Before Mr. Ben Bernanke became Fed chairman, he made a speech before the national Economists Club in Washington, DC. on November 21, 2002, titled “Deflation: Making Sure "It" Doesn't Happen Here.” In these remarks, there were 5 major points Mr. Bernanke pointed out as tools the Fed could use to fight deflation:

1. Lower interest rates to zero.

First, the Fed should try to preserve a buffer zone for the inflation rate, that is, during normal times it should not try to push inflation down all the way to zero.6 Most central banks seem to understand the need for a buffer zone. For example, central banks with explicit inflation targets almost invariably set their target for inflation above zero, generally between 1 and 3 percent per year. Maintaining an inflation buffer zone reduces the risk that a large, unanticipated drop in aggregate demand will drive the economy far enough into deflationary territory to lower the nominal interest rate to zero.

2. Buy securities from the banks to expand the Feds balance sheets Second, the Fed should take most seriously-as of course it does-its responsibility to ensure financial stability in the economy. Irving Fisher (1933) was perhaps the first economist to emphasize the potential connections between violent financial crises, which lead to "fire sales" of assets and falling asset prices, with general declines in aggregate demand and the price level. A healthy, well capitalized banking system and smoothly functioning capital markets are an important line of defense against deflationary shocks. The Fed should and does use its regulatory and supervisory powers to ensure that the financial system will remain resilient if financial conditions change rapidly. And at times of extreme threat to financial stability, the Federal Reserve stands ready to use the discount window and other tools to protect the financial system, as it did during the 1987 stock market crash and the September 11, 2001, terrorist attacks.

3. Increase the money supply. If we do fall into deflation, however, we can take comfort that the logic of the printing press example must assert itself, and sufficient injections of money will ultimately always reverse a deflation.

4. Buy our countries debt. The Fed was able to achieve these low interest rates despite a level of outstanding government debt (relative to GDP) significantly greater than we have today, as well as inflation rates substantially more variable. At times, in order to enforce these low rates, the Fed had actually to purchase the bulk of outstanding 90-day bills.

5. Devalue the dollar. Although a policy of intervening to affect the exchange value of the dollar is nowhere on the horizon today, it's worth noting that there have been times when exchange rate policy has been an effective weapon against deflation. A striking example from U.S. history is Franklin Roosevelt's 40 percent devaluation of the dollar against gold in 1933-34, enforced by a program of gold purchases and domestic money creation. The devaluation and the rapid increase in money supply it permitted ended the U.S. deflation remarkably quickly. Indeed, consumer price inflation in the United States, year on year, went from -10.3 percent in 1932 to -5.1 percent in 1933 to 3.4 percent in 1934.17 The economy grew strongly, and by the way, 1934 was one of the best years of the century for the stock market. If nothing else, the episode illustrates that monetary actions can have powerful effects on the economy, even when the nominal interest rate is at or near zero, as was the case at the time of Roosevelt's devaluation.

Source: http://www.federalreserve.gov/boarddocs/speeches/2002/20021121/default.htm

As we look at the highlighted tools the previous chairman of the Fed highlighted, 4 out of 5 have been implemented over the past 8 years. The one tool that has yet to be used, is #5/ devalue the dollar.

Why is this important?

President Trump has spoken on many occasions of his dissatisfaction that other countries devalue their currencies. The Fed has used almost every tool in their handbook over the last 8 years to overcome deflation and to stimulate the economy. The Fed has also begun to slowly hike the fed funds rate. The first hike came in December of 2015, 3 year's after they placed a 6.5% unemployment target on the fed funds rate. This gave a shock to the markets in December-January, breaking down to 1800 to get the street bearish, before turning higher to create one massive headfake: lows: http://www.chicagostocktrading.com/blog/sp500.html

The next hike didn't come until 12 months later in December of 2016. With the equity markets expanding higher following the new administration taking office, the Fed is expected to hike again on March 15, 2017. This would be a quicker pace as opposed to the 1 year rate seen last year.

As rates go higher, so will the borrowing cost for the US government. This is important as the US has not passed a budget in 10 years and the debt ceiling is quickly approaching with a new administration eager to achieve their goals.

