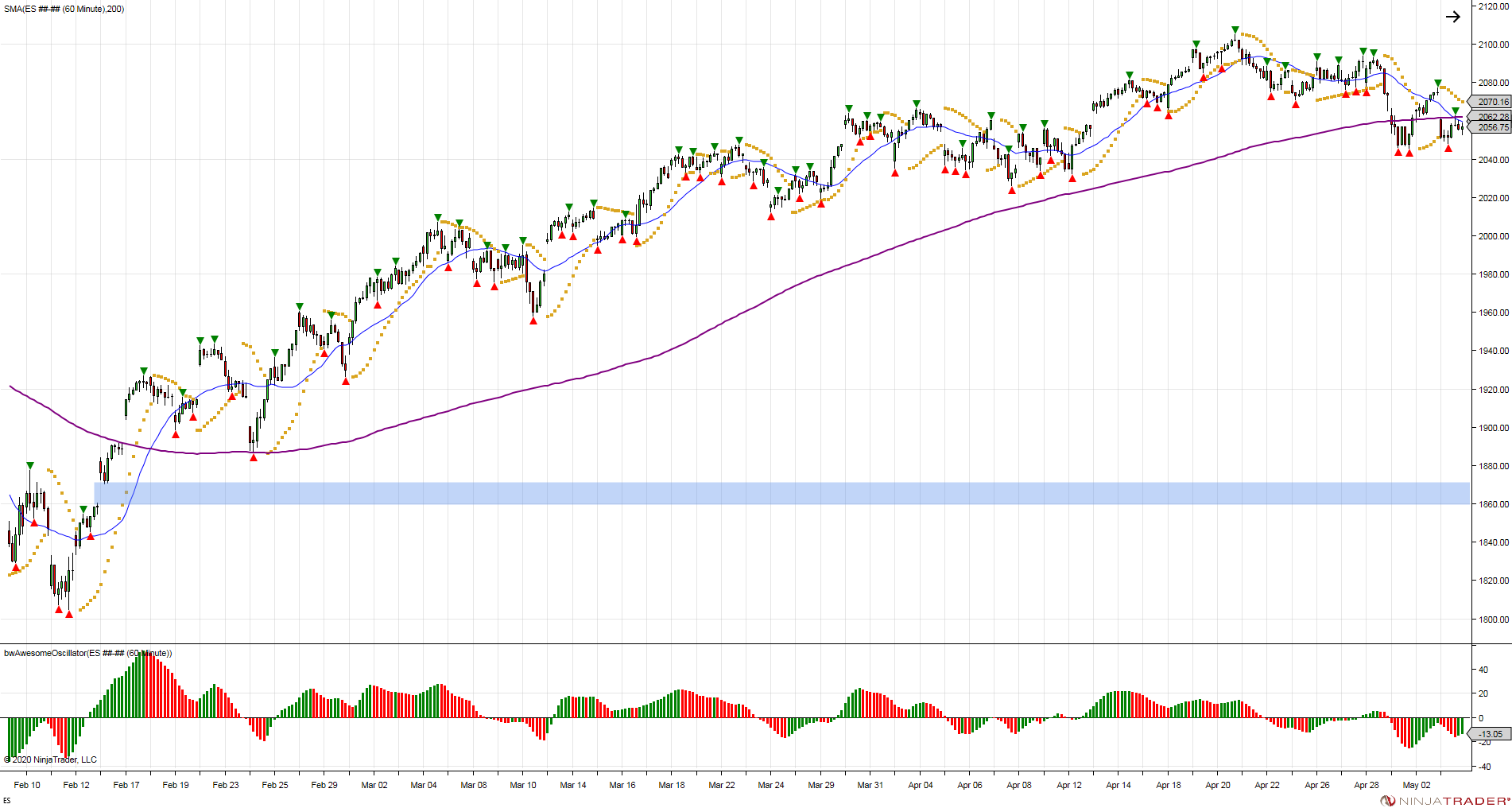

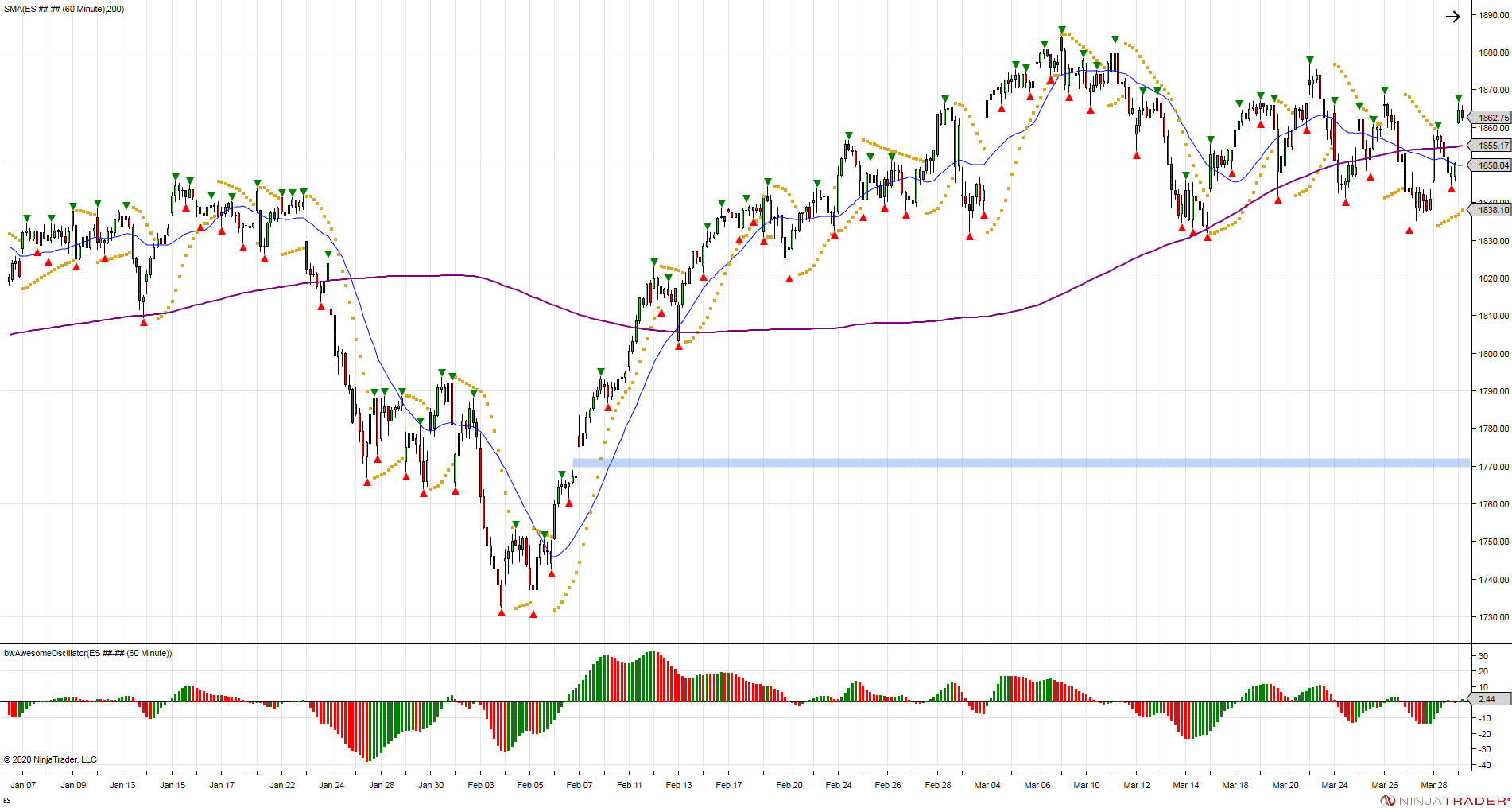

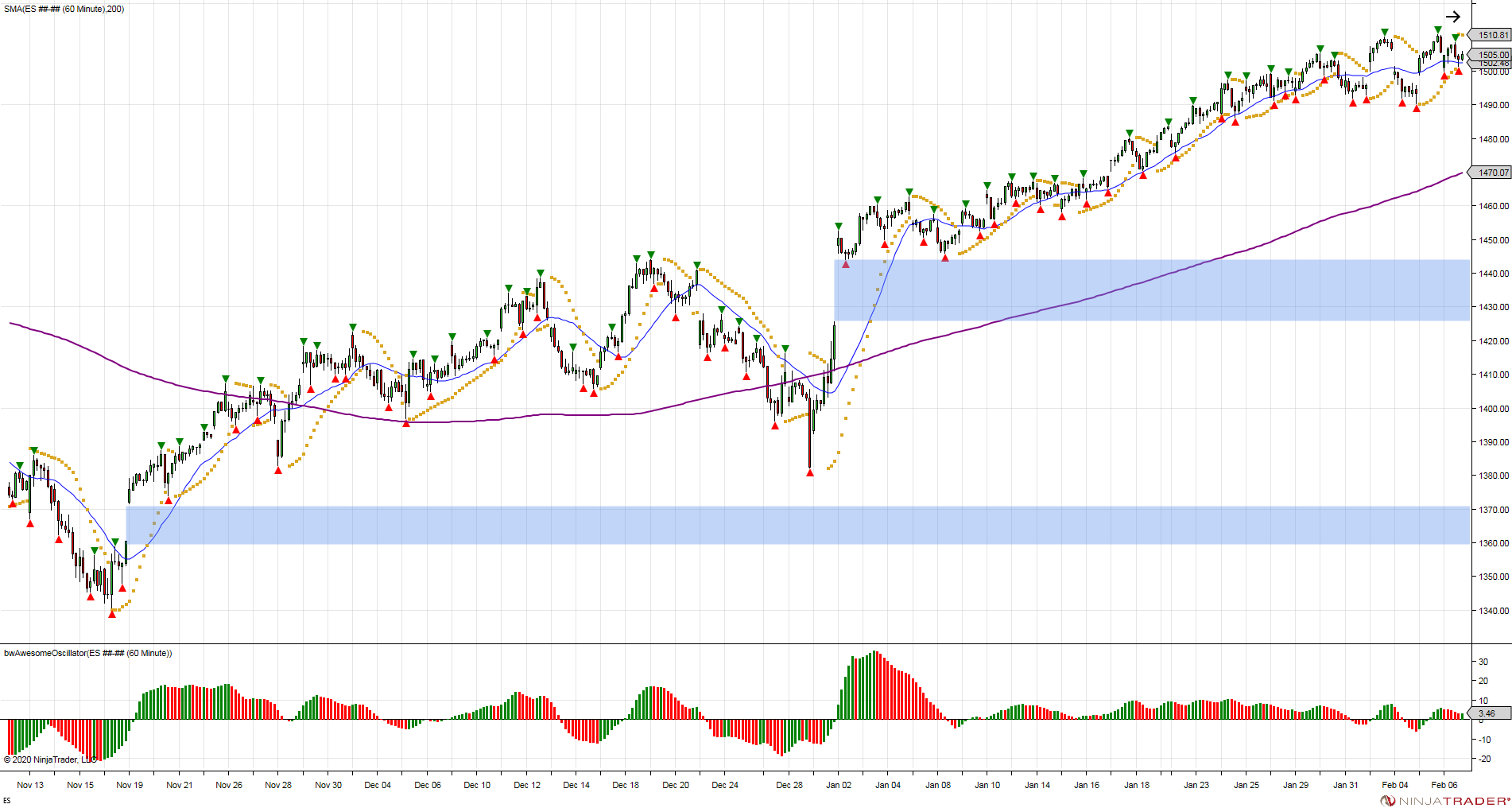

