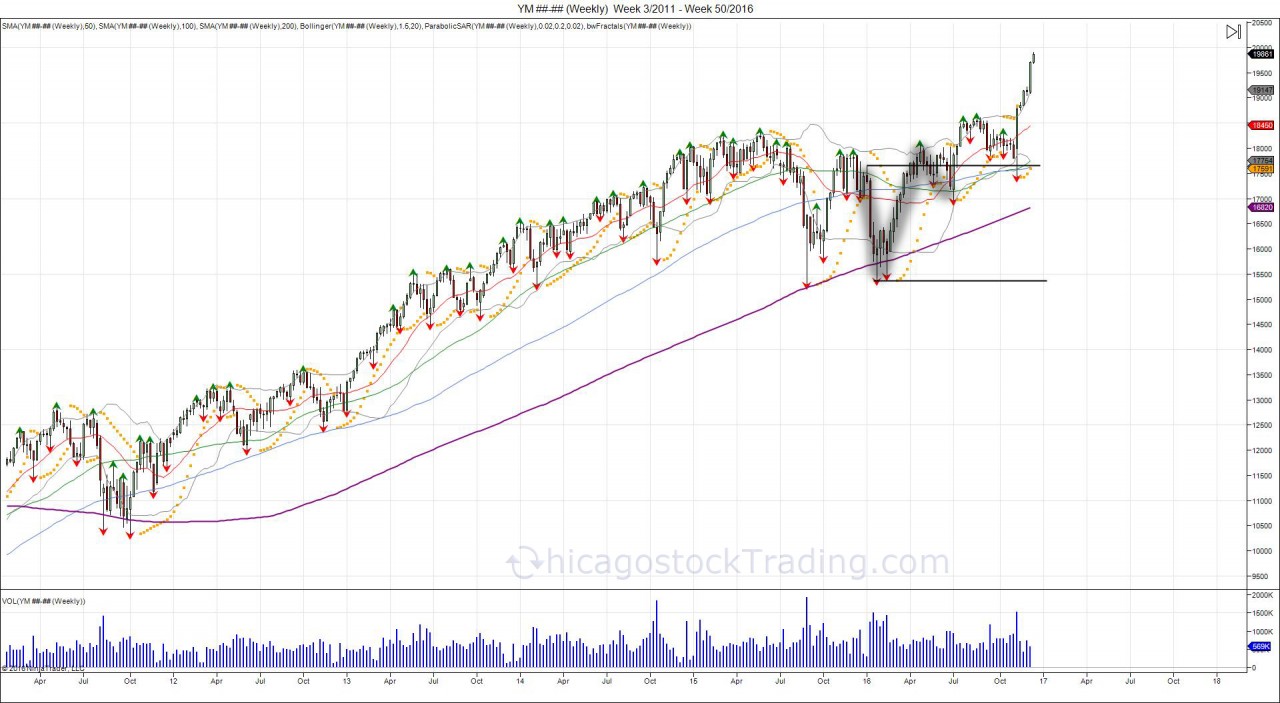

1- DOW JONES CUP/HANDLE TARGET 20K

$YM_F Dow C/H Expansion = 20k... All aboard.. $DIA pic.twitter.com/RuhbCGiM6w

— Chicagostock (@Chicagostock) July 10, 2016

Update to Cup/Handle in DOW posted in July projecting 20k. #technicals #stockmarket #dowjones @NYSE @CMEGroup pic.twitter.com/6fJpdvVmxz

— Chicagostock (@Chicagostock) December 15, 2016

The stock market started 2016 weak, however recovered the highs of the year by summer, making a U turn. Those that were caught short, bearish, and wrong, were now forced to reverse position, thus creating the cup/handle formation, giving way to expand the U turn up to 20k.

The stock market started 2016 weak, however recovered the highs of the year by summer, making a U turn. Those that were caught short, bearish, and wrong, were now forced to reverse position, thus creating the cup/handle formation, giving way to expand the U turn up to 20k.

