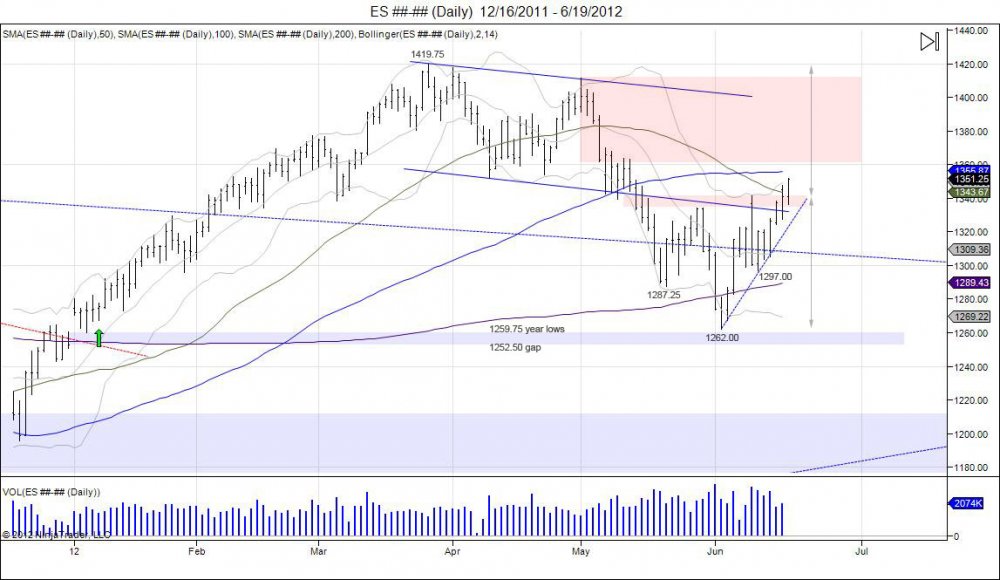

The SP500 is back at trading the levels from where it broke down early May around 1350. The market broke its channel at that point and fell into lows of 1287.25 May 21st, before seeing a small bounce that failed to regain the broken channel and was pushed back down to a new low. Lows of 1362 were made, holding the year lows of 1259.75, and keeping the gap from last year down to 1352.50 OPEN. This caught another bounce into 1342 on June 11th which was followed by another pullback that retested the lows. The market came down to 1297.00 and found support, in turn building a right shoulder as it retested the 1262 low and has built an inverted h/s formation. Since this right shoulder low the market has grinded higher and is now trading through its neckline of 1342, putting the market back within the channel it broke early May. Taking this range of 1342-1262 gives us a range of 80 handles, adding this to the neckline of 1342 sees an upside target of 1422 which targets the year highs of 1419.75. Recalling the upside target of 1441 being the May 2008 highs, the market stopped right at its last level of defense against this high which put in the highs this year at 1419.75. We went into correction off the level and retested the lows of the year, however keeping the gap open has kept the potential to retake 1441 still there. With a new target of 1422 now the market is working its way through heavy resistance and sellers. Doing so will give room to finally complete that May 08 high of 1441. The bounce here is retracing the market to where it failed in May, so this will be an uphill battle as it comes back to where we failed within 1361-1411.75 as the range for sellers to defend. Failing to continue this move higher and falling back below 1297 puts the lows of 1262 in sight followed by the year lows of 1259.75 and the gap of 1252.50 to derail this bull.

ES