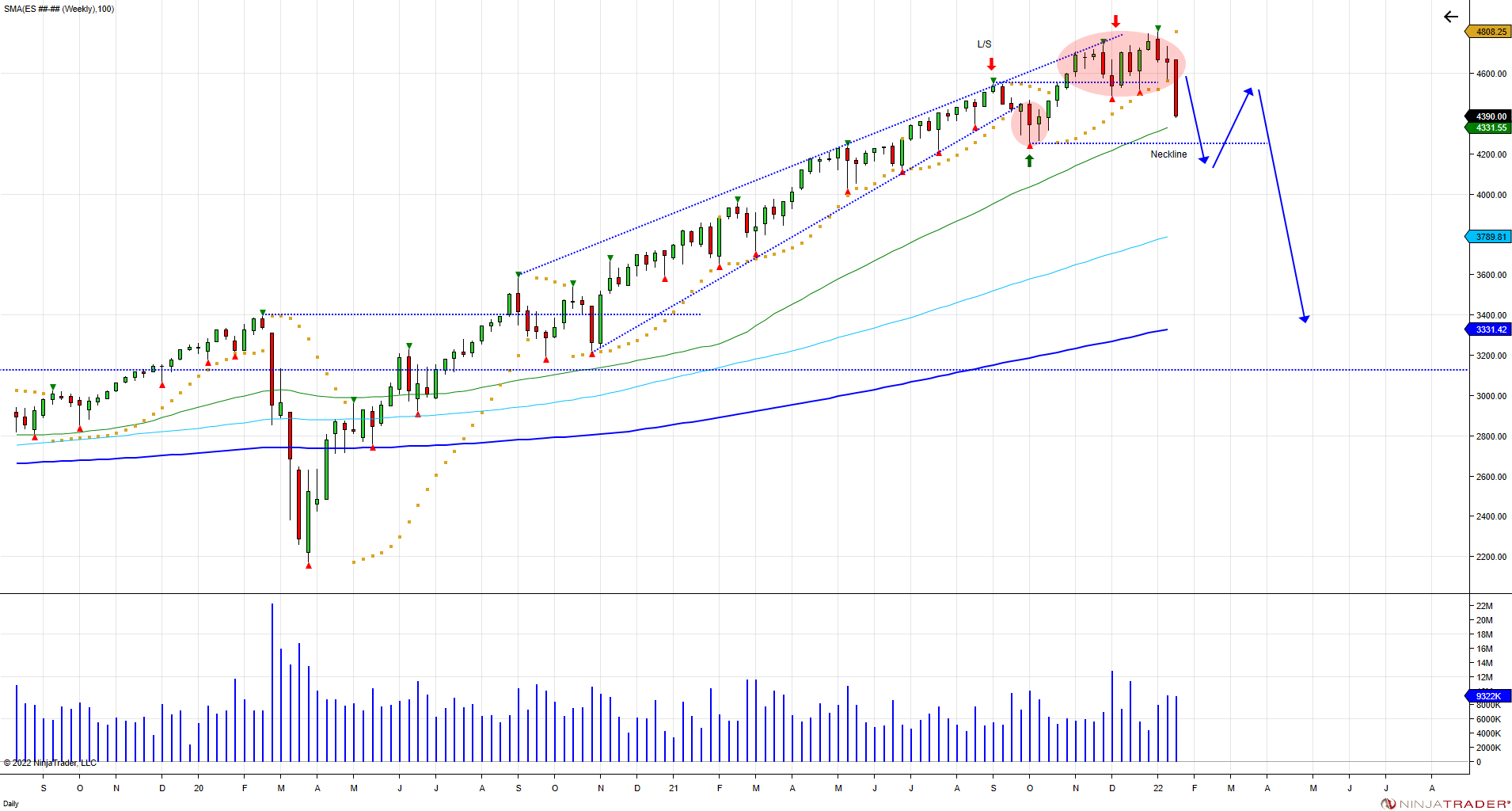

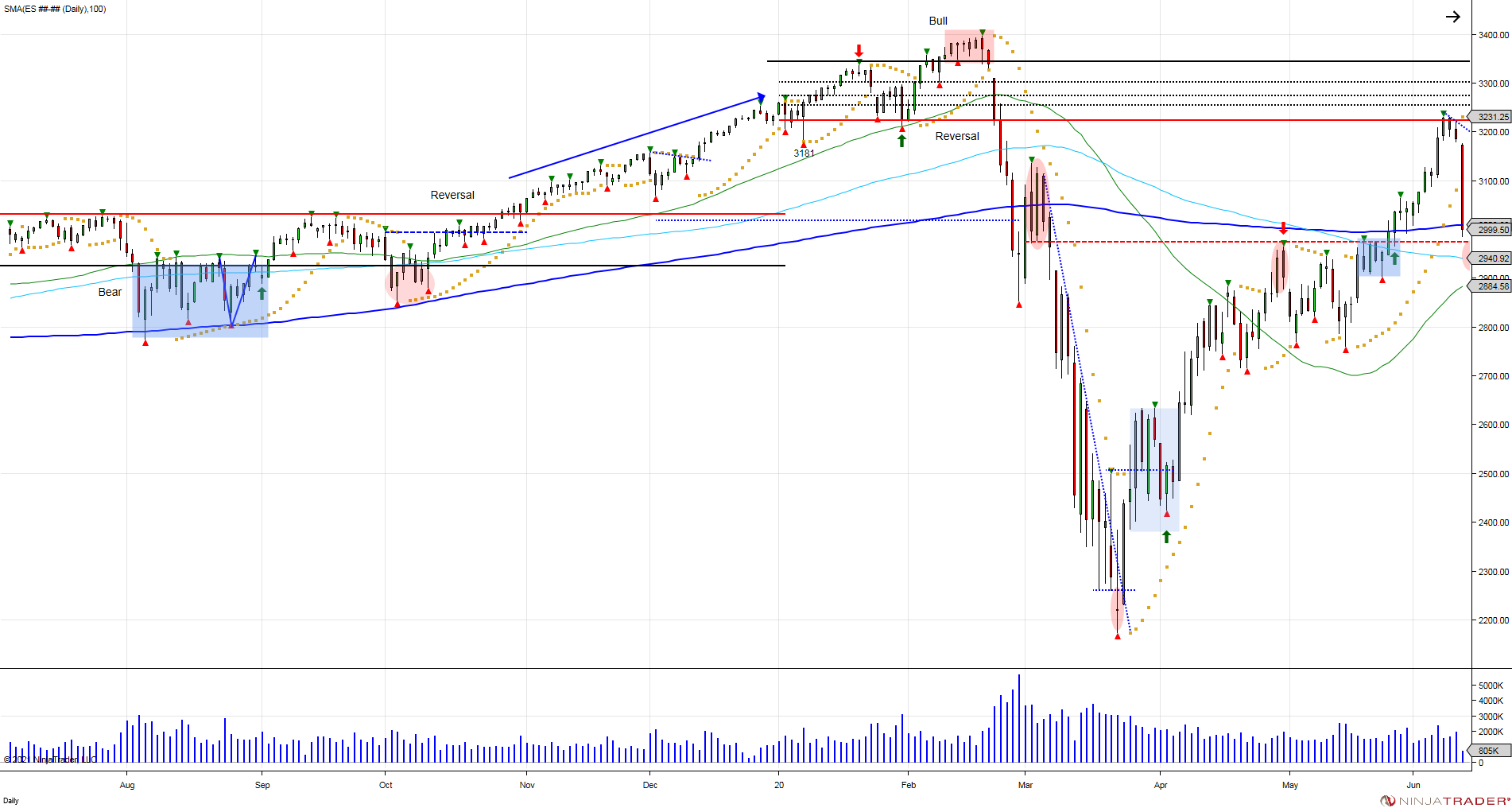

After the Nasdaq put an all-time high in November of 2021 at 16767, the market dropped 37% in the year 2022 to a low of 10484. The Fed has continued its hike program, which has raised rates to a 22-year high while signaling further hikes would be data-dependent. Investors are assuming they are done hiking interest rates. “There is belief that the Fed is probably done,” said Timothy Graf, head of EMEA macro strategy at State Street Bank & Trust Co. “Markets are also seeing a US economy that’s held up far better than the consensus outlook. They are pricing that we have achieved a landing that everyone thought would be impossible to achieve.” Meanwhile, earnings continue to beat analyst estimates. On top of that, GDP rose in Q2 at 2.4% above estimates of 1.8% and higher than the previous period of 2%, showing an expansion of the US economy.

