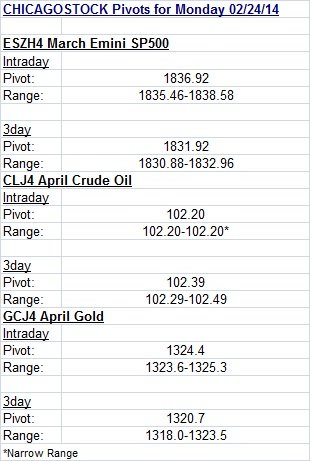

Pivots are used to determine areas of reference for support/resistance. Pivots are calculated by adding the high, low, and close of the determined time period, and subtracting by 3. This gives a "mean" of the market from that past data. Pivots themselves are not always enough. By adding ranges to the pivot (above and below), this gives an area of cushion around the pivot. The tighter the range, the more indecisive the previous data was, giving room for expansion of volatility. In the above examples, the intraday pivots are derived from the previous day's session. The three day pivots are derived from the last 3 trading sessions.