As Col Sargis Sangari writes:

Currently President Trump is trying to drain the proverbial swamp and seeking funding for the programs that will enable his administration to achieve this goal. Members of Congress who’s financials are tied to the old networks want to see a quicker raise in interest rates, and will do everything they can to block Trump from borrowing from the Fed and as the cost of money goes up they will use it as an excuse to limit his ability to borrow from the FED. If they succeed in doing so, this plus the nations failure to pass a budget for the past 10 years will almost certainly result in a government shutdown or an unrecoverable bubble burst in May 2017. http://www.westernfreepress.com/2017/03/15/will-the-fed-increase-rates-to-handicap-trump/

Should the US markets see a sharp correction to the downside, the Fed cannot go back to unwinding their rates. This would be a major hit to their credibility. How much lower can they go anyway? The way of BOJ and negative? Thus the Fed has that last major tool in their tool box, which is the nuclear option, devaluation of the dollar. Not many have this factored in, which is a mistake. Even if this does not take place, it should be viewed as a possibility, after all, former Fed Chairman Ben Bernanke laid it out in his outline as a tool to fight deflation.

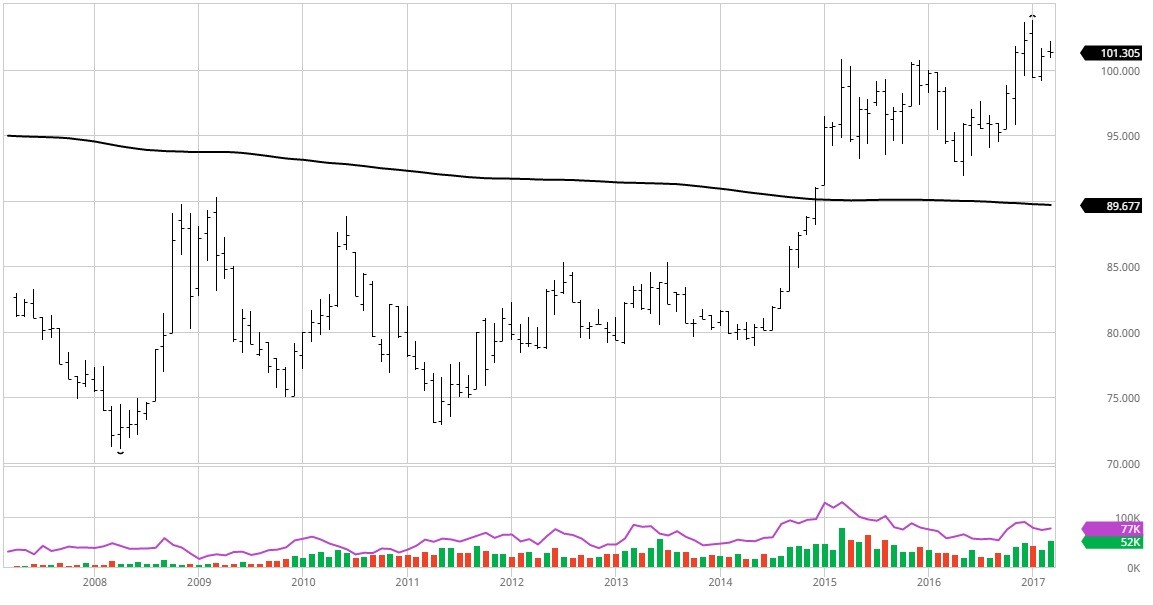

The USD recently took out last year’s high, however has seen a minor pullback going into the new administration. Short term pressure remains higher, however a loss of the year low at 99145 gives room to retest last May's low of 9188. Any move below this would reject the current breakout and give way to reverse momentum lower.

With that being said, here are the latest remarks from the POTUS reiterating how other countries devalue their currency:

"A lot of the companies have moved out, they don't make the drugs in our country anymore. A lot of it has to do with regulation, a lot of it has to do with other countries take advantage of us with their money and their money supply and devaluation. Our country has been run so badly, we know nothing about devaluation; every other country lives on devaluation. You look at what China's doing, you look at what Japan has done over the years, they played the money market, they played the devaluation market and we sit there like a bunch of dummies, so you have to get your companies back here."

Comments begin at 2:20

RISK DISCLOSURE: PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN TRADING FUTURES AND OPTIONS IS SUBSTANTIAL AND SUCH INVESTING IS NOT SUITABLE FOR ALL INVESTORS. AN INVESTOR COULD LOSE MORE THAN THE INITIAL INVESTMENT.