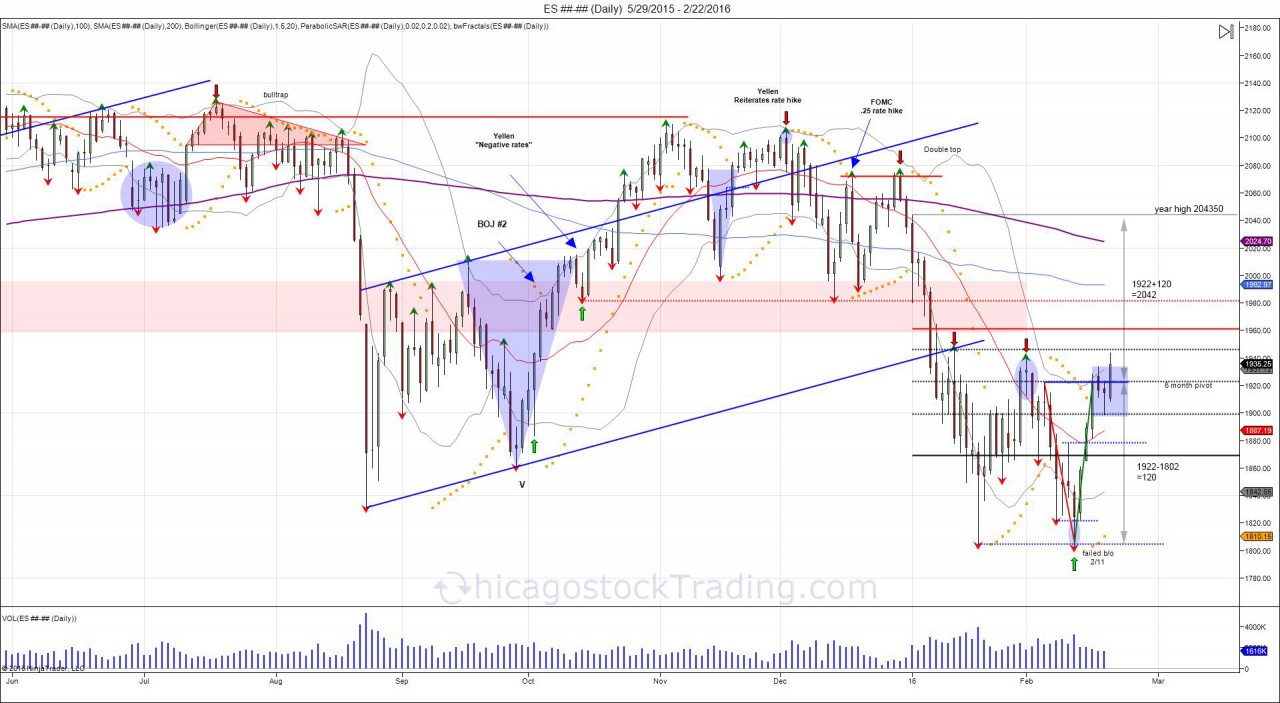

2- STOCKS BOTTOM / SP500 V BOTTOM PROJECTING NEW YEAR HIGHS @ 2040

Lots of fear and bearishness on TV vs last month today...

— Chicagostock (@Chicagostock) February 9, 2016

FOMC next week... Spoos known for rallying into these minutes.... #FWIW

— Chicagostock (@Chicagostock) February 12, 2016

$ES_F Daily V bottom. Expansion > 1920 = test of year high. #psa pic.twitter.com/w558cz49I0

— Chicagostock (@Chicagostock) February 22, 2016

Commented on StockTwits: $ES_F Completes V bottom objective of 2042 from 1920. $SPY $SPX https://t.co/j102MzSsXB pic.twitter.com/yEP6aGyTfU

— Chicagostock (@Chicagostock) March 19, 2016

January-February of 2016 was very bearish. Many of the talking heads were extremely bearish as highlighted by the above tweet on Feb 8. On Feb 11, the market bottomed, setting up the V bottom and leaving shorts trapped. This gave fuel to squeeze new highs on the year above 2040. After making new highs on the year, bears caught on the wrong side of the market were forced to reverse positions and get long. This created the sideways chop at 2040 and eventual expansion higher into the 2nd half of the year to visualize a larger cup/handle.SP500 Market Update 05/09/16 - https://t.co/QSJaIhhxiD pic.twitter.com/fJPE9z8PJV