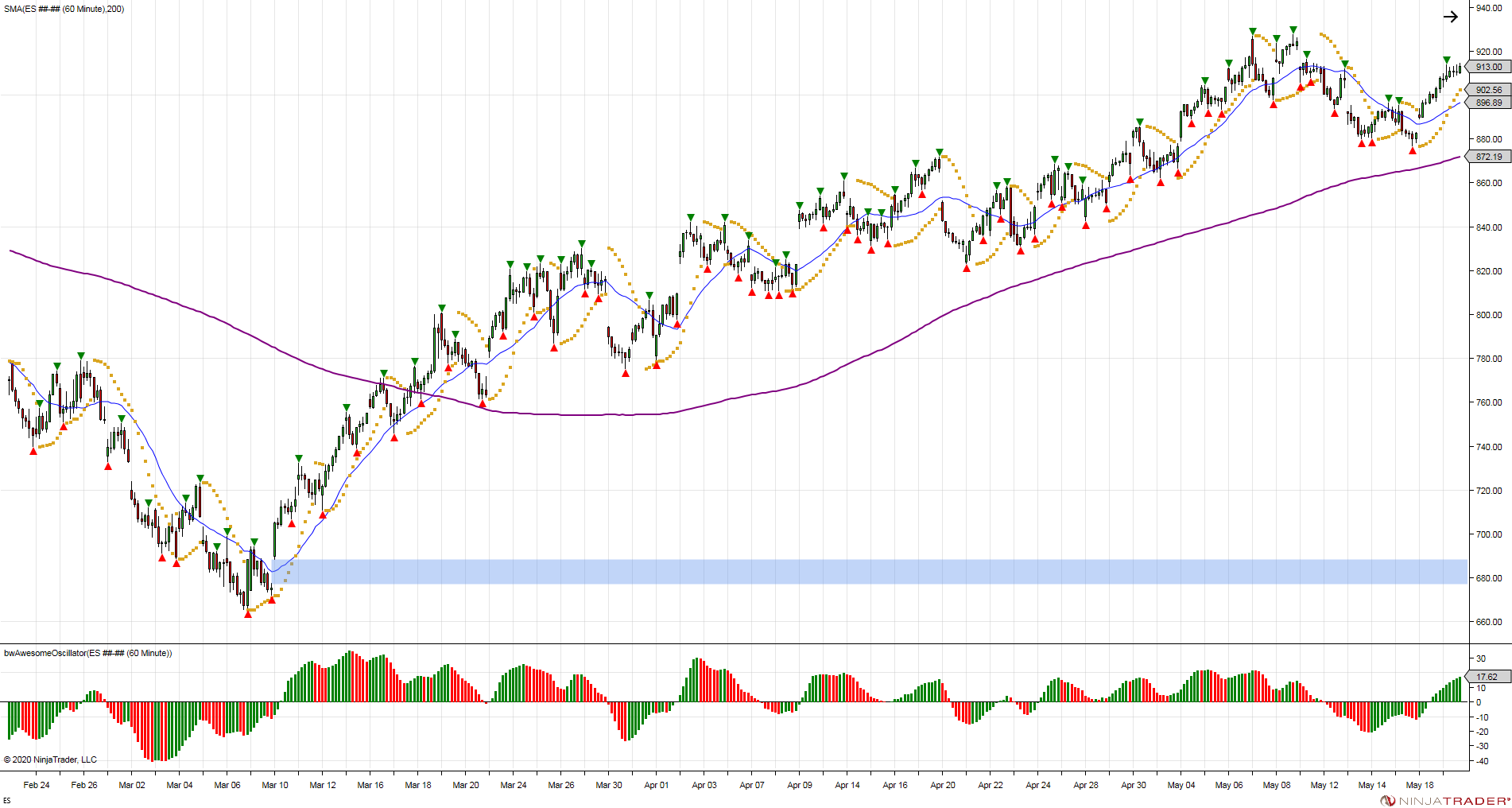

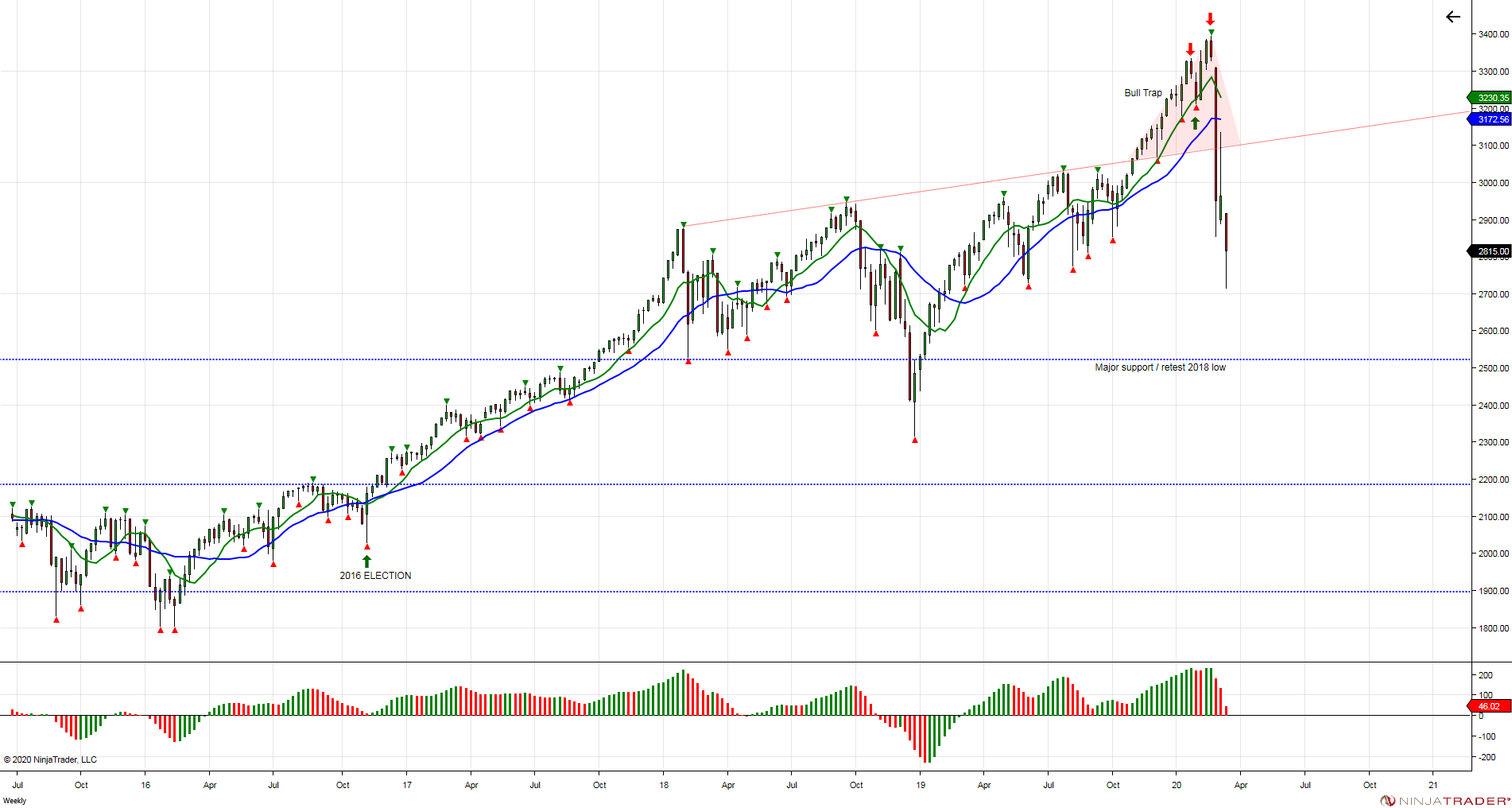

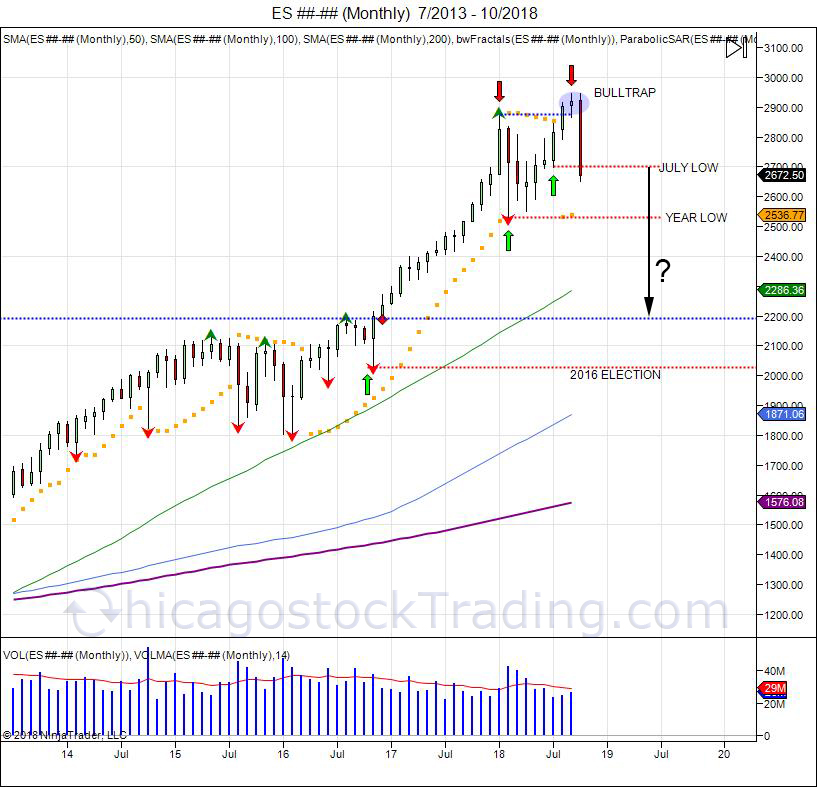