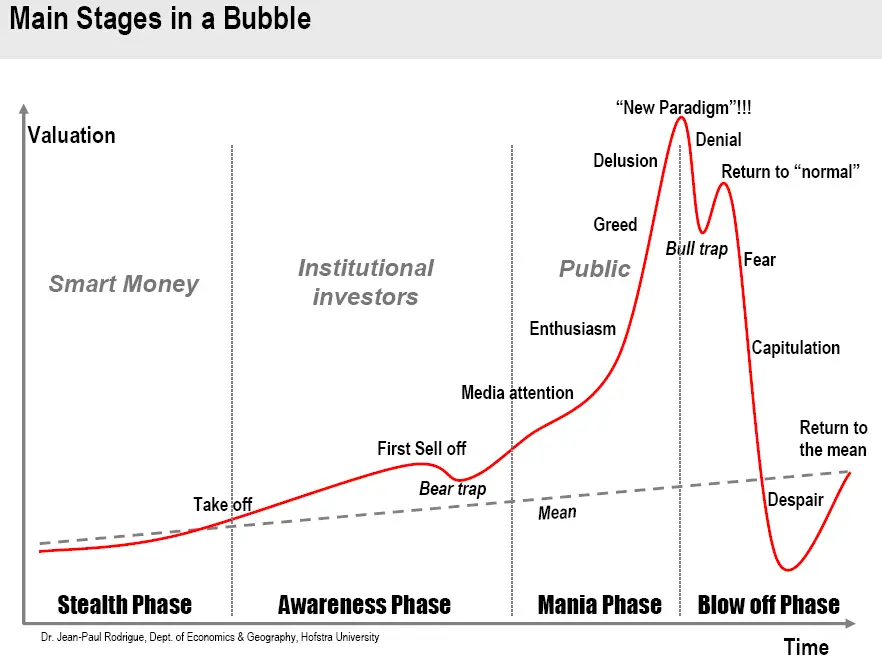

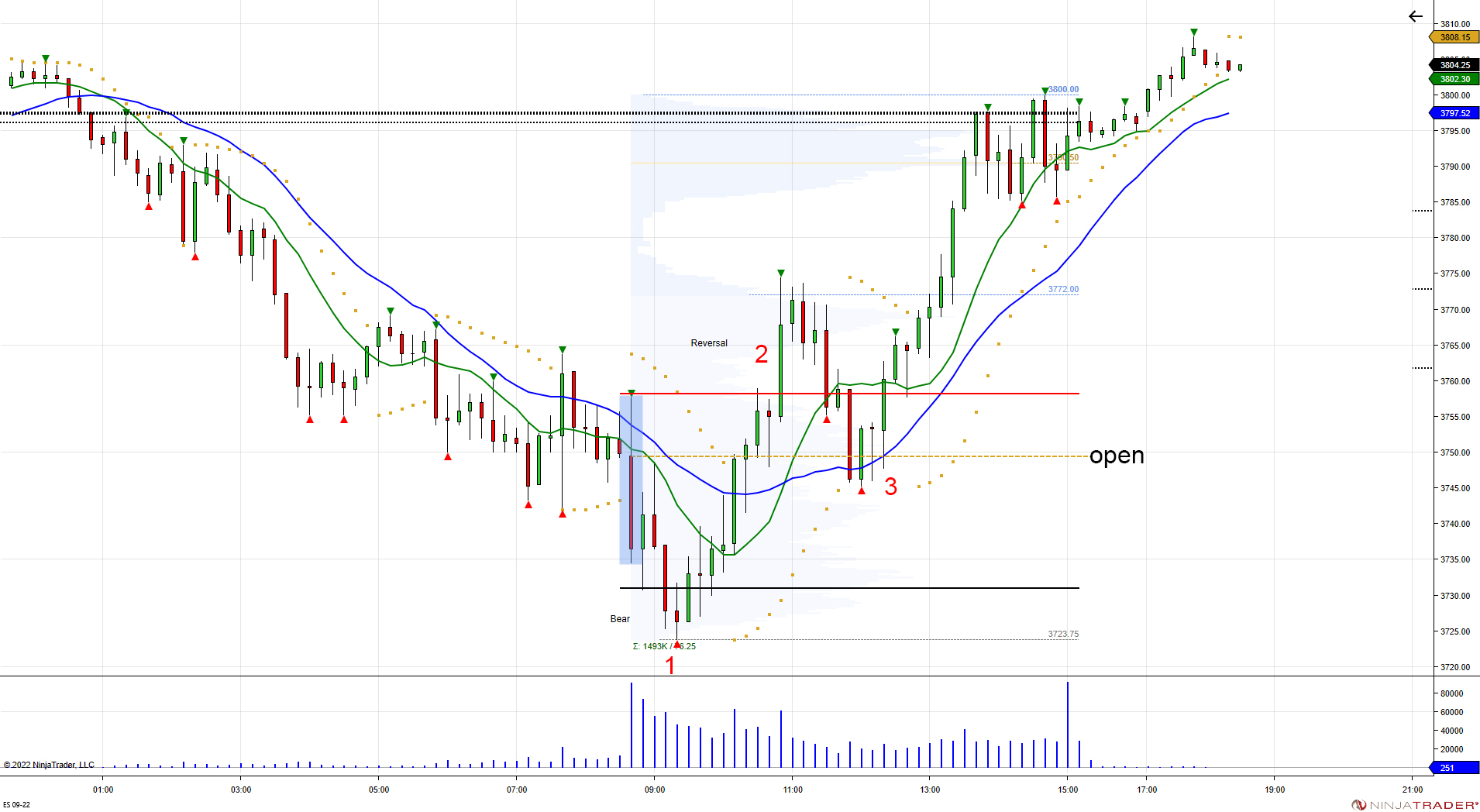

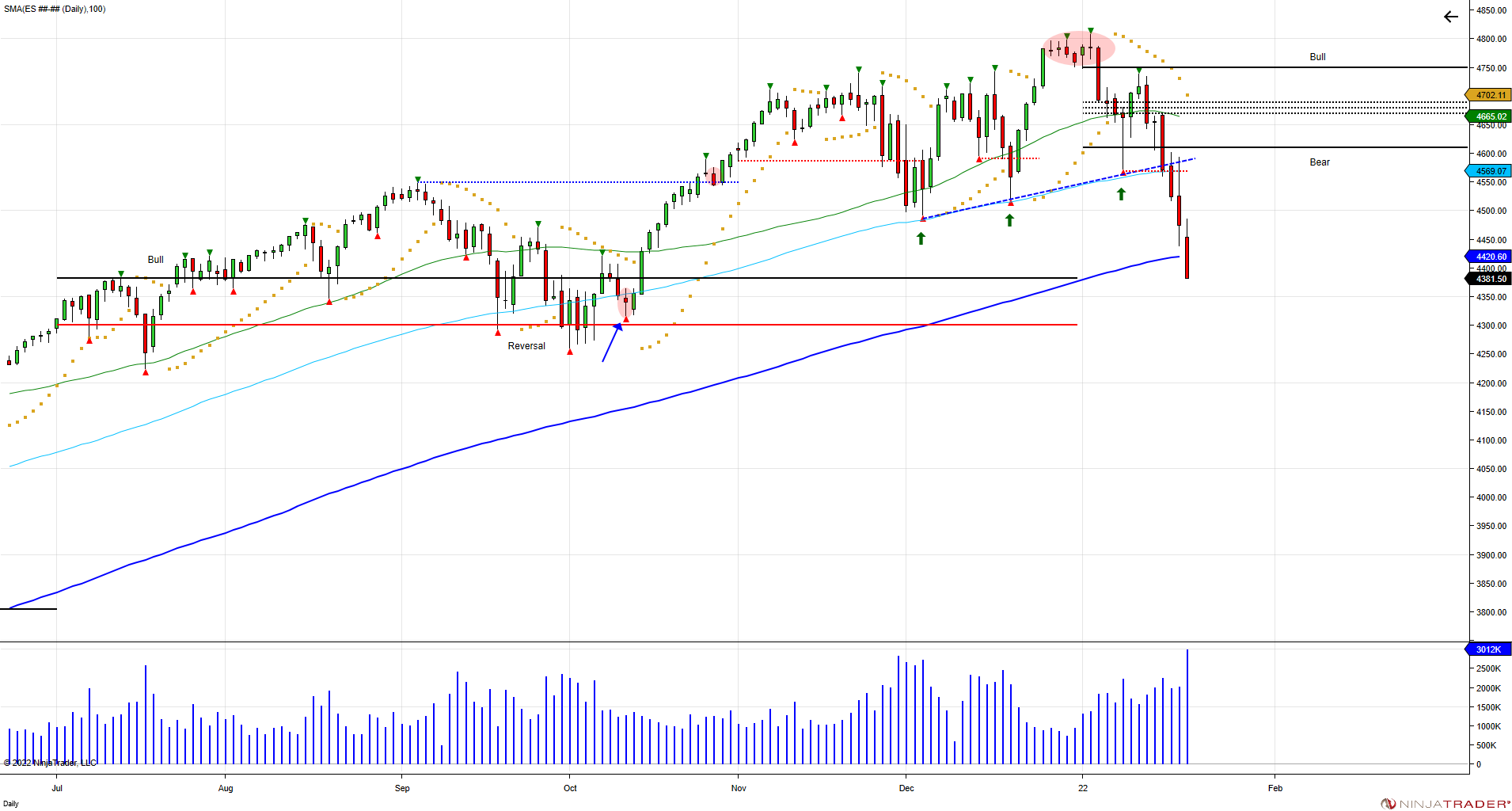

This strong data comes as the market retests the failure from November of 2021 where it trapped buyers to bring up the question, have we returned to "normal"? If you take a look at the chart on the main stages of a bubble, the Nasdaq is tracking it back to the return to normal phase. The retest of the November 2021 failure is key resistance for buyers to overcome, as well as sellers to defend, hedge, or lighten up on positions. We are at a point of testing supply and looking for demand as demand will have to keep up to continue the rally in any attempt at taking out the 2021 high. Failure to push through and a failure at these levels can give way for another wave down that would be more fierce than what we saw last year, giving opportunity to retrace back down to retest the March 2020 high from where the market took off after the Covid breakdown.