— MrTopStep (@MrTopStep) May 9, 2016

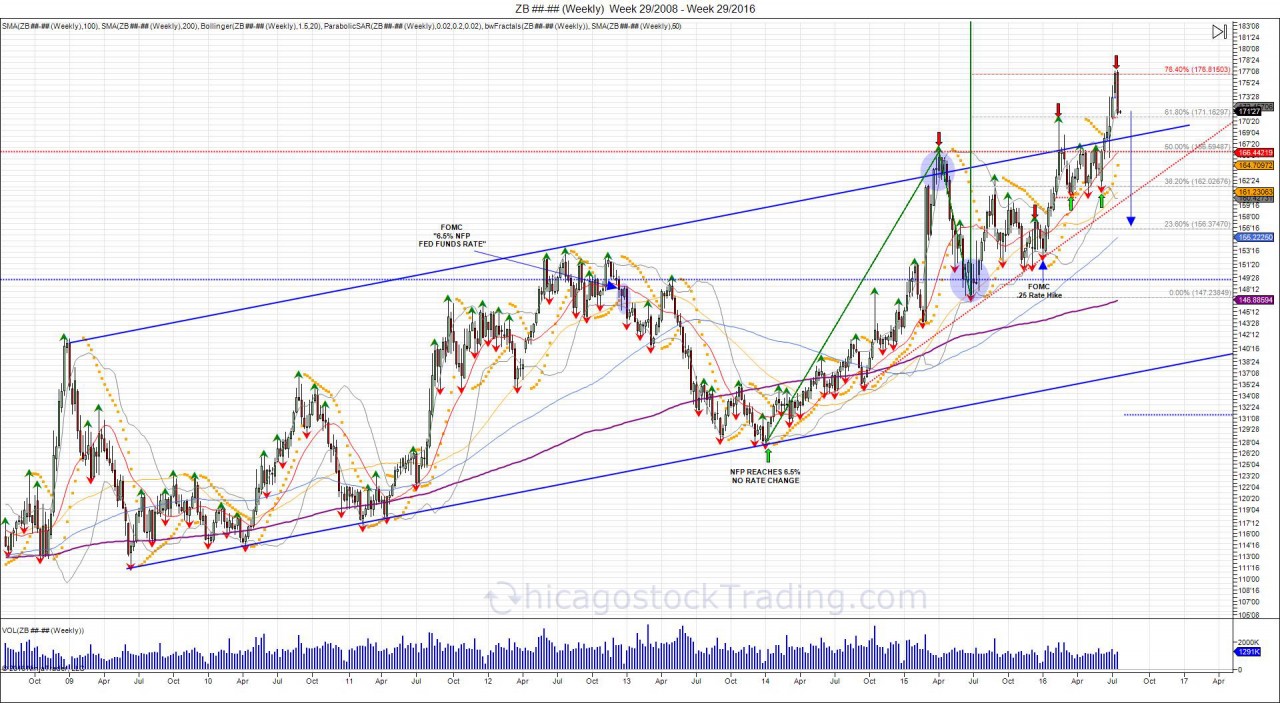

3- 30 YEAR BOND MARKET TOP

$ZB_F 30 year backing off major resistance from 76.4% fib extension. $TLT pic.twitter.com/99doa80Qnq

— Chicagostock (@Chicagostock) July 6, 2016

30 year to 156 / 2.9% $ZB_F $TLT #Bonds #treasury

— Chicagostock (@Chicagostock) July 14, 2016

$ZB_F 30 Year bond market topped again at fib extension of 76.4.... Room down to 156. $TLT pic.twitter.com/3uwGFBUZP7

— Chicagostock (@Chicagostock) July 18, 2016

$ZB_F 30 Year bonds clip June 2015 low by a tick @ 14710 $TLT pic.twitter.com/IRw1ioPw0w

— Chicagostock (@Chicagostock) December 12, 2016

30 year bond market hit its peak at 177 against it's 76.4% fib extension early July as we pointed out on July 6th. This turned to be the top as the market rejected the level to fall below 170 and leave buyers trapped above, giving way to our target of 156 and low from June of 2015 at 14711 that began the second leg higher.