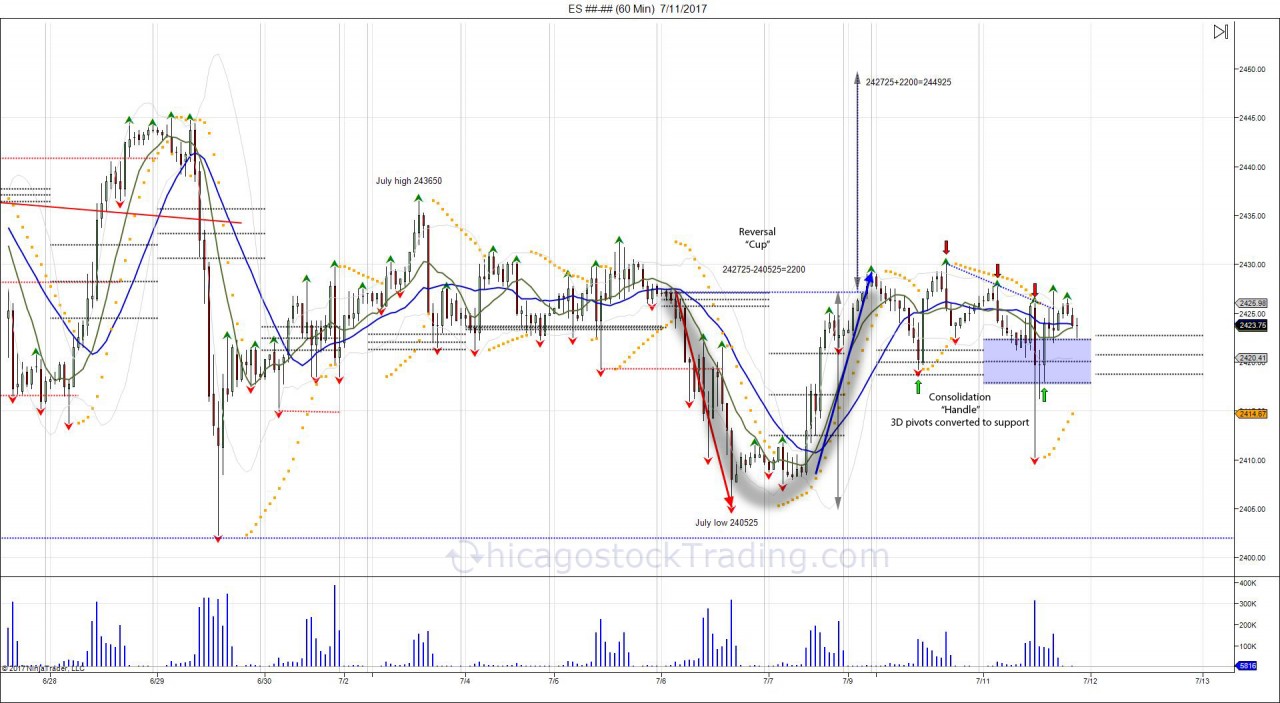

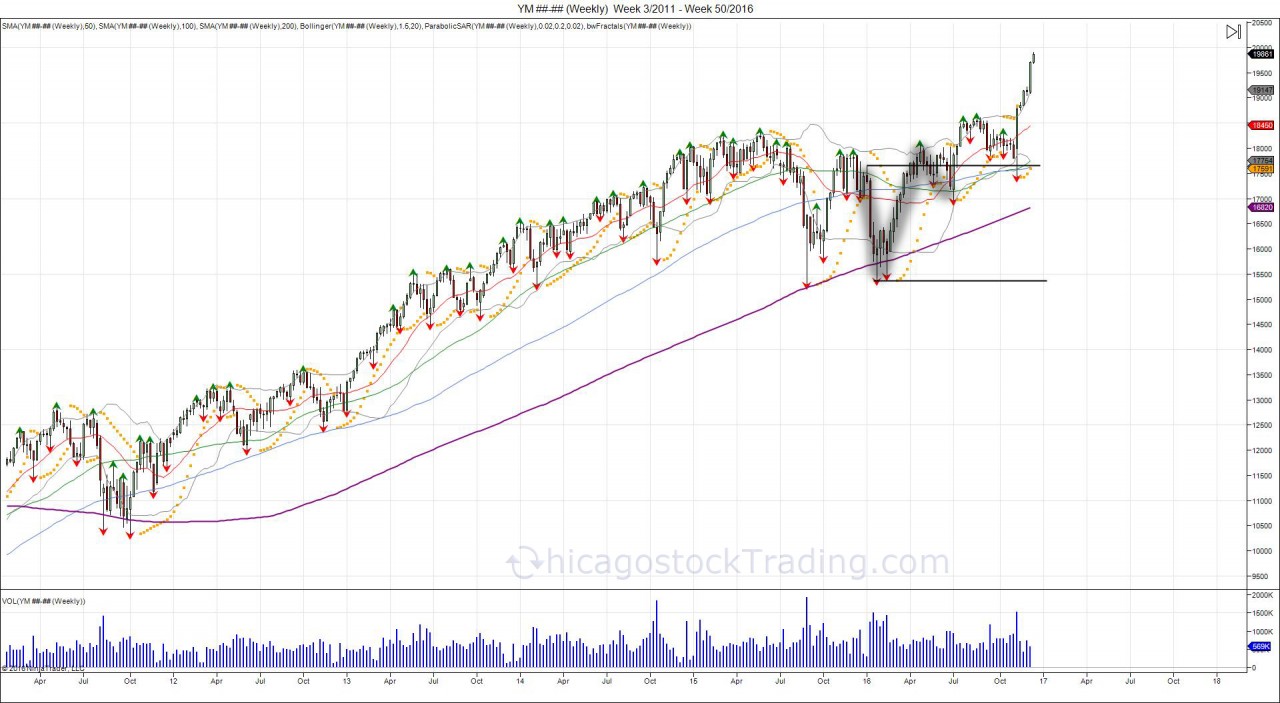

The stock market started 2016 weak, however recovered the highs of the year by summer, making a U turn. Those that were caught short, bearish, and wrong, were now forced to reverse position, thus creating the cup/handle formation, giving way to expand the U turn up to 20k.

The stock market started 2016 weak, however recovered the highs of the year by summer, making a U turn. Those that were caught short, bearish, and wrong, were now forced to reverse position, thus creating the cup/handle formation, giving way to expand the U turn up to 20k.