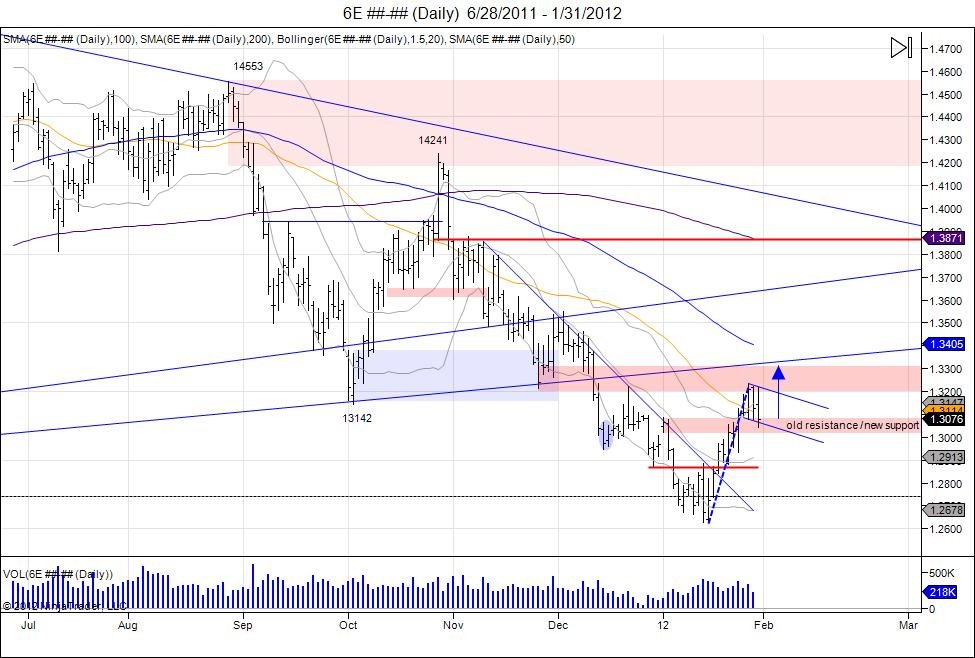

Since the Euro reversed its downward trend mid January by climbing above 12900 and through the downward trendline, the market has gone into a short squeeze which led the market to take out the year highs at 13085 and bump against resistance from December 13th at 13237.

more...

The Euro moved 6 handles from its lows in January of 12628 to these highs 13237. As the market hits this resistance, we are now seeing an attempt to consolidate the market after this 6 handle run up. This consolidation is the struggle against this 13237 and attempt to use the old January highs of 13085-13020 as support. In turn "flagging" off the 6 handle "flagpole" in attempts to build a bullflag pattern. This pattern looks to build up energy for the next leg up through this resistance. Should the market find strength to continue through this resistance, this targets up to 138 (132+6), retracing the market back to where it broke down from in October, and clearing the shorts who have not covered from the past 3 months. Failure to hold this support on the other hand and the market is vulnerable to retesting the lows with 12900 as the last level of support to hold followed by 12628.