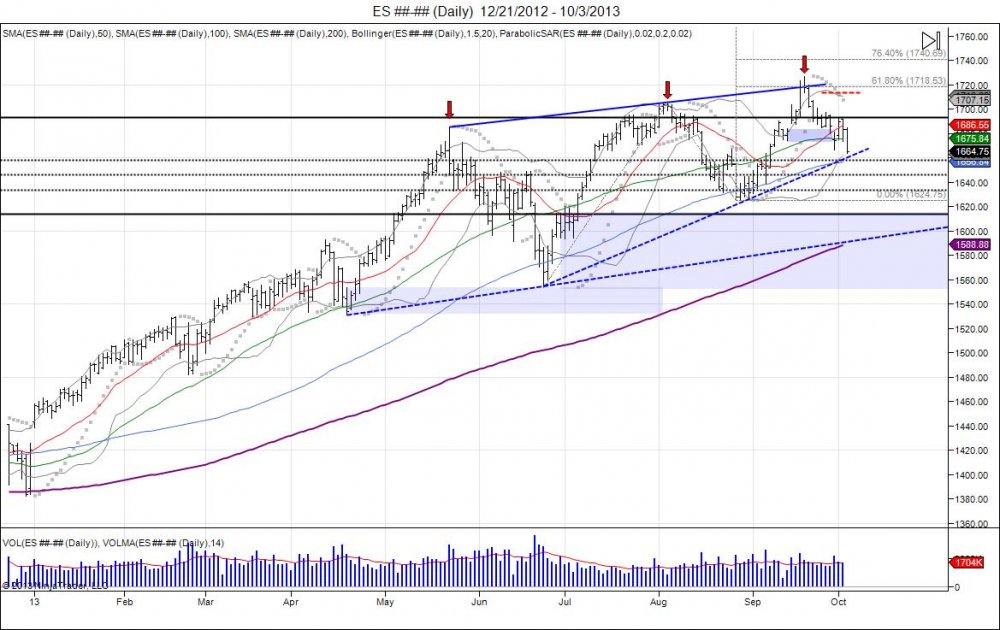

The struggle to top since the first correction in May from 1685-1553, being the most violent of the year, led to higher lows and higher highs as new highs squeezed shorts and every dip became more and more shallow. Buyers continued to pile into these dips making them more shallow, afraid of missing "the next leg up". This recipe is what makes the rising wedge, and a recipe for disaster as bulls and bears make money, but hogs g slaughtered. Thus far the surprises from the Fed on "no summers" and "no taper" have held as the highs as shorts capitulated into 1726s and market gave it all back the following week. Bulls have another opportunity to make a higher low here as the market comes into this support line from the June lows. Failure to hold the August lows of 162475 break the wedge to give way for a test of the June lows to confirm the failed higher high up to 1726.

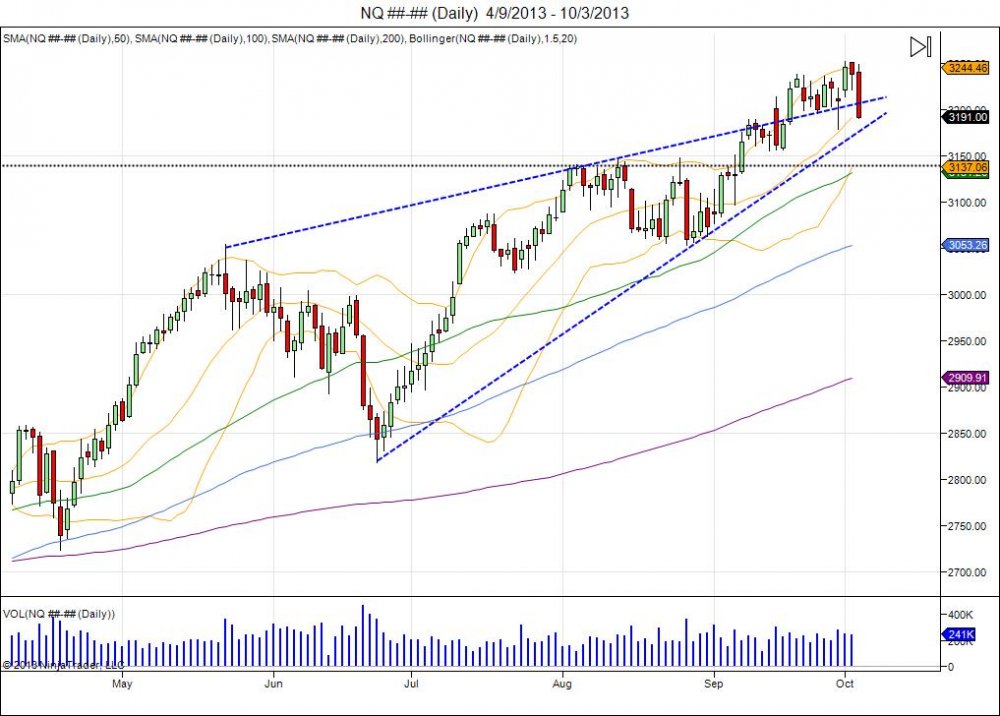

Nasdaq chart shows breakout above rising wedge to squeeze shorts and move back inside wedge to retest support. This can lead to a water fall effect with confirmation of top on a break of 3055.

RISK DISCLOSURE: PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN TRADING FUTURES AND OPTIONS IS SUBSTANTIAL AND SUCH INVESTING IS NOT SUITABLE FOR ALL INVESTORS. AN INVESTOR COULD LOSE MORE THAN THE INITIAL INVESTMENT.