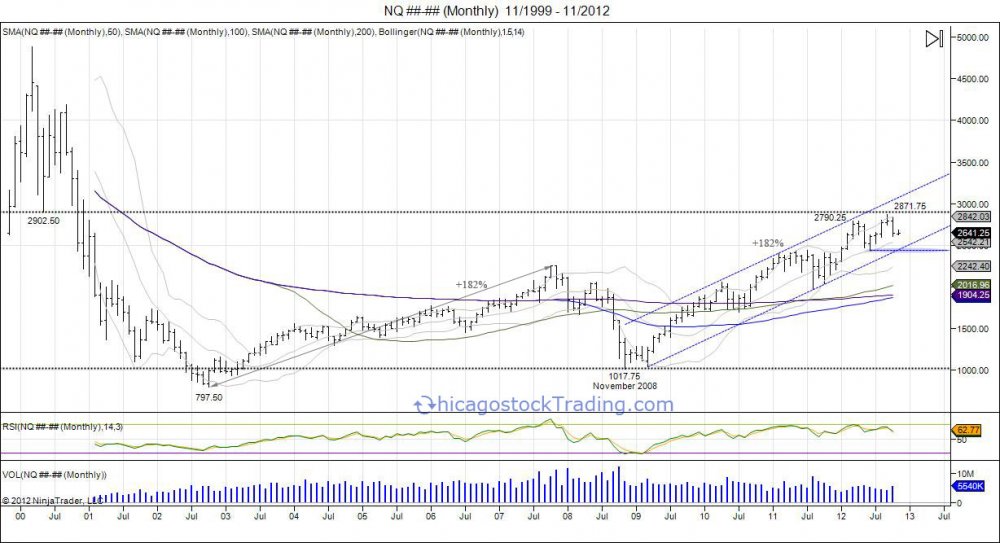

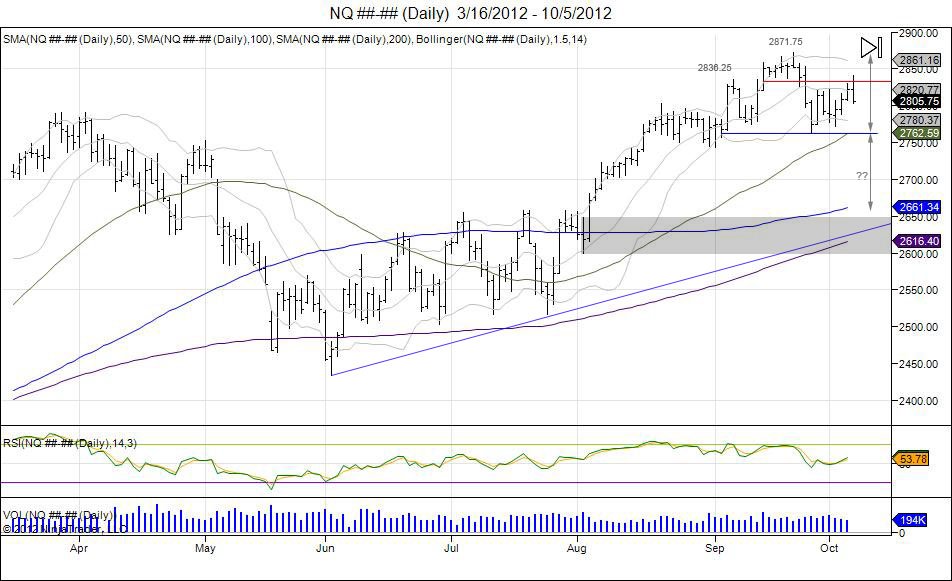

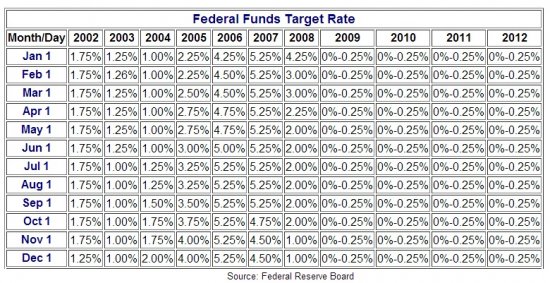

Since the last election in November of 2008, the Nasdaq has risen 182% off the lows of 1017.75 to highs of 2871.75 set just last September. This 182% increase in 4 years, matches exactly the same amount it rose from 797.50 to 2256.25 within the time period of 2002-2007. The market corrected after this gain from 2002-2007, falling back to retesting the lows set in 2002. The test came during the time of the last election in 2008 as the market fell to 1017.75 following the crash of 2008 and found support based off the 2002 lows. Since this last election and lows, a slow short squeeze and grind higher has taken place, through the 2007 highs and retracing back to where the Nasdaq failed in the dot com era at the 2900 level. The market fell short of the 2900 level by about 30 points before reversing in October down to 2604.50. An attempt to test the September high of 2871.75 was seen during the October Non-farm payroll numbers as the Nasdaq rallied to 2840.75 and reversed lower as it failed to move past the September highs. This in turn built a daily head/shoulder corrective pattern that targeted the 2650 level. This small corrective pattern completed in October down as the market fell into its support range of 2650-2600 based off where it broke out to the highs in August. Going forward, the small corrective pattern is over, however on a longer term picture as we look at the monthly chart, we see this small corrective pattern as a road block going forward. Based off the longer time frame the September range of 2736-2871.75 now offers a new area of major resistance for the market to work through to regain the upside momentum. Until then, rallies up to this level offer an area for longs to take profits, protect longs, and or short the market. There is a chance the market fails to test the level as the market is in a downside chase having caught buyers off guard by the reversal and not giving an opportunity to gain on their most recent purchases. Continued pain and chase sees the market falling down to take out the 2433.75 low made in June, to squeeze out these buyers who have been trying to participate in this decline over the last month. By targeting the June lows, the market squeezes out these buyers and gives opportunity to establish a neckline for a short squeeze to retest the 2736-2871.75 level. This retest of the failure in September gives opportunity for buyers to show their strength by squeezing through and for sellers a level to defend to build a right shoulder for a larger head/shoulders topping pattern based on the monthly chart. There have been many programs established over the past years to keep the squeeze in equities afloat, the most recent one was the biggest with the Fed coming out with Quantitative Easing without an end date. This announcement came at the highs and gave the final push in the market up to 2871.75. Thus far it has failed to hold up. Here we are one day before the next election is voted on and the market is in a corrective phase. Regardless of the outcome of the election, we must take caution of October’s reversal as the market is now in sell the rally mode, until a move past the September high is seen. For buyers and sellers, it is wise to sit on hands as this month of November offers more data to be used. Buyers should await a move down to the June lows to defend, and sellers a test of 2736 to defend. Ultimately, should the market build this head/shoulder top on the monthly chart, this gives a projection down to the 1900 level to coincide with the August 2011 levels and the 50, 100, and 200day moving averages. During the last 4 years, the stock market (Nasdaq) is up 182%, US government debt per American under 18 is up 53%, the national debt up 52.6% and unemployment has risen from 6.8% to 7.9%. Looking at these numbers, it appears the past 4 years favored wall street over main street.

Daily head/shoulder pattern created during September-October 2012:

For precise entry, stop, and target levels on day and swing trades along with updates, click here for more information.

RISK DISCLOSURE: PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN TRADING FUTURES AND OPTIONS IS SUBSTANTIAL AND SUCH INVESTING IS NOT SUITABLE FOR ALL INVESTORS. AN INVESTOR COULD LOSE MORE THAN THE INITIAL INVESTMENT.