30 year bond market hit its peak at 177 against it's 76.4% fib extension early July as we pointed out on July 6th. This turned to be the top as the market rejected the level to fall below 170 and leave buyers trapped above, giving way to our target of 156 and low from June of 2015 at 14711 that began the second leg higher.

4- CRUDE OIL BOTTOM

Saudi said no production cuts and CL holds 31. Bears are in trouble...

— Chicagostock (@Chicagostock) February 24, 2016

Oil also began the year on a negative tone with bearish fundamentals. The new lows in February failed to expand down, setting up a failed breakdown. As news came out that production would not be cut, which fundamentally was bearish since it kept the supply high, the market rather then going lower, traded higher, which turned to be a sign of too many bears caught on the wrong side. Not to forget the famous words "If you are long oil get it through your head..."Oil bottom?

— Chicagostock (@Chicagostock) February 24, 2016

"If you are long oil get it through your head"... https://t.co/EA2r23mPDz

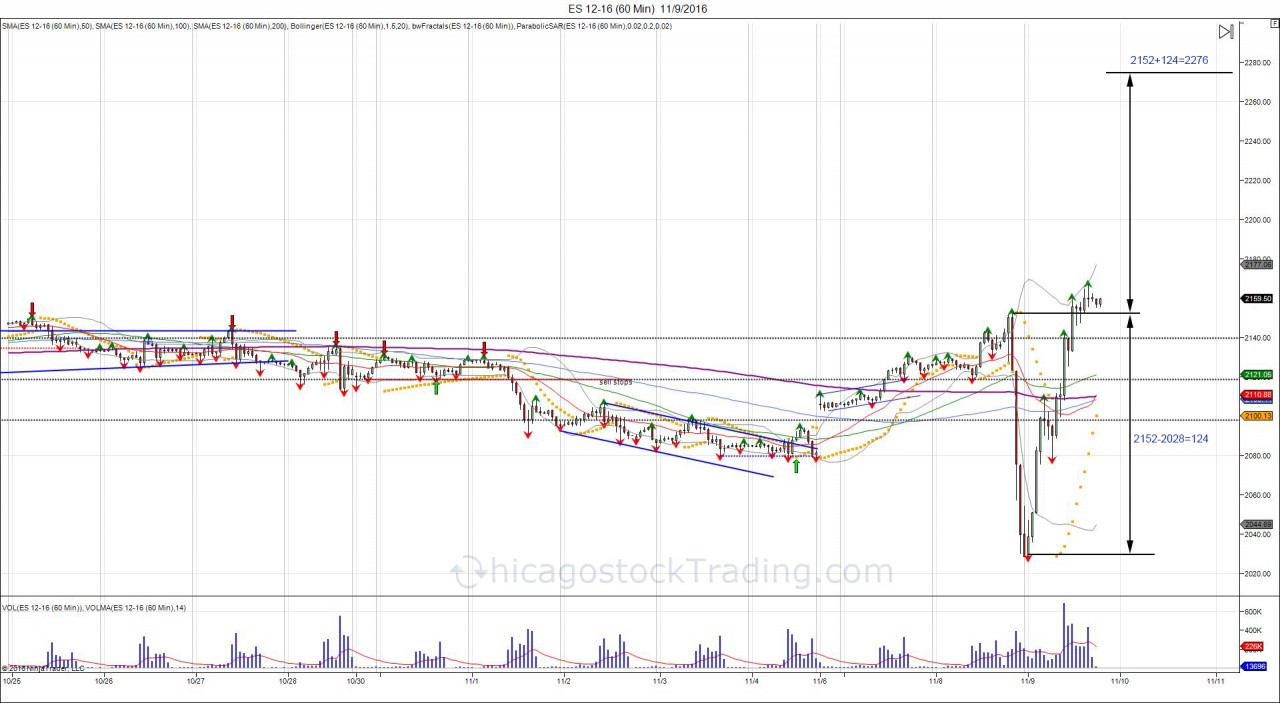

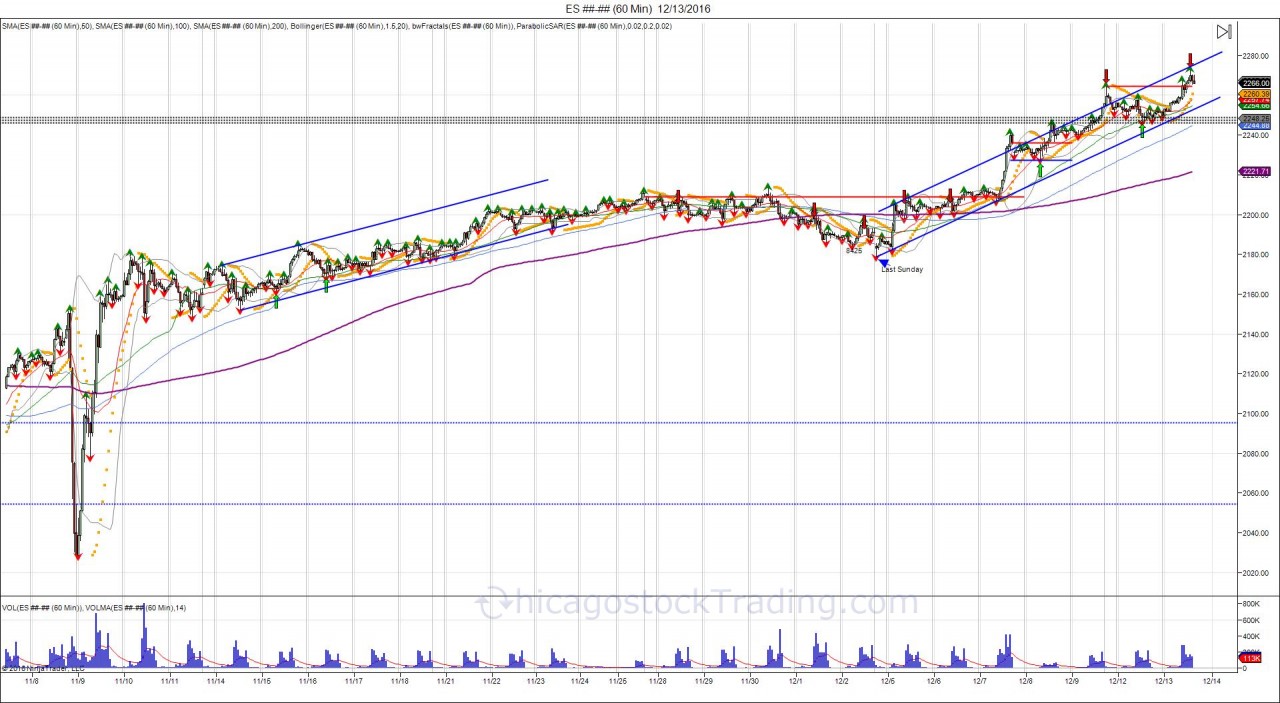

5- SP500 ELECTION V BOTTOM PROJECTING 2276

$ES_F Wednesday's V bottom gives room to expand up to 2276. #shortcapitulation #setupdecemberforaratehike $SPX $SPY pic.twitter.com/ktflPhHDDh

— Chicagostock (@Chicagostock) November 10, 2016

2273 high from 2152 breakout. Close enough to say cup/handle objective of 2276 met. pic.twitter.com/NUJPX7UADg

— Chicagostock (@Chicagostock) December 13, 2016

The US election turned out to be Brexit 2.0. The market traded from 2152 down to 2028 and back through 2152 in the same night after the election results. The V bottom and recovery above 2152 gave way to expand the 124 handle range up to 2276, completed in December with a 2273 high.

The US election turned out to be Brexit 2.0. The market traded from 2152 down to 2028 and back through 2152 in the same night after the election results. The V bottom and recovery above 2152 gave way to expand the 124 handle range up to 2276, completed in December with a 2273 high.

Click here to Subscribe

RISK DISCLOSURE: PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN TRADING FUTURES AND OPTIONS IS SUBSTANTIAL AND SUCH INVESTING IS NOT SUITABLE FOR ALL INVESTORS.